Every year, Individuals and corporate are required to file the Income-tax return (ITR) through the Income tax e-Filing portal. However, for filing the return, the user must be registered at the portal, and your registration process is complete.

Otherwise, you won’t be able to complete your ITR filing process. Not only this but for other income tax-related works also, it is necessary to complete the Income Tax login and registration process.

In this article, we are going to share the following details:

1. Two methods of login at the Income-tax E-filing website

2. Resetting of Income Tax E-filing login password

Key services at Income tax portal

Before moving ahead, let us tell you about the Key Services Available after Income Tax e-Filing Portal Login:

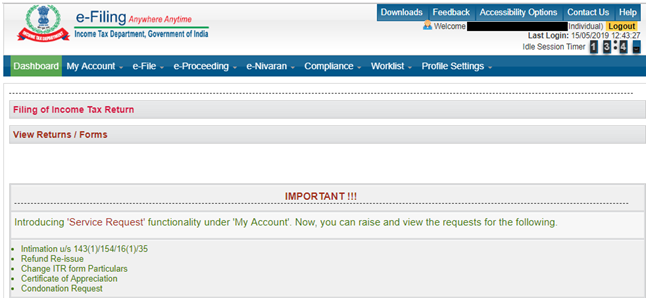

- Filing of Income Tax Return

- E-verification of Returns

- View previously filed income tax return(s)

- Download of Form 26AS

- For applying Income tax rectification request

- Generate EVC (electronic verification code)

- View Form 15CA

- Submit income tax grievance

- Check the status of the submitted grievance

- Pre-validate Bank/Demat account

Method 1: How to login at the Income-tax e-filing site through the portal?

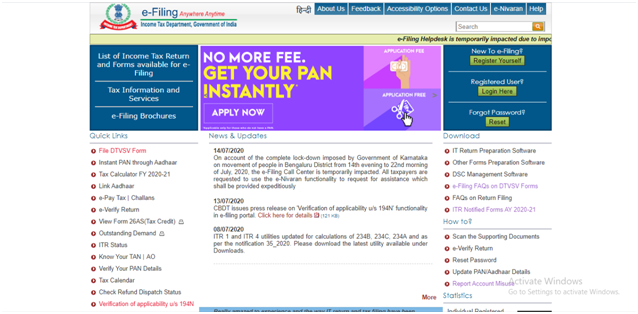

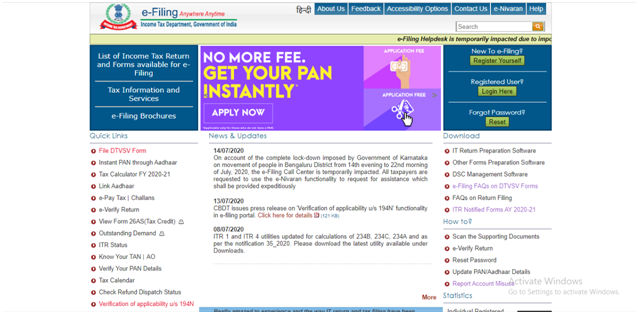

Step 1: Visit at the Income tax e-Filing portal https://www.incometaxindiaefiling.gov.in/home and click on the “Login here.”

Methods of login at the Income Tax e-Filing

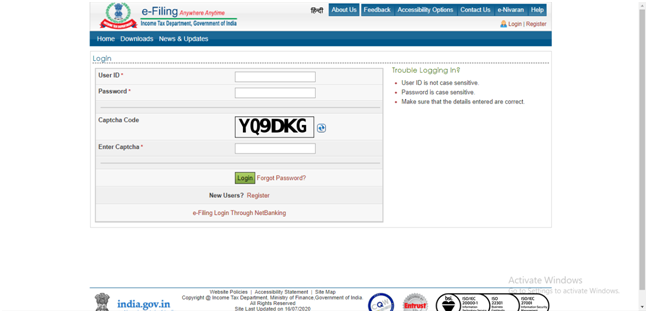

Step 2: On clicking, a new page will open. Here, you need to enter your User ID (PAN Number), password (set at the time of registration at Income tax website), Captcha Code, and click on “Login.”

