What is the Universal Account Number (UAN)?

UAN is a unique identification number issued by the Employees’ Provident Fund Organisation (EPFO) to its members. It is a 12 digit number provided to Every Provident Fund (PF) account holder to manage their PF accounts.

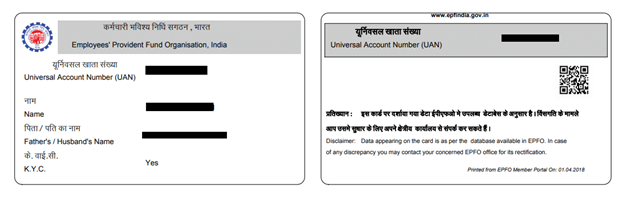

UAN Card contains the details of Universal Account Number and KYC details.

Important points related to Universal Account Number (UAN)

- Single UAN shall be allotted to each employee

- This UAN doesn’t change throughout the employment of the employee.

- UAN number is attached to your identity

- EPFO portal is responsible for issuing UAN and your employer to provide you

The objective of Universal Account Number

The objective of allotting unique account number is collating multiple Member Identification Numbers (Member Id) allotted to a single member. This will help the EPFO members to view details of all the Member Identification Numbers linked to it.

Benefits of Universal Account Number (UAN):

- Reduce the employer’s involvement

- No need for fund transfer in case of changing job

- Link all PF accounts at a single platform

- Monthly SMS updating of the PF contributions made

- KYC allows you to withdraw amount without the employer’s signature

- Extract the bank account details

- Track multiple jobs changes during the employment tenure

How shall I know my UAN?

There are two ways to know your Universal Account Number (UAN)

1. Ask from the Employer: Your employer is responsible for depositing the PF in EPFO Account. Hence, he is required to allot the UAN to every employee.

2. Through EPFO Portal: Another way to get your UAN is through the EPFO portal. Make sure you must have the member ID to know your UAN

Visit at EPFO portal https://epfindia.gov.in/site_en/index.php or directly access to UAN portal of EPFO https://unifiedportal-mem.epfindia.gov.in/memberinterface/

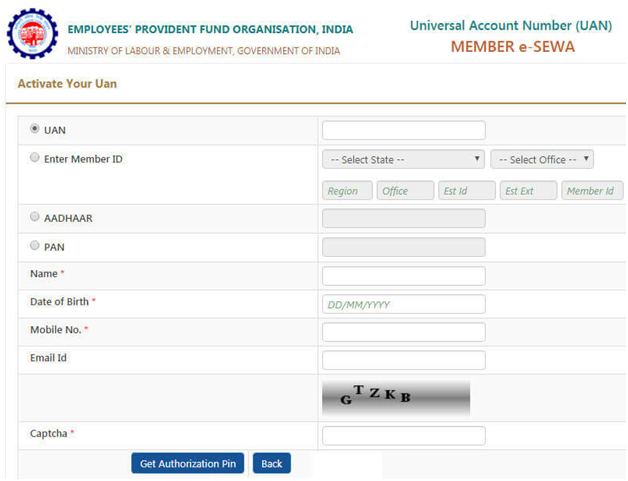

Step 1: Click on ‘Activate UAN,’ a webpage will be displayed to fill the details.

Step 2: Now, click on Enter Member ID along with other details such as name, date of birth, mobile no. etc.

Note: you can get your member Id through your salary slip.

Step 3: Click on ‘Get Authorization PIN’ to receive the PIN on your registered mobile number.

Step 4: Enter the received PIN and click on Validate OTP and Activate UAN”. You will receive your UAN on mobile.

In case you forgot your UAN, then you can follow the same process to retrieve your UAN.

How to activate the Universal Account Number (UAN)?

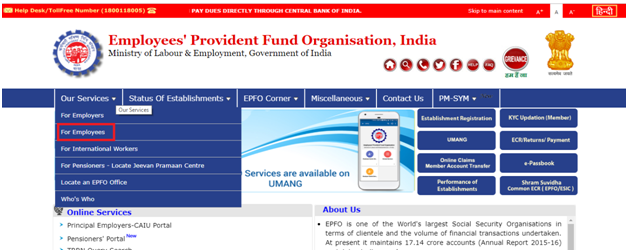

Step 1: Visit the official website of EPFO https://epfindia.gov.in/site_en/index.php, click on For employees option under the ‘Services’ Tab and then Member UAN/Online Service (OCS/OTCP) or directly at https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Click on the “Activate UAN,” showing under the important links.

Step 3: Fill the required information such as UAN, member Id, name, date of birth, mobile number, Aadhar and PAN

Step 4: After providing the details, click on “Get Authorization PIN.” This PIN will be sent on your registered mobile number.

Step 5: Enter the PIN and verify the details.

Step 6: Now, click on the “I Agree” checkbox and submit the OTP received on your registered mobile number

Step 7: Click on ‘Validate OTP and Activate UAN.’ You will receive a password on your mobile to log in at the portal.

What are the documents required for UAN Registration?

To register the UAN, you need the following documents:

- Aadhar Card

- PAN Card

- ESIC Card

- Address proof such as electricity bill, rent agreement, ration card, etc.

- Identity proof such as Voter Id, Passport, Driving license, etc

- Bank account details such as account number, IFSC Code, Branch, etc.

Note: You have to submit the documents for the first time of joining the company. Once your UAN is generated, you are not required to submit documents again.

What are the facilities available on UAN Member Portal?

- Download PF passbook containing the details of EPF contribution by you and employer

- Submit the new ‘EPF transfer claim.’

- Download or print your UAN Card

- View the status of transfer claim

- Update your KYC information

- View the member’s linked IDs and PF status

So, next time when you change your job, you need to submit your UAN to your new job employer. Rest all claims, and the amount will be automatically transferred to your new EPF account.