The UAN is a unique number allotted to EPFO members who contribute towards their EPF Accounts. According to the Employees’ Provident Fund Organisation (EPFO) rules, every PF member should have only one UAN.

In case the employees change their jobs, the UAN of the members remains the same. However, employees are claiming to have more than one UAN during their employment period. Ideally, it is against the rules of EPFO to have more than one UAN.

Therefore, an employee having two UANs can get their EPF account transferred from one to another and get their previous UAN deactivated.

Reasons for allotment of two UANs

Multiple job changes typically result in multiple Employee provident funds, consequently, allotment of UANs. When an employee switches their job, the new company opens a new EPF account. All EPF accounts are linked with a UAN. Hence, there are chances that a new UAN is allotted to the employee when they change their organisation.

So, there are mainly two reasons for the allocation of two UANs:

Non-disclosure of previous allotted UAN

When an employee changes job, they have already a UAN Number EPF account number (Member ID). They have to disclose their UAN to the employer of a new job. If they forgot to give these details, the new employer would open a new UAN and EPF account.

Non-mentioning of Date of exit

Your previous employer has to mention the date of exit in the Electronic Challan and Return (ECR). If this information is not provided on time, the new establishment allots a new UAN to the employee.

How deactivate or merge two UAN?

If you have two UANs, then you must apply to deactivate one UAN. Here are the two methods to deactivate a UAN.

Method 1:

1. Report the issue to EPFO by mail: You can directly mail the issue at [email protected]. Mention the previous and current UAN in the mail and your Member ID.

2. Verification process: After receiving the mail, the EPFO will conduct the verification.

3. Activation of new UAN: Once the verification completes, they will block your previous UAN, and the new one will be kept active.

4. Submitting the claim: The employee has to submit a claim to transfer the EPF account that is linked with the blocked UAN to the active account.

Method 2:

1. Apply for transferring EPF: Here, firstly employee has to apply for transfer of old EPF to the new one. And, the EPFO portal will automatically identify the EPF accounts of the employee.

2. Blocked and Deactivation of previous UAN: Upon the identification of accounts, old UANs will be processed to the new EPS accounts’ UAN. The portal will deactivate and block the old UAN.

3. Intimation by SMS: The employee will receive an SMS for the deactivation status.

4. Activation of new UAN: Now, in case the new UAN is not yet activated, then the employee has to request to activate it. After activated only, you can see the status of the updates of your PF account.

5. Auto-population of UAN: The system auto-populates the new UAN number in the ECR. The employee can claim the PF arrears from the previous employer in this new UAN linked account.

How to transfer EPF online?

Here is the procedure to transfer your EPF online:

Step 1: Visit the official website of EPFO by visiting here and log in to Unified Portal. Click here to log in directly https://unifiedportal-mem.epfindia.gov.in/memberinterface/. Login account with UAN number and Password.

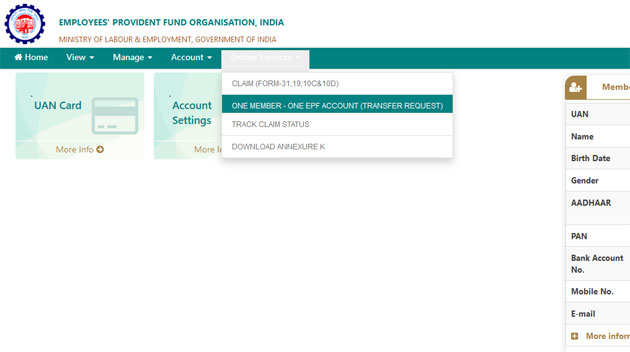

Step 2: Now, at the online dashboard, click on ‘One Member – One EPF Account (Transfer Request)’ under the drop-down list of “Online Services.”

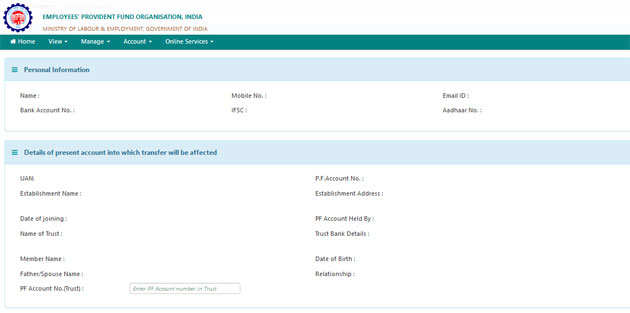

Step 3: A new webpage with “personal information” and “PF account for present employment will open.”

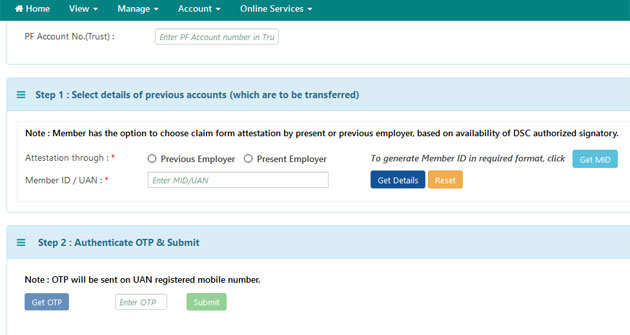

Step 4: Select whether your present or previous employer will attest your online transfer form. Tick accordingly, and enter the member ID/UAN. Click on “Get details.” It will show your EPF accounts.

Note: Enter the EPF account number (Member ID) in case your UAN registered with your present, and the previous employer is the same.

Step 5: Select the EPF account from where the money has to be transferred to the present EPF account.

Step 6: Once you have selected, click on “Get OTP”. You will receive an OTP on your UAN registered mobile number. Enter the OTP and submit it.

Step 7: The employer will digitally approve your EPF transfer request with his/her own unified portal.

Step 8: After submitting the form, the system will generate a tracking Id to track the status of EPF transfer.

Note: Download the Form in PDF format for your reference.

FORM -13 –Transfer Claim Form

Certain regional EPFO offices may insist on submitting the Form 13 -Transfer Claim Form along with the signed copy of the above-generated PDF.

Therefore, fill form 13 online with the PF details of previous and current employer and post it to the employer within ten days. The employers will verify the details entered by you and approve it to transfer your EPF claim online.

Once the employer approves your transfer request, the status will be shown as “Accepted by the employer”.