The government has made the PF withdrawal rules easier now without leaving a job. However, 100% withdrawal is not permitted but the EPF Members are allowed to make partial PF withdrawals while working on the job.

Partial withdrawal from EPF accounts is permitted in some emergency cases such as Home Construction /Plot Purchase, medical emergency, higher education, etc. The account holder can apply online through the EPFO portal for partial withdrawal. However, there are few conditions and eligibility criteria that need to be followed for the partial PF Withdrawal.

Here is the eligibility and conditions for EPF advance:

Employees are allowed to withdraw on the below-listed criteria. Based on the different purposes of withdrawal, they need to serve the minimum service and then eligible for the minimum withdrawal amount.

| Sl No. | Purpose of the Withdrawal | Minimum Years of service Duration | PF withdrawal amount | Number of Withdrawal permitted | Documents Required |

| 1 | Home Construction /Plot Purchase | 3 years | 90% of the EPF balance or, Total Expense whichever is least | Once | Declaration form not required |

| 2 | Renovation or repairing of House | 3 years from the construction of House | 12 months salary (Basic + DA) or, Employee Share with interest or, Cost of work Whichever is least | Once | Declaration form not required |

| 3 | Prepayment of Home Loan | 10 years | 36 months of salary (wages and DA) or, 100% of EPF Balance with interest or, Outstanding Loan amount Whichever is least | Once | Form 31 Certificate indicating the outstanding balance (Principal and Interest) from the agency (Financial Institution/Bank) |

| 4 | For your own treatment or Family | Any Time | 6 months salary (basic wages + DA) or, employee EPF share with interest Whichever is least | No Limit (Whenever you need funds) | Form 31 A certificate signed by doctor and employer |

| 5 | For Marriage of self/son/daughter/brother/sister | 7 years | 50% of Employee Share with interest | 3 times | Members declaration in Form 31 |

| 6 | Post matric Education of Self/son/daughter | 7 years | 50% of Employee Share with interest | 3 times | Form 31 Certificate regarding the course and estimated expenditure from the institution |

| 7 | For purchasing equipment for physically handicapped employees | Any Time | 6 months salary (basic wages + DA) or, employee share + interest or, Cost of equipment Whichever is least | After the interval of 3 years | Form 31 Certificate from Doctor |

| 8 | Withdrawal Prior before Retirement | After 54 years of age and one year before retirement | 90% of the EPF balance | Once | – |

| 9 | Closure of the Company | Whenever required | 100% of EPF Balance | Not applicable | – |

Here is the process of withdrawing of PF without leaving a job:

Employees can easily withdraw PF balance through the EPFO member portal by following the below steps: Make sure that you have an active UAN number, and it should be linked with an Aadhaar card. In such cases, employees do not require the attestation of documents from their employers to make PF withdrawal.

