The Government of India is encouraging the small and medium enterprises in the country. MSME registered enterprise are eligible to get various incentives, benefits, and subsidies.

To bring all the MSME at a single platform and saves paperwork, the government has introduced Udyam Registration services. It is based on the self-declaration and Aadhaar details only.

What is Udyam Registration?

Udyam registration or MSME registration is a government registration provided to small and medium enterprises.

It gives a recognition certificate and 12-digits unique number to certify the eligible medium and small enterprises for availing various benefits.

Earlier, there was EM-I/II (Entrepreneur Memorandum) system that involved lots of paperwork and time consuming.

Therefore, to make the process homogenous for all MSME enterprises, the government has introduced Udyam Registration free of cost at a single portal

So, if you have not taken Udyam registration yet, your MSME enterprise is missing various major benefits. The process is straightforward and doesn’t involve any cost. You can yourself follow the step (As mentioned below) and take MSME registration.

Eligibility for Udyam Registration

The main question arises “who can get Udyam registration?” the answer is, organizations engaged in the below sectors are eligible:

- Manufacturing

- Processing

- Producing

- Good preservation

- Providing services

In addition, As per the Micro, Small and Medium Enterprise Development Act, 2006 (MSMED), the enterprises need to quality specified criteria to get the Udyam registration as:

Classification of Enterprises:

| Type of Enterprise (both Manufacturing and services) | Investment in Plant and Machinery | Turnover |

| Micro enterprises | Up to 1 Cr | Up to 5 Cr |

| Small Enterprises | Up to 10 Cr | Up to 50 Cr |

| Medium enterprises | Up to 50 Cr | Up to 250 Cr |

Benefits of Udyam Registration

- Cheaper bank loans as the interest rate is up to 1.5% only

- Many tax rebates and tariff subsidies

- Benefit in getting government tenders

- Credit access at lower rates

- Lower cost of getting patent

- Loans up to 10 lakh without any collateral

- Hassle-free opening of current bank accounts

- One time settlement scheme for NPAs settlement

- Priority sector advances

- Easy to get various approvals, licenses, and registrations

Documents required for Udyam Registration online

- You must have an Aadhaar number.

- On the basis of valid Aadhaar, the portal will itself collect the PAN and GST details linked with enterprise turnover and investments made in plant and machinery.

- No requirement to attach any other document

Note: PAN and GST is mandatory for Udyam Registration from 01.04.2021.

Read More: Online GST Registration process

Udyam registration for existing enterprises:

All existing registered enterprises under EM – Part II OR (Entrepreneurs Memorandum) or UAM (Udyog Aadhar Memorandum Portal) have to take registration again under Udyam registration at portal w.e.f. 07/07/2020.

All enterprises registered till 30/06/2020 will be classified again based on the MSME specified criteria.

The due date of Udyam registration at the portal for the existing enterprises is up to 31st March 2021.

Udyam registration for new enterprises:

Here are the simple new Process for MSME registration Online:

Step 1: Visit at UDYAM registration online portal.

Visit at Udyam Registration and click on “Free new Entrepreneurs who are not registered yet as MSME” option.

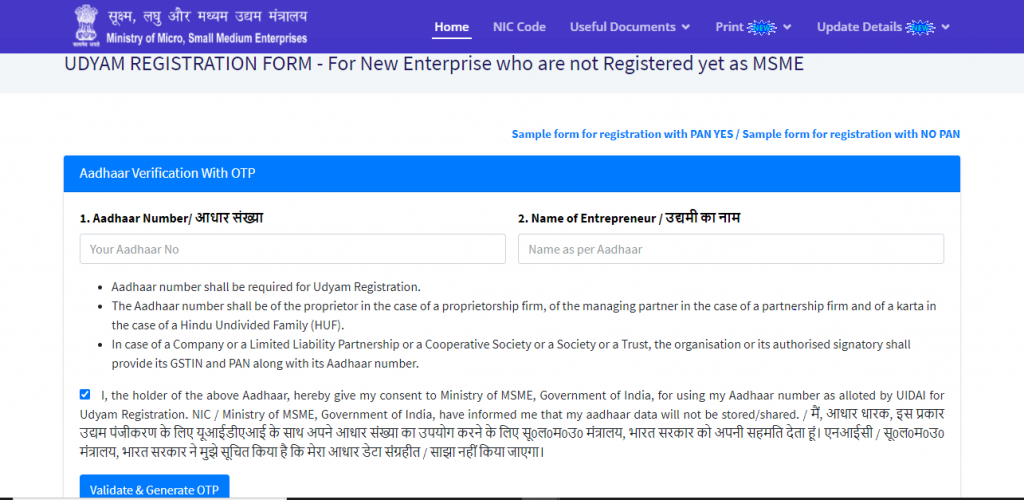

Step 2: Aadhaar verification

A page will open to fill the “Aadhaar Number” and “Name of Entrepreneur.” Fill the details and click on “Validate & Generate OTP.”

