The online banking system has made our life more comfortable. Now, we don’t have to wait in queues for a longer time. Although you can operate every bank transaction from your online banking such as opening an account, transferring funds, making payments, apply for loans, or opening the deposit accounts.

Similarly, NEFT is one of the most popular funds transferring systems in India that is available around the clock throughout the year, i.e., on a 24x7x365 basis.

What is NEFT?

National Electronic Funds Transfer (NEFT) is a simple, secure, and efficient system that helps to transfer funds electronically from one bank’s branch to another branch in the country.

The facility can also be used to make payments for loans, EMI’s, credit card dues, and more. The biggest advantage of using the NEFT system is neither you need to visit the bank, nor is the physical presence of either party required.

Any individual, firm, or corporate can use this facility. Users are only required to enable internet banking with your bank.

Advantages of using NEFT Facility

- Real-time fund transfer

- Round the clock availability

- PAN India coverage

- No charges on transactions

- SMS/E-mail confirmation of the transaction

- Can be accessed via the internet from any place

- Compensation/penalty by the bank for delayed credit of funds.

NEFT Timings

NEFT facility for transferring the fund is available as

- From Monday to Friday: between 8 am to 6: 30 pm

- On Saturday: between 8 am to 1: 00 pm (mostly bank do not provide fund settlement on 2nd and 4th Saturdays)

- Sundays and bank holidays as specified by RBI: Not available

The fund transfer processing works in the batches at every 30 minutes interval.

NEFT charges on fund transfer

Whenever users receive funds (inward transactions) via NEFT, the bank branches don’t charge any amount. However, when you send money (outward transactions) to someone’s account, some charges are levied as follows:

| Transaction amount | NEFT Charges |

| For transactions up to Rs.10,000 | Not exceeding Rs. 2.50 (+ GST) |

| For transactions above Rs.10,000 and up to Rs.1 lakh | Not exceeding Rs. 5 (+ GST) |

| For transactions above Rs.1 lakh and up to Rs.2 lakhs | Not exceeding Rs. 15 (+ GST) |

| For transactions above Rs.2 lakhs | Not exceeding Rs. 25 (+GST) |

What is the NEFT transfer limit?

With NEFT transfers, there is no minimum and the maximum amount limit to transfer by RBI. You can transfer as low as Rs. 1. However, the banks may specify the maximum transfer limits. For instance, HDFC Bank NEFT Transfer Limit is Rs.25 Lakh per day per customer; ICICI permits transfer up to Rs. 10 lakh.

For a one-time cash mode transaction, you can transfer a maximum of Rs. 50, 000 in each transaction.

How to transfer funds through NEFT?

Any person holding a bank account in any branch can easily transfer fund by following the procedure given below:

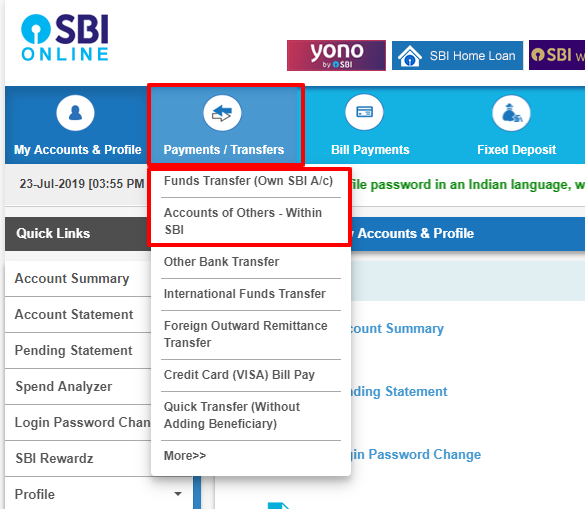

Step 1: Log in to your internet banking account with a user name and password.

Step 2: At the dashboard, look for the section “NEFT Fund transfer.”

Step 3: Add beneficiary details (the person with whom you want to make transactions) like name, bank account number, branch name, account type, and IFSC Code.

Note: Ensure that the bank of the remitter and the beneficiary must have enabled NEFT features on their online banking system.

Step 4: After adding the beneficiary, verify the details, and click the ‘accept Terms of Service (Terms & Conditions)’ button followed by ‘confirm.’

Step 5: You will receive an OTP and a confirmation message on your registered number. Now, you can proceed with fund transfer by entering the amount.