Employees Provident Fund (EPF) is a saving scheme that helps the employees to save corpus for retirement. The scheme is governed under the Employees’ Provident Funds and Miscellaneous Provisions Act, 1952 and regulated by the Employees’ Provident Fund Organisation (EPFO).

As per the EPF scheme, employers and employees are under the obligation to contribute a fixed percentage of salary towards the provident fund. The employees are eligible to take benefit of the amount accumulated in their EPF accounts after retirement.

Also Read: EPF Advance Rules 2020

EPF Registration for employers – Eligibility Criteria

The following categories of the employer are compulsorily required to obtain EPF registration within 30 days of reaching the threshold limits:

- Factories having 20 or more employees during any time of the year engaged in any industry.

- The organizations having 20 or more employees at any time in the previous year.

- Any other establishment when the Central Government gives, not less than two months’ notice to the particular establishment for registration.

- For any employee who is earning less than INR 15000/- per month

- Establishments having less than 20 employees can also apply for voluntary registration. In such a case, all the employees shall be liable to contribute from the commencement of their employment.

- Co-operative societies can register if their number of employees exceeds 50 or more.

Note: If the registered establishments fall below the threshold limit of the employees in any subsequent years, they continue to follow the contributions and rules and regulations.

Documents required for EPF registration for employers

Before proceeding for the online EPF registration for the employer, you must have documents ready. The list of documents that need to be submitted by the employer depends upon the type of entity. Here is the list of documents for online EPF registration:

| Type of entity | Documents required |

| Proprietorship firm | Employer’s name PAN card Identity proof (driving license, passport, voter ID card) Address proof of the place in which the business is being carried out Residential address proof Contact number |

| Partnership firm | Registration certificate of firm Partnership deed Partner’s ID proof (Driving license, passport, voter ID card) Details of all the partners of the firm (including address proofs) |

| Company/Limited Liability Partnership (LLP) | Incorporation certificate Director’s ID proof and Digital Signature Certificate (DSC) Details of all the directors (including address) MoA and AOA of the company |

| Co-operative society/ Trust | Incorporation certificate Memorandum of Association (MoA) PAN card Details of the president of the society and its members Address proof |

| Other Entities | Invoice of the first sale First purchase invoice of the machinery and other raw materials Bank details (account number, IFSC code, name, address, and branch) Monthly strength of employees’ record Salary and Provident fund (PF) details Cross cancelled cheque |

Procedure of EPF Registration for Employer online

Here are the simple steps you need to follow. Ensure that the employer’s Digital Signature is ready before proceedings because it is mandatory for the first time online registration of the employer;

Visit the official EPFO Portal https://www.epfindia.gov.in/

On the home page of the Unified portal, there is an option as “Establishment Registration,” or you can directly click here https://registration.shramsuvidha.gov.in/user/register

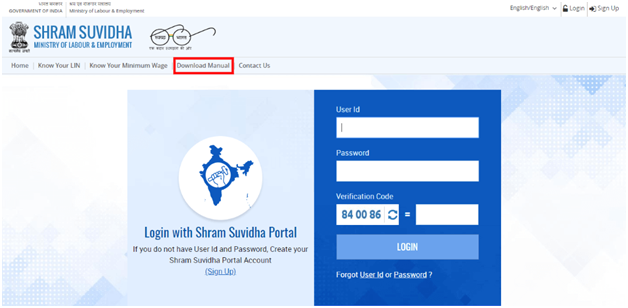

After clicking, a new page will open as “Login with Shram Suvidha Portal.” Here you will see the option of “Sign up.”

Note: On this page, you will see the option of “Download Manual.” You can download it and read the instructions carefully.

Now, a signup page will open asking the details like Name, Email, Mobile No., and Verification code. Fill the details correctly and click on the “Sign Up” button.

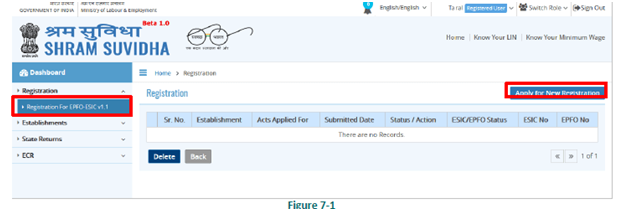

After signing up, click on the option “Registration for EPFO-ESIC,” and the next page will open. Now, here click on the option of “Apply for New Registration.”

Here you will get two options as the “Employees’ State Insurance Act” and “Employees Provident Fund and Miscellaneous Provision Act, 1956.” Choose accordingly and submit it.

Fill the required details of the employer such as

| Establishment Details | Name, address, incorporation date, PAN and type of establishment. Further, in case of MSME, the MSME registration is to be filled and In case of the factory, factory license details to be filled. |

| eContacts | Email id and mobile number of the authorised person. |

| Contact Persons | Name, Date of birth, Contact details |

| Identifiers | license information |

| Employment Details | No. of employees, Wage limit, activity type and total wages |

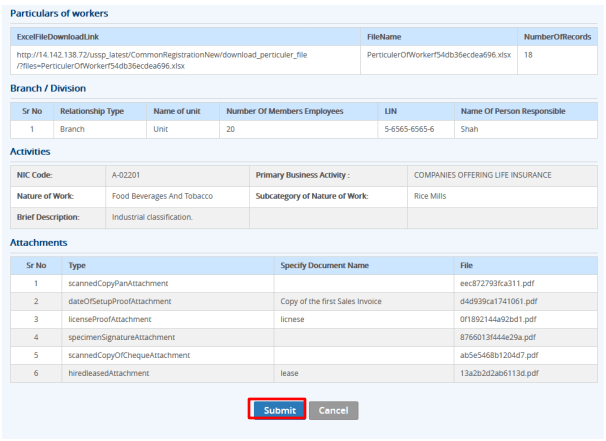

| Branch/Division, Activities | name/premise number and address of the branch/division |

| Attachments | Select the attachments to be attached from the drop down list. |

After that, you can review the summary of all the details on the dashboard. Once the draft is reviewed, click on the submit button.

At last, complete the registration process with the help of a digital signature certificate (DSC). You will receive an email that registration has been completed.