Income Tax: Login Problem due to PIN number through email or Mobile Number

Everyone are looking forward to file their Income tax returns for the current financial year 2016-17 as the last date for filing Income Tax returns has been approaching. The last date for all the employees to file their Income Tax Returns 2016 is 31stJuly i.e., the end of this month. Earlier, the Income Tax department has enabled its taxpayers file their Income Tax returns in a manual process of taking a printout of ITR-V and sending it to Centralised Processing Centre (CPC) which is located in Bengaluru.

Recently, the Income tax Department has rolled out online system for E-filing Income Tax returns in a simple way. By introducing this new online verification method, the Income tax department has facilitated its tax payers a relief so that the payers need not struggle a lot to do this process of e-filing and verification of Income Tax Returns in a manual way. The great difficulty of sending Income Tax returns via post has been solved and allows its tax payers send it directly online without any hassle.

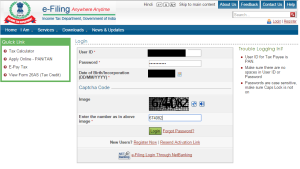

But, the tax payers have been confronting some issues while e-filing Income tax returns through this online process. While using online mode to send e-filing to the Income Tax department, the tax payers need to register with a mobile number and Email id in order to get through the verification process of income tax return for the financial year 2016-17.

The tax payers have been facing some issues at the time of logging in with the PIN number sent by the Income Tax Department to Mobile number and Email ID. Here, I have come up with a simple solution to fix the login issues while e-filing or verification process of Income Tax returns.

How to Fix Login Issues of PIN Number via Mobile & Email ID?

The Income Tax department has introduced a new system of e-filing Income Tax Returns through online mode. Almost all the Income tax payers might be aware of the complete e-filing and verification process of Income Tax Returns online. It is known that the Income Tax Department will send a unique PIN number to the registered mobile number or email id of the tax payer to e-file Income Tax Return. Income Tax Department has instigated some rules for the tax payers during e-filing and verification of Income Tax Returns. The IT department has constrained the Income Tax payers to enter same mobile number or email address even they login from different devices for e-filing of Income Tax Returns.

Sometimes, the users might receive the PIN on their mobile but do not receive PIN on Email. Such issues are being encountered by the users at the time of login. These issues might be due to overloading of servers or server might be busy with too many logins. Whatever might be the issue, ultimately the target is the taxpayer who faces problems in e-filing of their Income Tax Return. So, we have come up with a solution to overcome these issues while e-filing Income Tax Returns.

E-filing Income Tax Returns – Login Verification via Mobile & Email

Income-Tax Department has introduced the process of online e-filing of Income Tax Returns. The Income Tax Department makes use of registered contact details such as the Mobile number & E-mail ID of the tax payers in order to communicate with the tax payer to notify him/her regarding their Income Tax Returns processing, acknowledgment and much more. In order to send updates regarding their e-Filing of Income Tax Returns, the IT department asks all the tax payers to register with valid contact details.

It is compulsoryfor all the Income tax payers toprovide valid contact details at the time of registration in e-Filing portal. After verifying at the registrations of the tax payers, the Income Tax department has noticed that most of the users who had registered do not have valid contact details in e-Filing portal or mightprovide details of other persons for temporary purpose.

This averts the Income Tax Department from communicating directly with the Income taxpayers on their private email and Mobile number. Additionally, it has been noticed that in most of the cases, taxpayers are unable to reset their password due to some issues at the time of receiving PIN on their registered Email and Mobile number.

Here, we have come up with solution to get through this E-filing login and verification process smoothly and in a secure way without any hassle.

Here’s the Solution: Update/Register with Valid Contact Info on E-filing Portal

All the Income Tax payers are requested to register with a valid Email ID and Mobile Number during the registration process of Income Tax Returns on the E-filing portal. If in case, the contact details of the tax payer have been changed, they must update their currently used contact details on the E-filing portal of the Income Tax Department so that the officials could acquire a simple and direct communication with taxpayer.

- One Time Passwords to Mobile & Email

The Income Tax Department will send different One Time Passwords (OTP) (which is also called as PIN number)separately on to the mobile number and email id provided by the Income taxpayer. The unique OTPs or PINs sent by the Income Tax Department must be entered by the taxpayer soon after logging into their e-filing account to validate their contact details.The OTPs which were sent by the IT department will endureauthenticated for 24 hours within which the taxpayer has to complete the process. In the given time of 24 hours, the tax payers must use the OTPs or PINs to the registered mobile number and Email id.For ‘Foreign or NRI’ Income taxpayers, the OTP authentication of the mobile number and email ID would be enough.

The authentication of email id and mobile numbers has been rolled out for the tax payer in order to facilitate them in various ways. In order to avoid the tax payers to register with incorrect email ids and mobile numbers provided by the tax payers, the Income tax department has introduced this method.

Authenticating the mobile number and email ID is a one-time password to register and login for E-filing Income Tax Returns. If in case, there are any changes in the Mobile Number and email ID of the tax payer, they must change or update it on their web portal of E-filing IT Returns.This process is often repeated in order to confirm that the contact details provided by the tax payers are accurate. If in case the tax payer forgets the password for login the Income Tax department will be sending an OTP in order to facilitate its users to reset their password.

- One Mobile Number & Email for 10 User Accounts [Primary Contact]

The Income Tax department has introduced a new rule that a single mobile number and an email ID can be used for a maximum of 10 user accounts as the tax payer’s Primary Contact. The primary contact can be registered just with a single Mobile Number and Email ID in e-Filing web portal. This has been made available in order to assure that the family members might not be having individual email or mobile number that can be covered under a shared email or mobile number.

But, as per the IT department guidelines, the taxpayers must have their own unique email ID and Mobile number registered with the Income Tax Department so that the department can communicate with the concerned tax payer through their personal account.

- Additional Mobile & Email ID – [Secondary Contact]

The taxpayer can also have an additional email id and mobile number that can be used as a Secondary Contact at the time of e-filing on the web portal. But, for the secondary contact there is no such restriction like number of user accounts linked as a secondary contact.

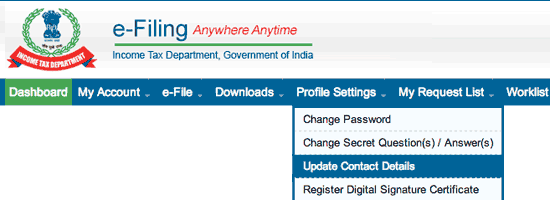

Here’s how to add secondary contact details:

The users must follow the below steps to add secondary contact details on the E-filing portal:

- Go to “Profile Settings >> Select“My Profile”.

- Now, the taxpayer can add his/her Secondary Contact details like mobile number and additional email id to also receive emails and mobile alerts.

- Safe List

It is suggested for all the tax payersto include all the emails and SMS sent from the Income tax Department in the ‘safe list’ or ‘white list’ in order to avert the communications from the concerned Department from being jammed or rejected or sent to Spam folder or Trash. It is also advised for all the tax payersto not to share their user id and password of their Income Tax e-filing account on the web portal even with their family member in order to avoid un-authorized access.

The Income Tax Department wishes smooth cooperation of all the Income Tax taxpayers for finishing this E-filing authentication process in a simple way as soon as possible without any glitches.