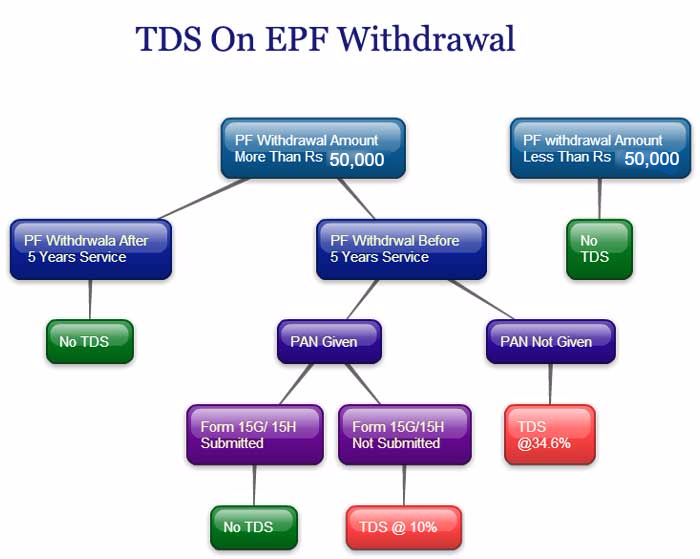

Tax on EPF Withdrawal, New TDS Rule Flowchart

Tax on EPF Withdrawal is a major issue for every employee who leaves their job before the retirement. There are certain Provident Fund Taxation Rules that must be followed by every employee. At the same time there are numerous tax benefits for various Provident Funds. In some situations, the employees are liable to pay the tax.

In order to understand all these things, we have come up with a detailed guide that help all the employees know about the PF Taxation Rules, Tax Benefits of various PFs, important tips to get rid of tax on PF and you can learn the best way to evade TDS. Take a look!

PF Taxation Rules

Usually, most of the employees understand the nature of tax-free EPF. The Employee Provident Fund is a best retirement corpus. The employee will get a decent interest rate and there is no chance for others to take your provident fund corpus. The PF which you receive is completely exempted from the tax. Most of the people have a common notion that the employee provident fund does not have any kind of tax issues.

But, only few of them are aware of the term tax even in the PF Corpus. In some situations, the PF Amount of an employee is subject to the tax. When the PF amount is subjected to the tax, then the employee will get a PF balance by a reduction of 34.6%. The employee will receive only 65.5% of the provident fund amount. The tax deducted at source (TDS) can affect your provident fund at a severe rate. However, there is a facility of tax on the premature withdrawal of Employee Provident Fund.

Types of Provident Funds

There are 4 types of Provident Fund that provide tax rebate. Here is the list of 4 types of Provident Fund:

- Employer’s contribution

- Employee’s contribution eligible for deduction u/s 80C

- Interest credited to the said fund

- Amount received at the time of termination of service

The calculation of the PF from the salary includes the following elements:

- Main salary

- Dearness Allowance

- Commission based on turnover fixed percentage accomplished by the employee.

Also Read: Download UAN Passbook from EPF Unified Portal

Tax benefits of EPF

The employee has numerous tax benefits with the employee provident fund and the EPF saves the employee from tax. Here are some of the tax benefits of EPF:

- The contribution of employer from your salary to the EPF Account is exempted or excluded from the tax. The exemption is of about 12% from your basic salary along with the Dearness Allowance (DA).

- The interest on the employer’s contribution is also exempted from the tax.

- The interest on the employee’s contribution is exempted from the tax.

- The employee contribution for the employee provident fund account is eligible for tax deduction u/s 80C.

How to calculate EPF Tax?

The tax payment of premature EPF Withdrawal is not so easy. It comprises of several years during which you have acquired the tax benefit. In order to pay the tax on employee provident fund, you need to follow the simple steps provided below.

Step 1: You need to add all the contributions that you have made during your work in a separate sheet for every financial year.

Step 2: You need to enter the employee contribution by exempting the interest part.

Step 3: The employee must add the contribution made by the employer by exempting the interest.

Step 4: You need to choose the interest on employee contribution for one year. For that one year, you need to deduct the interest of the previous financial year from the current financial year.

- For example, if the current financial year interest is 12,678 and the interest of previous financial year is 10,603 then the total interest will be 2,075.

Step 5: In the same way, you need to calculate the interest on the employer’s contribution.

Step 6: Now, you need to open the official web portal of income tax e-filing.

Step 7: You need to select the current financial year in order to revise your income tax return.

Step 8: You can increase the taxable income by the employers EPF contribution and the interest which you have earned in the year.

Step 9: you need to enter the interest on employer’s contribution in the other column of income.

Step 10: You need to deduct the employee contribution from the total investment amount of 80C, so that your 80C investment will be reduced.

You need to repeat all the above 10 steps for every financial year which you have listed on a sheet. You need to check the amount of tax before submitting your income tax return.

You need to pay the income tax and receive the challan number. You need to enter the total amount of tax paid and submit that revised income tax return for every financial year.

TDS on EPF

This is a sad thing for the employee due to the Tax Deducted at Source Rule that is present in taxation rules of Provident Fund. The total deduction amount of TDS is up to a rate of 34.6% which is considered as the maximum marginal rate of the income tax. Most of the people think that it is the amount of 34.6% tax is very large that is deducted from the amount of employee provident fund account. For most of the people, this is an irritating thing when they receive their EPF amount after such a massive deduction.

Terms and Conditions of TDS on EPF Withdrawal

The Employee Provident Fund Organisation can deduct TDS only if the employee comes under two different criteria.

- The employee has not finished a total of 5 years of his continuous service in the job.

- The EPF Withdrawal amount is greater than Rs.50, 000. Previously this limit was only Rs.30, 000.

How to avoid tax on EPF Withdrawal?

Here is a way to avoid the tax on EPF Withdrawal:

- Never try to withdraw the EPF amount after coming out of every job. Due to this, you might give tax after every withdrawal. Then the provident fund transfer will save your income tax.

- If you are looking to take slight break from your job, you mustnot withdraw your EPF amount. Instead you can transfer the EPF balance to the place where you have joined in the new service. A Provident Fund Account provides interest till three years of non-contribution.

- If in case, you are leaving a job completely and turning towards starting a new business. In such a case, you can wait for the completion of five years.

How to avoid TDS on your EPF?

This is only possible only in few cases and not all the times. The employee might have some kind of compulsion to leave the job prior to the completion of five years. This indicates that the employee must pay the tax on EPF Withdrawal. However, the tax on EPF will be less than 10% of the EPF amount. The TDS will be a minimum of up to 10%. In such a case people find ways to avoid the TDS. There is a possibility to avoid the TDS.

In order to avoid the TDS, the employee must fill the form 15G or form 15H which are the forms of declaration of non-taxability. Usually the form 15G is used by the common people in order to avoid TDS. On the other hand, the form 15H is used by Senior Citizens.

That’s it! This is all about the taxation rules, tax benefits, process of avoiding TDS on EPF and tax on EPF.