Universal Account Number (UAN) is a 12 digits number assigned by Employees’ Provident Fund Organisation (EPFO) to its Provident Fund (PF) members. With the help of UAN number, employees can manage their PF accounts like check balance, claim for transfer, check the contribution, etc. without any hassle.

Furthermore, they don’t have to wait for the year-end to check their PF statements or the employer’s signature.

Benefits of updating KYC in EPF UAN

The government has made it mandatory to update your Know Your Customer (KYC) information for EPF. To provide convenience, the employees can update their KYC online via the UAN EPFO portal.

There are various benefits of keeping your KYC details up-to-date in your EPF account. Some of the important benefits are mentioned below.

- If the KYC completed, then you will not face any delay for the transfer or withdrawal of money. Hence, it ensures the smooth transfer of EPF accounts.

- If the bank account details are up to date, your claim will not be rejected.

- EPF holders will get the SMS alerts notifying the monthly PF after activation.

- The benefits of updating the KYC details include low TDS on withdrawals.

Once you open the KYC section on UAN portal, you can update the following information –

- Bank Account Number

- PAN

- Passport

- AADHAR

- Driving License

- Election Card

- Ration Card

- National Population Register

However, Updating the Aadhaar Card, PAN Card, and Bank details is mandatory.

Follow the below-mentioned steps to upload KYC in EPF UAN

As an individual, you can now upload your KYC information for EPF by using the EPFO portal. To upload or update the KYC at EPFO Portal, All you need your UAN credentials.

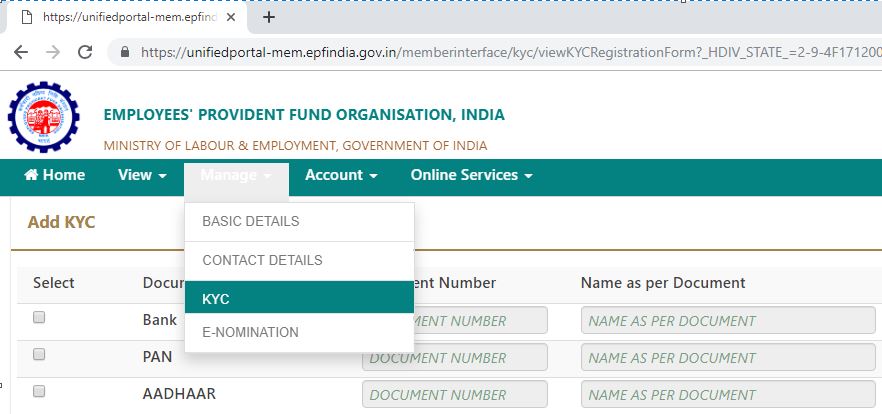

1. Go to Employees’ Provident Fund Organisation (EPFO) official website by clicking here https://unifiedportal-mem.epfindia.gov.in/memberinterface/

2. Now, log in the portal by using the UAN, Password, and Captcha

3. Once you logged in the portal, click on the ‘KYC’ under the option of “Manage.”

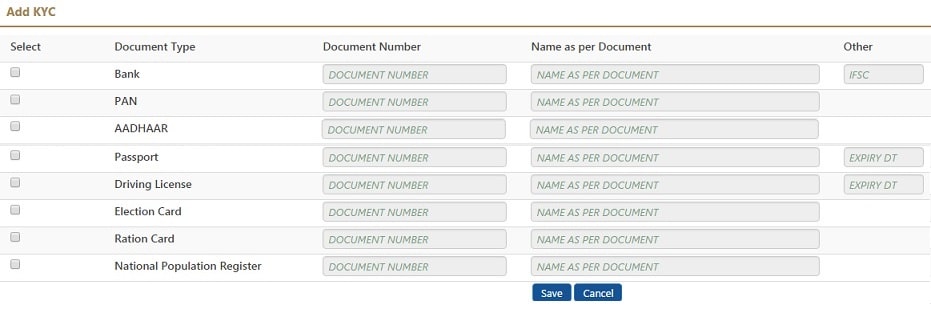

4. A page will open containing the details of different'” Document Type” like Bank, PAN, Aadhaar, Election card, etc.

5. Here, in front of every document type, there is a blank space to fill the details of KYC documents. Fill the “Document number” and “Name as per document” details in the checkbox.

Note: If you are updating the bank account details, you have to provide the IFSC code.

For updating the driving license and Passport, you have to fill the expiry date also.

6. Once the details are filled, click on the “Save” option. You will see a message of KYC Data Update completed successfully, and the data will be saved automatically under the “Pending KYC” section.

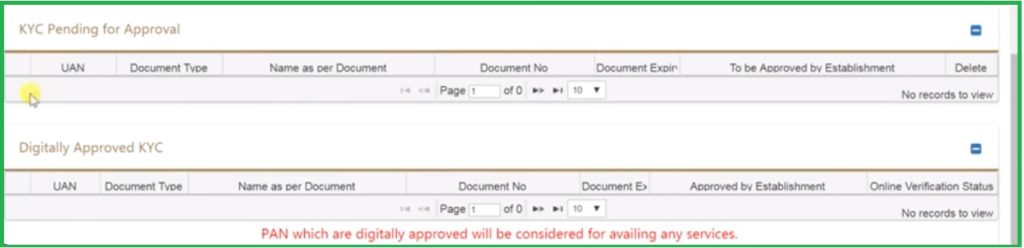

7. After clicking the save option, you will see the KYC status shown as “KYC Pending for Approval.”

8. Once your employer verifies and approves the documents, the status will be changed as “Digitally Approved KYC.” After approval, you will also receive an SMS on your registered number.

How the employer approves the KYC?

Employers also have the account on EPFO Portal with their UAN credentials. They need to register their establishment or organization.

The employer will log in to the portal and approves the employee’s KYC using his digital signature.

How much time does it take for KYC documents to be approved?

It takes around 3 to 5 working days for the review and approval of the KYC documents.