How to Update Contact Details in the Income Tax e-Filing Portal

The time has just arrived for all the Income Tax Payers to file their Income Tax Returns to the Income Tax Department and there is pretty much time leftover to do so. All the Income Tax payers must ensure that all their details that are provided to the Department of Income Tax are precise genuine and latest one. Now, the Income Tax Department has made it mandatory for all the tax payers to validate or update their contact details such as Mobile Number, E-mail ID and address in the e-Filing official portal of Income Tax.

Usually, Income Tax department makes use of Mobile number, e-mail Id and all other essential details of the taxpayers in order to communicate quite well with the tax payers. This is the reason the IT department has now made this rule mandatory to update their valid contact details in the web portal. By acquiring valid and updated contact details from all the tax payers, it would certainly facilitate the Income tax department to send necessary details to the payers like processing their e-filing Income Tax Return status, issue of Income Tax refunds that are directly to the taxpayers to their bank account.

It’s been almost a year for all the tax payers wherein they need to e-file their income tax returns for the financial year 2016-17. Likewise e-filing Income tax Returns to the Income Tax Department for every financial year, the IT department also wish its users or tax payers update their current using contact details on the e-filing portal. The last date for filing the income tax return or ITR for the financial year 2016-17 is the end of this month i.e., 30th July, 2016. If you haven’t yet e-filed your income tax returns to the Income Tax Department, it’s advised to do it early so that you can rectify or change if there are any issues with the e-filing. ,

The process of updating the valid details is onetime process for all the tax payers and whenever there is change in contact details of the taxpayers, they must update their precise contact details using the procedure that we’ve provided below in a detailed manner. Here, we are providing a detailed process on how to update and validate precise contact details on the Income tax e-filing portal. Take a look!

How to Update or Authenticate Contact Details in the Income Tax e-Filing Portal?

It is quite simple to simply visit the official website of the Income Tax e-filing, check out the e-mail address, mobile number and just validate or update them with the new one. But this process is not the same for all the users of tax payers. The process of updating the contact details will be quite different for the new users and already registered users or Income tax payers. Here is a detailed guide for all the Income tax payers regarding how to update or authenticate and validate the contact details of the tax payers in the Income Tax e-Filing portal.

- Update Contact Details in e-filing Portal for “New Users”

A taxpayer who is seeking to register himself/herself on the e-filing portal for the first time, theymusthave to provide their contact details such as a mobile number and a valid e-mail ID at the time of registration. Soon after registering using the above-mentioned contact details, a One-Time Password (OTP) or a random PIN would be sent to the registered mobile number or an activation link would be sent to the registered e-mail ID of the new user or tax payer.

The taxpayer is thenasked to access theire-mail and hit the link which was sent by the IT department provided in the e-mail. The usercan also enter the OTP received by him/her to their registered mobile number in order to complete their registration processand successfully activate them as a new registereduser in the Income Tax e-filing portal. The valid mobile number and the E-mail with which the user get registered to the e-filing portal of Income Tax would be considered as the primary contact for every user or Tax Payer of IT Returns.

[For New Users] Steps to Update Contact Details in e-filing Portal:

- The new user must provide precise or correct mobile number and Email ID during the process of registration in the Income Tax e-filing portal for the first time.

- The IT departmentwill send an Activation link or a One-time password to the registered Email Id or the registered mobile number of the user.

- User must click to activate the link in the Email and enter theOTP sent to the mobile for successful activation of registration.

- Update Contact Details in e-filing Portal for Registered users

If you’re an already registered user of e-filing Income tax portal, you can simply head over the portal to update your new mobile number and some other currently used email id by signing into the e-filing account of Income Tax.Soon after logging or signing into the web portal, the tax payer or the user can update their current mobile number and new email id (if any).

Once you fill in the latest valid details, simply hit the submit button to submit your authenticate details to the IT department. Soon after the submission, two OTPs or two unique PINswill be sent to both the new mobile number and email id of the user. You need to enter the OTP such as that is received on the new mobile number of the user in the e-filing portal. Likewise, enter the PIN sent to the authenticate email id.

Resending PINs

If in case, the tax payer does not receive the unique PINs, the taxpayer can choose the option “Resend PINs” in order to get the PIN for the second time. The PINs that are received by the user to their registered mobile number and e-mail id are valid for 24 hours. It is advised for the tax payers to validate or update the contact details using the unique PINs received by them via mobile number and email id within 24 hours. If your contact details are not updated or authenticated within 24 hours after receiving the PINs, the taxpayer must once again login and follow the same procedure as mentioned above.

Validate Communication Address

You can even change the communication address if required by the Income Tax Department. You can change the communication address by following the step provided below:

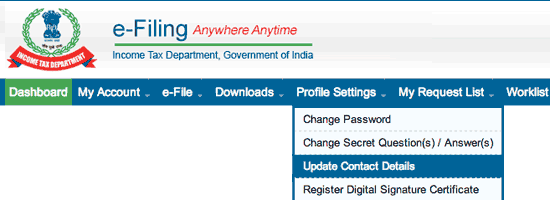

- On your e-filing web portal, you can find an option as “Profile Settings.”

- Under this option you need to choose the option “My Profile”.

- From here, you can update or validate your precise or current living communication address.

Latest Restrictions by the IT Department

Earlier, the Income Tax department has provided a possibility of using a single Mobile Number and an email id to be used in only four accounts as Primary Contact.

**New Update: Now, the IT department has passed a new rule that the user or tax payer is allowed to make use of a single e-mail id and a mobile number to be used on 10 accounts.

The Income Tax Department has rolled out this new update in order to ensure that the professional tax filers don’t enter their details as Primary contact but to make it convenient for a family.

On the other hand, there is no such restriction for a secondary contact. A secondary email or a mobile number can be used in multiple accounts as secondary contact.

The new mandatory rule of updating the contact details of the tax payers is a good move by the Income Tax department as it helps the tax payers by receiving the status of their Income Tax returns filing and other acknowledgement details. If you wish to change your contact details, just head over the official portal and update right now!!