Universal Account Number (UAN) is a unique number provided to the employees to check their EPF balance. However, if you have forgotten your UAN number, is it possible to check the EPF balance without UAN?

The answer is yes !! You have some other options which allow you to check the EPF balance without UAN. Besides that, a few other benefits of UAN number are:

- Know your EPF contributions made

- Helps to withdraw from PF accounts

- No need to contact employers

- Claim transfers

- No need to open a new PF account every time you change employer

Here, we are explaining the step by step methods to know EPF balance:

1. Missed call option to check EPF balance without UAN

Checking EPF balance by giving a missed call is the simplest way, but make sure your UAN is activated. In case you have not activated UAN at the EPFO portal, you have to activate it first. After activation, give a missed call at “01122901406.”

You will receive the SMS from the EPF containing the following details:

- Your name and Date of Birth

- Your UAN number (You got your UAN here; note it down for future reference)

- Employer Share

- Employee Share

- Pension Amount

- Last Contribution

2. Sending SMS option to check EPF balance without UAN

For checking EPF balance via SMS, you need to ensure that your UAN is activated. The benefit of using the SMS option is that you can choose your preferred language to know the EPF account status.

You need to send SMS at “7738299899.” And the format to send SMS is “EPFOHO UAN ENG.”

Here, the last 3 alphabets indicate the language, i.e., ENG stands for English. Similarly, you can choose your desired language code, as shown below:

| Language and Code | |

| English (Default) | Hindi (HIN) |

| Gujarati (GUJ) | Punjabi (PUN) |

| Marathi (MAR) | Kannada (KAN) |

| Malayalam (MAL) | Tamil (TAM) |

| Telugu (TEL) | Bengali (BEN) |

After sending SMS, you will receive the following details via SMS:

- UAN (You get your UAN, save it for future reference)

- Name

- Date of Birth

- Aadhaar

- PAN

- Bank Account

- Last Contribution

- Total EPF Balance

How to find UAN with Aadhaar or PAN?

If you have any of the three information, i.e.,

- EPF account number

- Aadhaar Card number, or

- PAN

Then, you can easily know your UAN. However, your Aadhaar and PAN must be linked to your EPF account. Follow the step by step process:

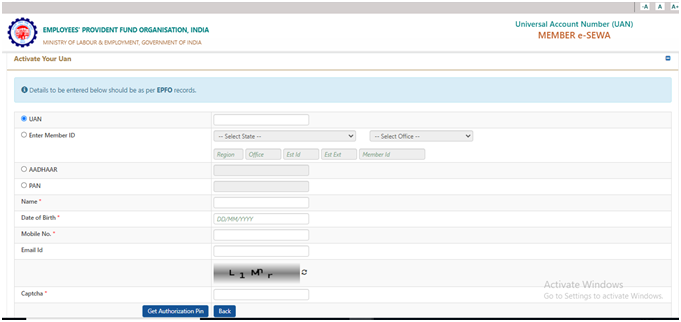

Step 1: Visit EPFO UAN portal https://unifiedportal-mem.epfindia.gov.in/memberinterface/ and click on “Know Your UAN.”

Step 2: Enter any of the details among PAN, Aadhaar, or EPF number And other details such as name, date of birth, mobile number along with captcha.

Step 3: After submitting the details, you will get OTP on your registered mobile number.

Step 4: Enter the OTP, and you will get your UAN number on your mobile number via SMS.

What to do if my UAN is not activated?

It is advisable to remember your UAN for availing of any EPF related service. In such a situation, you can use a missed call or SMS facility. Another option is to ask your employer to check your EPF balance and provide you the UAN number. The employer must have your UAN because they need to contribute to your PF account every month.

Other option to know your UAN is by “Activate Your UAN.” You can visit the EPFO UAN portal https://unifiedportal-mem.epfindia.gov.in/ and activate your UAN easily after submitting the required details.

How to download EPF Passbook with UAN?

Once you have got your UAN by following any of the above methods, you can download the EPF passbook. Here is the simple process to download the EPF passbook:

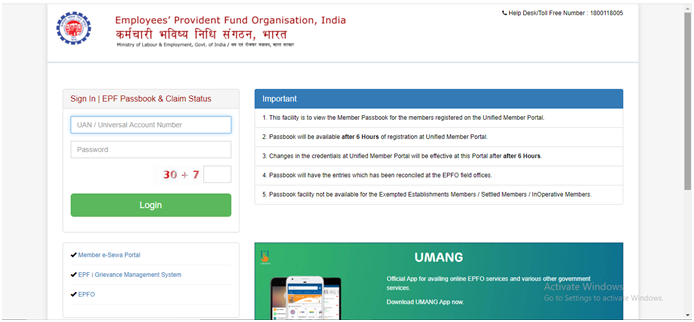

Step 1: Log in at the EPFO portal with your UAN number and password by clicking here https://passbook.epfindia.gov.in/MemberPassBook/Login

Step 2: After login, the employee’s member ID will be displayed. Click on the member ID of which you want to download the EPF passbook.

Step 3: On clicking the member ID, you will see all details such as organization name, employee name, office location, employer’s and employee share, and the contribution made in the EPS account.

Step 4: You can download the EPF passbook in the PDF format and print it out.