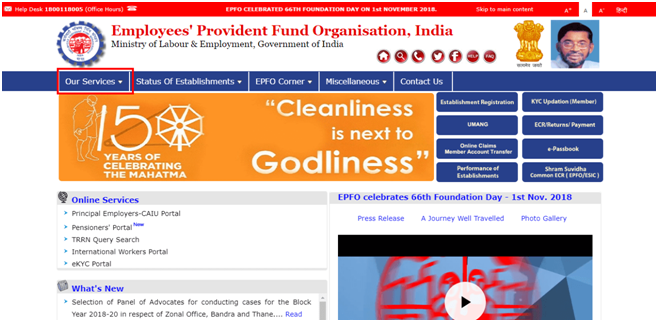

1. Visit the official website of EPFO https://www.epfindia.gov.in/site_en/index.php

2. Here you will see the “Our Services” tab; under this, choose the option “For employees.”

3. Under the “For employees” options, click on the option “Member UAN/Online Service (OCS/OTCP)”

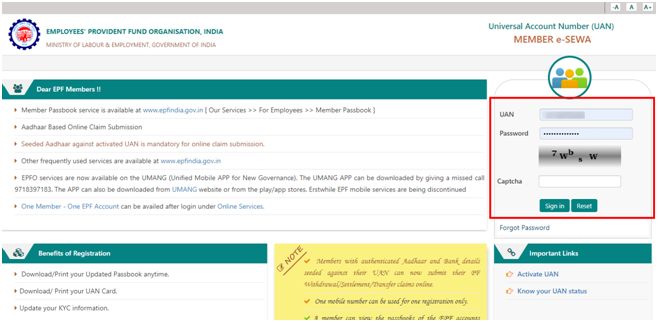

4. A login page will be opened to login by using your UAN and password, as shown below.

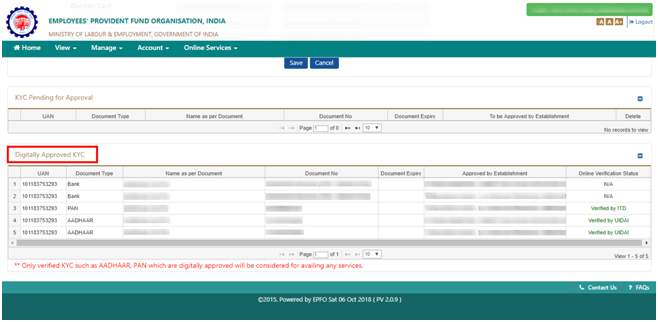

5. After login, you will see the “Manage” tab, drop down the same and click on the “KYC” option.

6. Now, scroll down till the bottom of the page. Here you will find the option of the “Digitally Approved KYC” section. Check the KYC details. Make sure that the details are accurate to proceed further.

7. Once you are ensured that the KYC details are correct. Now, click on the “CLAIM (FORM-31, 19 & 10C) under the drop-down list of the “Online service” tab to proceed for withdrawing the PF amount.

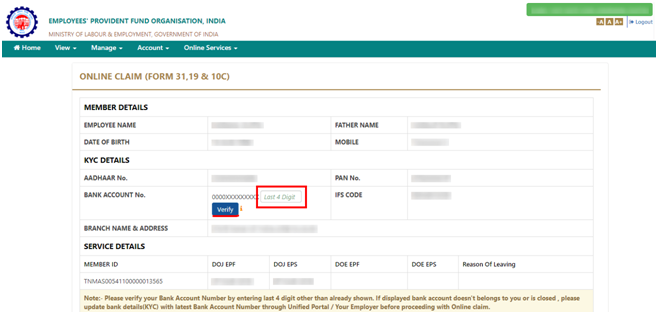

8. You will be redirected to a new page, where “ONLINE CLAIM (FORM 31, 19 & 10C)” form will be automatically generated as below:

9. This automatically generated form required to enter and verify the last 4 digits of your registered bank account number.

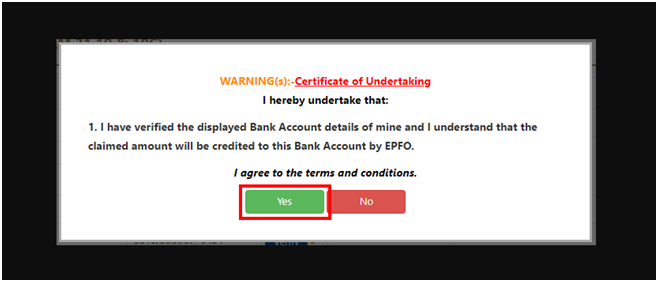

10. Once your bank account details are verified, a “Certificate of Undertaking” will be generated. Click “Yes” to proceed further.

11. A tab with “Proceed for Online Claim” shall be prompted to proceed further.

12. Now, firstly, click on the drop-down list of “I want to apply for” and select the option of “PF ADVANCE (FORM – 31) for withdrawing the PF fund.

13. Once you select the declaration form (FROM -31), choose the purpose for which the advance is required. Complete the form by filling the employee address and amount of advance required.

Note: There might be the need for uploading scanned documents depending upon the nature of withdrawal.

14. Once you complete the process, your employer will approve the withdrawal request as submitted by you; the withdrawal amount will be transferred to your bank account. You will also receive an SMS notification on your registered mobile number.