Note: Aadhaar number shall be filled with the following persons:

| Entity type | Aadhaar number |

| Proprietorship firm | Proprietor |

| Partnership Firm | Managing Partner |

| Hindi Undivided Family (HUF) | Karta |

| Company/LLP/Cooperative Society/Society/Trust | Authorized signatory |

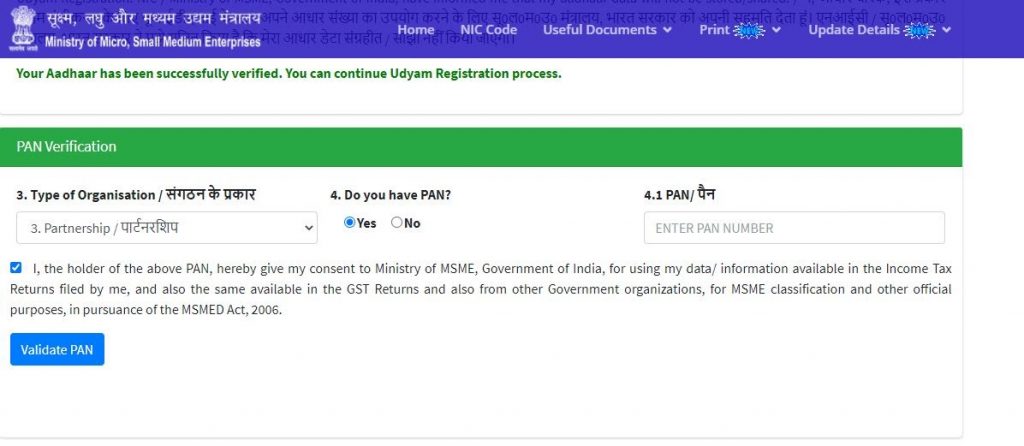

Step 3: PAN verification

On successful Aadhaar verification, you need to validate PAN. Here, select the organization type and enter PAN no. Click on validate option.

Step 4: ITR and GSTIN details

You need to mark

- Whether you have filed an ITR of the previous year and

- Do you have GSTIN?

Step 5: Plant locations

Here, fill all the details related to your plants like unit name and complete address.

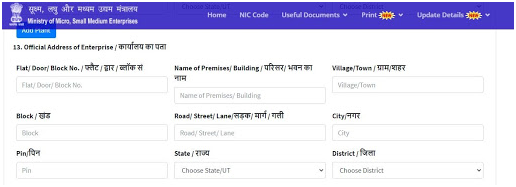

Step 6: Address and contact details of organizations

Next step is to fill the complete postal address of the organization, including company’s state, district, pin code, email address and mobile number.

Step 7: Fill bank details

Once the above details are submitted, fill the bank details. Enter the organization’s active bank account number and IFSC code.

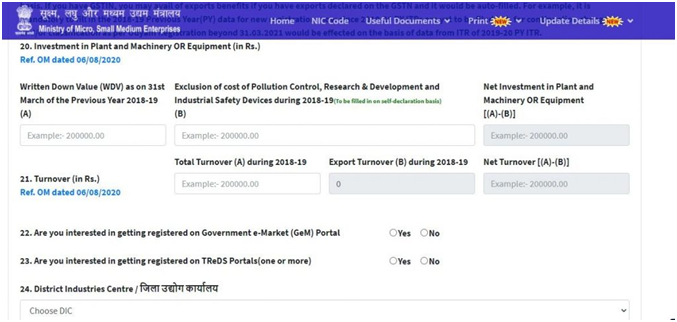

Step 8: Enterprise activity details

You need to mention the details related to your enterprises:

- Mainline activity: Services or Manufacturing

- Total number of persons employed

- National Industry Classification (NIC) Code for Activities

- Total money invested in Plant and Machinery (in lakhs)

- District industry centre from drop down list

Step 9: Accept the declaration

The last step is to accept the declaration and click on “Submit and Get Final OTP.” You will receive the OTP on your registered number. Enter the OTP and click on the “Final Submit” button.

You will receive a registration number for future reference. The portal will verify all the details. Once it is successful, you will receive a “Udyam Registration Certificate” (E-registration document) on your email id.

In case of any discrepancy, the applicants can contact to the “General Manager of the District Industries Centre of the concerned District.”

Meaning of Plant & machinery and Turnover for Udyam registration

Plant & machinery: It includes all tangible assets except Land & building and Furniture & fixtures

Turnover: As per Income tax act/CGST Act

Important points to be considered:

As per the latest updates:

- Udyam registration has been wholly integrated with Income tax and GST portal.

- The enterprises have to update the ITR and GST return details at the MSME portal.

- In the case of failure to update details, the registration can be suspended.

- The enterprise classifications will be updated from lower to a higher category or higher to lower, as the case may be.