E-Verification of Income Tax Return: Process and Manual

All the people who are looking forward for filing their Income Tax returns can be now cheerful as the verification process of income tax return has become quite simpler and easier. It is mandatory rule passed by the government that if the income of particular individual is above five lakhs, they must and should file and income tax return to the relevant authorities. You need not send any kind of Income Tax Returns-V in order to accomplish the return filing process.

The income tax department has now introduced the e-verification process making it pretty much simple for all the employees to make their income tax return get verified online without any hectic process. Earlier, people used to send the printout of ITR-V to Centralised Processing Centre (CPC) Bengaluru in order to file their Income Tax returns. With this new system of online verification process has provided a great relief to all the people. Earlier, it was quite arduous for the salaried tax payers for sending their ITR-V via the post and many of them considered it as a major difficulty.

Now, you need not have to worry about filing your Income Tax Returns. You can easily complete that entire verification process through the latest online verification process rolled out by the Income Tax department in order to ease its tax payers. Usually, every year, the last date of filing income tax return will be in the month of July dated as July 31. So, you have enough time to file your Income Tax Returns. But, before that you need to know the verification process that takes place online as it has been recently introduced by the department.

Here is everything you need to know about the simple steps and process of filing yourincome tax return through the online E-verification system. Have a look!

What is E-Verification?

The Income Tax Department has introduced the online system of verifying the ITR-V in order to authenticate the e-filing of income tax return. The ITR-V comprises of your filing details alongside the signature of the payer. In order toacquire your signature, the department of Income Tax asks the payer to send the ITR-V by post to the main office. Now, it has simplified the process by introducing the authentication of income tax filers via online e-verification.

Authentication Parameters

The Income Tax department need various parameters for authentication of the Income Tax filers along with their authorized signature. Here are the various parameters.

- Email and mobile number

- Aadhaar number

- Net banking account

- Bank Account Particulars

- Demat Account Particulars

Various Options of E-Verification &Procedure

The Income Tax Department provides five different options for doing E-verification of Income Tax Returns by the filers. The five different options include Mobile and Email, Net banking, Aadhaar, Authenticated Bank Account and Authenticated Demat Account. Among these, you can choose net banking option for E-Verification as it is the simplest of all the above-mentioned options.

It is easy to go through the log in process if you pick net banking option as it provides a bypass procedure so that you could directly get to the dashboard and file your Income Tax Return right from there. The verification process of income tax return does not ask for any kind of OTP from the filer. However, let’s check out the process of filing income tax return online using all the above-mentioned methods or ways.

E-Verification of ITR via Net banking

It is recommended to use the Net Banking method for filing the Income Tax Return as it is the simplest method of all the options. Several nationalized and private banks provide the facility of filing Income Tax Return via Net Baking.

- Initially, login your net banking account.

- You can search for the ‘e-file your tax return’ under the tab of ‘taxes’ section.

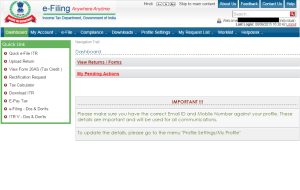

- Once you login, you will be directed right to the dashboard of E-filing portal so that you can file your income tax return through this process.

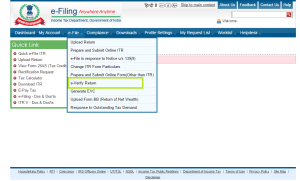

- Once you submit the ITR form, you can simply choose the option ‘e-verify return’.

- That’s it! You have successfully filed your ITR.

E-Verification of ITR via Aadhaar

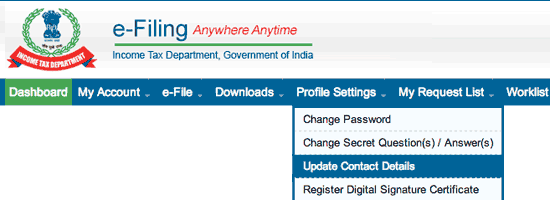

The E-verification of Income Tax Return viaAadhaaris quite simple and you need to link your Aadhaar number with your PAN which is a one-time process. The e-filing portal asks for linking the Aadhaar number just after the login.

- You need to provide your Aadhaar number to the E-filing portal where you are filing your ITR.

- In order to link your Aadhaar, you will have to enter the OTP (One-Time Password) which will be sent to your registered Mobile Number.

- Submit the details and make sure that you download the acknowledgement for future reference.

E-Verification of ITR via Mobile &Email

The verification process of income tax return via the mobile number or email is also quite simple.

- You need to fill in the ITR forms and submit them the IT department.

- Once you submit the ITR form, you need to generate EVC to your registered mobile number or Email Id.

- You will get an OTP that must be entered on the E-filing website in order to finish the verification process.

- Type the EVC which is received by the tax payer via their mobile number or Email Id and submit it to e-Verify return.

- Take a print out or download the acknowledgement.

E-Verification of ITR viaAuthenticated Bank Account

The E-Verification of ITR via Authenticated Bank Account method is pretty much beneficial for the user who does not have access to net banking. All you need to do is to pre-validate your authorized bank account number.

When you send your bank account information to the income tax department they will match both the information and authenticates that genuine person is filing income tax return. The tax payer must provide that following bank account details as part of validation.

- Authenticated Bank account number

- IFSC code

- Mobile number

- Email ID.

Based on the provided Bank account number, the IT department will be able to access your Bank account details. During income tax return e-filing, you will receive an electronic verification code to your registered mobile number.

E-Verification of ITR viaAuthenticated Demat Account

Similar to the E-verification of ITR via the authenticated Bank account, the E-verification of ITR goes the same way for authenticated Demat account.

When you send your Demat account information to the income tax department they will check whether both the information is tallied and authenticates that genuine person is filing income tax return. The tax payer must provide that following Demat account details as part of validation.

- Demat Account Number

- Mobile Number

Based on the provided Demat account number, the IT department will be able to access your Demat account information. During income tax return e-filing, you will receive an electronic verification code to your registered mobile number.

Digital Signature

After sending the e-filing to the concerned Income Tax department, if in case, the Income Tax return is not verified completely due to some issue regarding the digital signature, you have a period of 120 days i.e., 4 months to recheck or verify your income tax return of e-filing. In this period, you can once again send a signed ITR-V in a manual way to the Centralised Processing Centre of Income tax department or you can even send it via the online validation of an Electronic Verification Code (EVC).If you fail to do this within the specified period of time, your filed income tax return would not be processed and will be remain as an invalid income tax return filing.