The tax payers need to pay the income tax every year. The amount of the tax calculated based on their annual income. There is a process for making the payment of income tax either online or offline. Earlier, people used to visit the banks in order to make the payment of their income tax. Now, with the advancement in the technology, it has become quite simple to pay Income tax within minutes via online mode.

In this tutorial, we have come up with a detailed guide to making the payment of income tax online within few minutes. Here is everything you need to know about the payment of Income Tax via online mode. You can now follow the steps provided below in this post to pay the income tax online within less span of time.

Who must pay Income Tax?

If you carry out the below criterion, you need to pay the income tax:

- If you are gaining over the tax-free limit.

- After acquiring a certain amount as the exemption and deduction some of your income falls under the tax amount for the tax payers.

- Tax not deducted at source.

If you fall below the above-mentioned criteria, you need to be prepared to pay taxes via online. You need to calculate the amount of the tax you need to pay and accordingly pay it to the concerned department of the government. The Government is not responsible for calculating the income tax that you need to pay and it does not send any kind of acknowledgment or bills to the payer. If in case, you neglect the payment of income tax; the concerned officials triple the amount that you have avoided without paying.

How to Calculate Income Tax?

There are different ways to calculate the Income Tax paid to the concerned Income Tax department. One way to calculate the tax is via the tax calculators. You can deduct the TDS from the total tax before the payment of tax online if you have paid some amount of tax already to the concerned department. If you make the payment of the tax after the due date, you need to pay an income tax with 1% interest for every overdue month. It is often better to make use of a perfect calculator to calculate the tax amount that must be paid by the tax payer.

Is it Mandatory to Pay Income Tax Online?

Usually, the tax payers make the payment of the income tax to the government via authorized banks. Most of the government banks listed below and some other popular private banks agree tax payers pay the income tax in their banks. The tax payers need to fill the given Challan in order to pay the tax through. After the payment of the tax, the banks give acknowledgment to the tax payers comprising the Challan identification number. This CIN is used at the time of e-filing your income tax return.

Previously, the process of paying income tax was finished offline. In order to pay the income tax, people used to visit the nearest bank. But, now everything has become online so people can pay the tax through online itself. There are various benefits for the tax payers if they do the payment online. They need not fill in the Challan forms and wait for a long time in the banks. It is advisable to make payment via online mode.

Requirements for e-Payment of Tax

In order to make payment of tax via online mode, the tax payers need to have the following details.

- Bank Account in the authorized bank

- Valid TAN and PAN

- Internet Banking provision

- Decent internet connection

- Adequate balance in the Authorised Bank

Authorized Banks for e-payment of Taxes

The Income Tax department accepts the tax payers to make their payment of tax via various government and popular private banks. Here is the list of various banks that accept payment of tax.

- Allahabad Bank

- Andhra Bank

- Axis Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- Corporation Bank

- Dena Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- Indian Bank

- Indian Overseas Bank

- Jammu & Kashmir Bank

- Oriental Bank of Commerce

- Punjab and Sind Bank

- Punjab National Bank

- State Bank of Bikaner & Jaipur

- State Bank of Hyderabad

- State Bank of India

- State Bank of Mysore

- State Bank of Patiala

- State Bank of Travancore

- Syndicate Bank

- UCO Bank

- Union Bank of India

- United Bank of India

- Vijaya Bank

How to Make Payment of Income tax via Online?

Here are the simple steps to make payment of Income Tax via online mode:

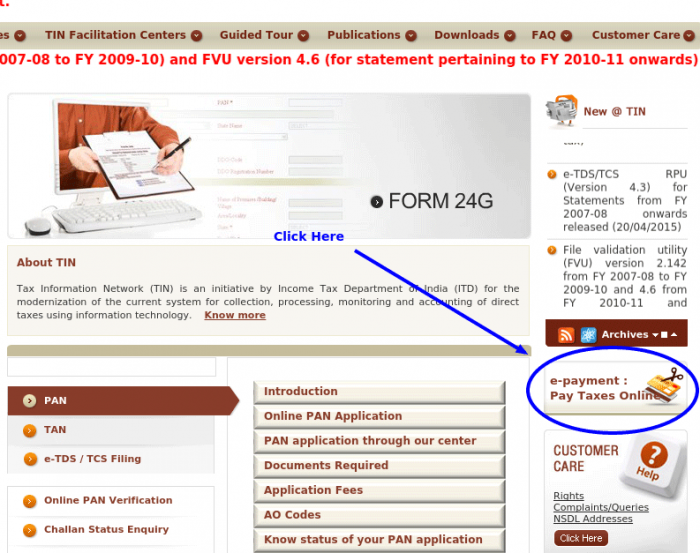

- First of all, visit the official website of NSDL at www.tin-nsdl.com.

- Click on the option that says e-Payment and click on Pay taxes Online.

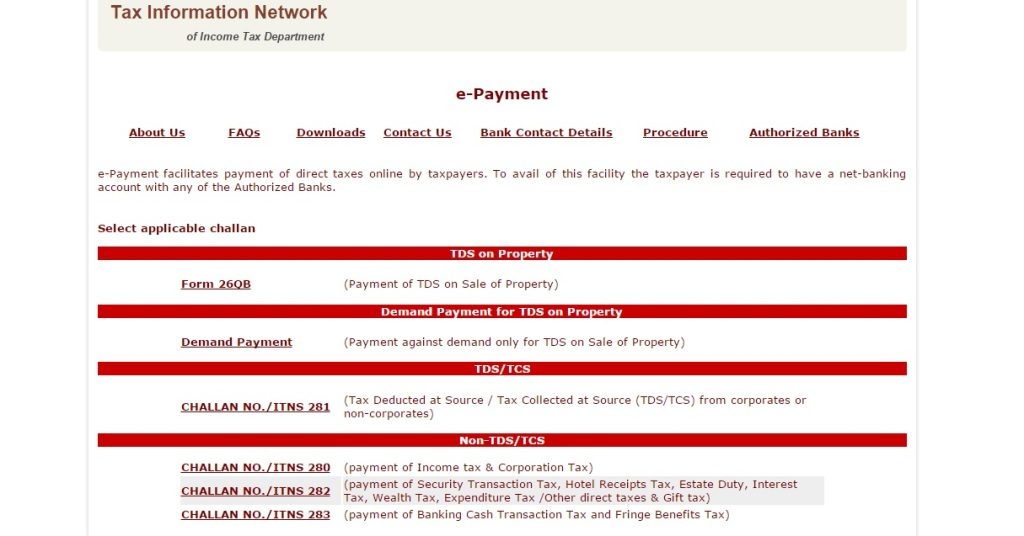

- You need to select the given Challan.

- Enter all the essential details in the provided fields.

- You need to select the bank and fill in the Customer ID and Password for Net Banking.

- Confirm the payment and take a print out of the Challan Identification Number (CIN).

How to Check the Status of Income Tax Payment Online?

After successful payment of the tax to the concerned department through the authorized bank, the tax payer can check the status of their payment via online. In order to check it, just visit the official web portal of NSDL. You can check it one week after the payment. In the web page, you need to provide the BSR code of the relevant bank, Challan serial number, date of payment and amount in the provided fields. You can then check the status of your payment whether it is processed or not.

This is the simple procedure to make online payment of income tax.