We are able to most of the end up being a little weighed down some times toward thought of going into the mortgage procedure. It will also take a look a bit challenging understanding how much you have got to disclose having last acceptance with the a home loan.

But with most everything in our lives, preparedness is paramount to making certain anything have completed better and you can promptly – providing improve the method. Therefore by the knowing what you desire and you can training your self towards mortgage techniques, not only are you able to make sure you may be waiting, and in addition potentially avoid a postponed or denial to own recognition towards your house loan.

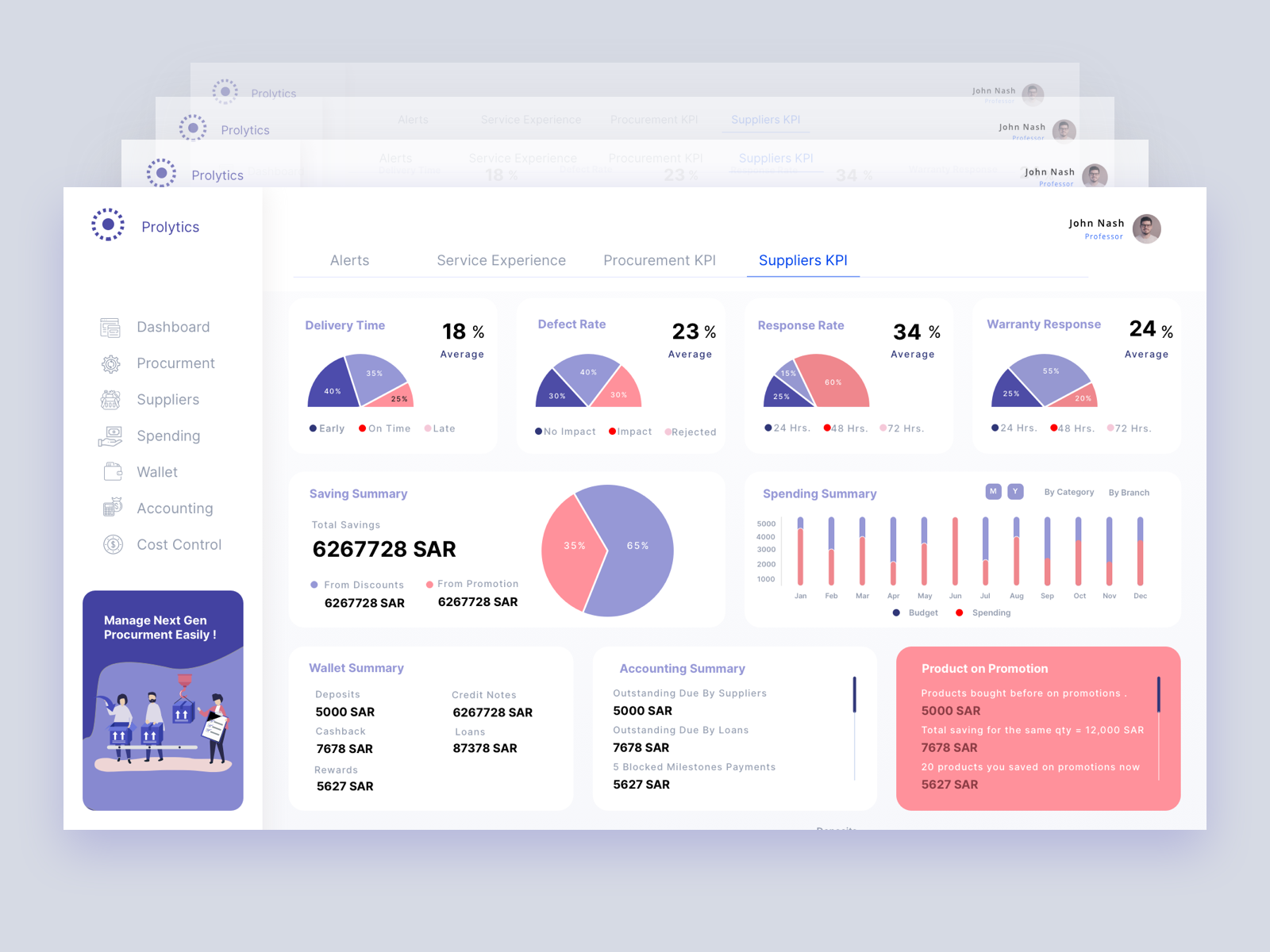

Mortgage processes snapshot

You will find one or two pathways you might take to score a good financial. You might talk with a real estate agent earliest to track down our home you dream about, up coming fill in the job which have an address. Performing this like that, you’ll ultimately find out if you have the money to cover one to house after you have recorded a deal. Of a lot agents need you to pre-qualify basic so they has actually a general notion of your spending budget.

Unfortunately, pre-qualifying is not a completed deal. This doesn’t mean you will be guaranteed that number. It is based on what you have informed your own financial to be true, but it hasn’t been affirmed yet ,.

One you’ll be able payday loans online Anderson AL to result is you find yourself not receiving an enthusiastic approval or it’s put off once your application experiences the brand new underwriting process due to omitted details, or maybe you just overestimated the assets and income, etcetera. One other you can easily channel, that isn’t normal with larger banks however, preferred for sure separate loan providers like Atlantic Bay Financial Classification, try an initial underwriting processes. Your sense might be more successful from inside the moving the borrowed funds process along and you’ll be warmer knowing how far household it’s possible to pay for early your research.

Thus underwriters tend to dive deep in the economic advice, such as your credit score, all your assets, earnings, etcetera. locate a great comprehension of what you can do to repay the brand new mortgage. The benefit of performing this upfront would be the fact you’ll get an effective conditional approval page after the underwriter goes through your guidance before you could come across a home. Their page will help boost your even offers on the house whilst confirms your in search of belongings at a cost section you can pay for. Not just does the process give one, but it addittionally makes you look for residential property within this times off ending up in their home loan banker. Upfront underwriting is additionally one thing real estate agents perform take pleasure in since it means they have a genuine comprehension of your finances getting a property. Like that, both you and your broker can with certainty glance at homes and focus more on perhaps the home caters to your chosen lifestyle as an alternative regarding focusing and you will worrying about brand new budget.

Delays to possess approval

No matter which channel you take, approvals and you can conditional approvals is going to be put off if not offer as often details as needed. Financial bankers work along with you every step of method and direct you through the mortgage techniques, but even then, possibly the latest borrower’s mistake may cause some right back-and-forward that have documents; sooner or later supporting the brand new approval processes. Here you will find the points that is also commonly impede an acceptance and you can the way to avoid them:

step one. Decreased a job details

It is essential to give 24 months away from employment history to exhibit you really have a reliable earnings weight. Lenders have a tendency to mostly look at the legs spend, exactly what comes up in your current shell out stubs, W-2, or any other tax processing variations away from annually. Type of a job may differ. Such as for example, some individuals functions regarding tips or percentage generally as opposed to paycheck.