Step 3: After login, the Income-tax e-Filing dashboard with services will open.

Method 2: How to login at the Income-tax e-filing site through Internet banking?

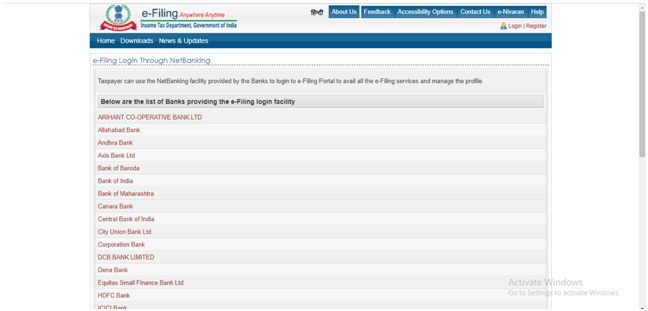

For the taxpayer’s convenience, the Income-tax department allows them to log in to their E-filing portal via internet banking. However, this facility is available only for those who have updated their PAN cards in the banks.

Here is the step by step process of Income-tax login via internet banking:

Step 1: Visit the Income-tax E-filing portal to check the authorized banks for login at the portal through internet banking.

Click here for bank list: https://www.incometaxindiaefiling.gov.in/main/bank_netbanking

Step 2: Click on the bank name (in which you have an account, and PAN is updated), you will be redirected to the bank’s Internet banking login page.

Step 3: A login page will open. You need to enter your Net banking ID and Password to log in at the internet banking portal.

Step 4: Once logged in, you will see a range of income tax services to avail as per your requirements.

How to reset Income Tax e-Filing portal Password?

In case you have forgotten your Income Tax e-Filing portal’s password, you can rest it easily by following the 3 simple steps:

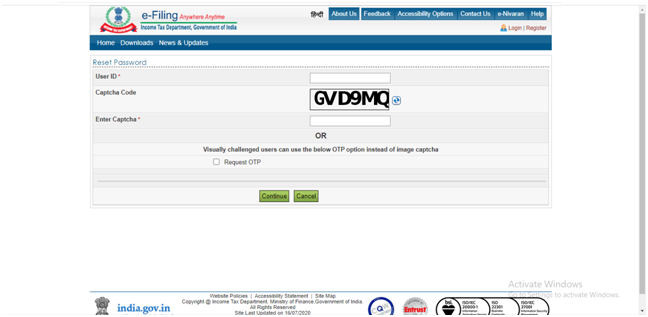

Step 1: Visit at the Income tax e-Filing portal https://www.incometaxindiaefiling.gov.in/home and click on the “Reset” showing under the “Forget Password.”

Step 2: Now, enter the User ID (PAN), Captcha code, and click on the “Continue” button.

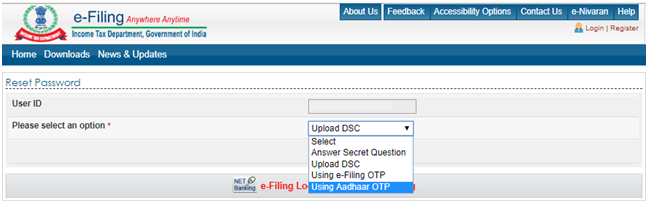

Step 3: Once you continue, you will get 4 different options to reset or recover the password as below:

- Answer secret question (The user has submitted at the time of registration)

- By uploading DSC (Digital Signature Certificate)

- With the help of e-Filing OTP

- By using Aadhaar OTP (User’s Aadhaar must be linked with PAN and PAN should be updated at the Income-tax portal)

Step 4: Choose the appropriate option and complete your process to reset the password.