Every eligible business needs to take GST registration under Goods and Service Tax (GST). After GST registration, the GST portal allots a unique GSTIN (Goods and Services Tax Identification Number) to every taxpayer. It is a 15 digit alphanumeric number in the prescribed structure.

The GST number verification online is necessary as it helps the taxpayers to cross-check the authenticity of details provided at the portal. It is very easy to verify GST online at the portal within a few minutes.

Benefits of GSTIN verification

- Cross-check the authenticity

- Avoiding frauds and errors

- Prevention against fake GST registrations

GSTIN structure

GSTIN is a 15 digit unique number consisting of the following structure:

| 1st and 2nd digit | It is the state code in which the business is operated |

| 3rd to 12th digits | It is 10 digits alpha numeric containing taxpayers PAN card number |

| 13th digit | It is the entity number of same PAN |

| 14th digit | It is Alphabet “Z” by default |

| 15th digit | It is the check code, either number or alphabet |

GST verification process

Let us share a simple process on “How to do GSTIN verification at GST portal.” You just need to follow simple steps:

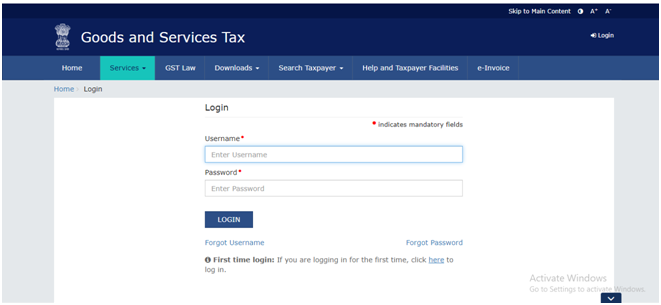

Step 1: Visit at GST portal and login with your credentials, i.e., username and Password.

Read more: Online GST Registration process

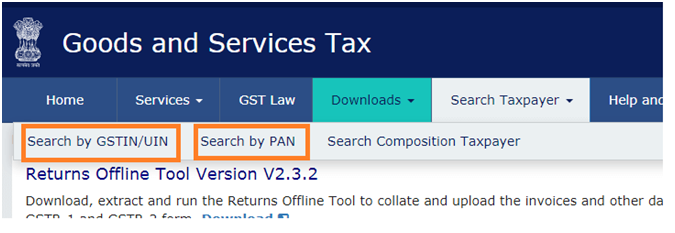

Step 2: Select the option from the above tab, “Search Taxpayer.” Here click on the option depending upon your convenience from:

- GSTIN/UIN

- PAN, or

- Search by composition taxpayer

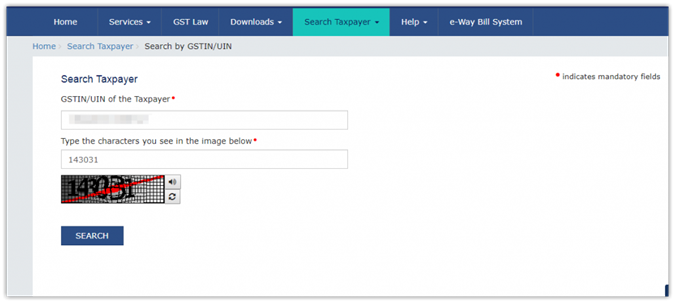

Step 3: Now, enter your GSTIN/UIN number/Composition number or PAN number and click on SEARCH.

Step 4: Once you clicked, the taxpayer’s details will be displayed on the screen. Make sure to fill the correct details; otherwise, an error message will be there. The details you can view with GST number verification online process are:

- Business legal name

- Location (state) of the business

- Business registration date

- Business type – Sole proprietor, Partnership, or company

- Taxpayer type -Composition dealer or regular taxpayer