Predatory loan providers play with highest-stress sales ideas and steer your into large-attract money with many rubbish charge tacked for the, even although you will get be eligible for a better financing. High-interest levels and you will so many costs enhance the count you ought to acquire, while making it tough for you to help make your monthly obligations. Which throws you at risk of dropping your house as well as the currency you have paid off into it.

You will not know if a loan provider are legitimate or predatory up to your research rates and now have estimates out of multiple lenders. While to acquire a property, or just refinancing your existing loan, it is very important evaluate additional fund and also the cost of each. Even although you features good credit, you could potentially slip target in order to predatory Inverness loans lenders. Cover your self because of the trying to find fund at the various other finance companies, borrowing unions, or any other loan providers.

Predatory credit methods

- Do not inform you of straight down rates finance it’s also possible to be eligible for.

- Put too many charges, aren’t called rubbish charges to mat their finances.

- Encourage one to repeatedly refinance. This enables them to collect alot more financing charge from you.

How to get an effective home loan

Predatory lenders prey on people that have no idea how good a great mortgage it be eligible for. You could potentially cover yourself by-doing the second:

Get a copy of one’s credit history and you may FICO get. The better the FICO score, the greater the borrowed funds you can purchase. In the event your FICO score was reasonable, you can learn how-to replace your score.

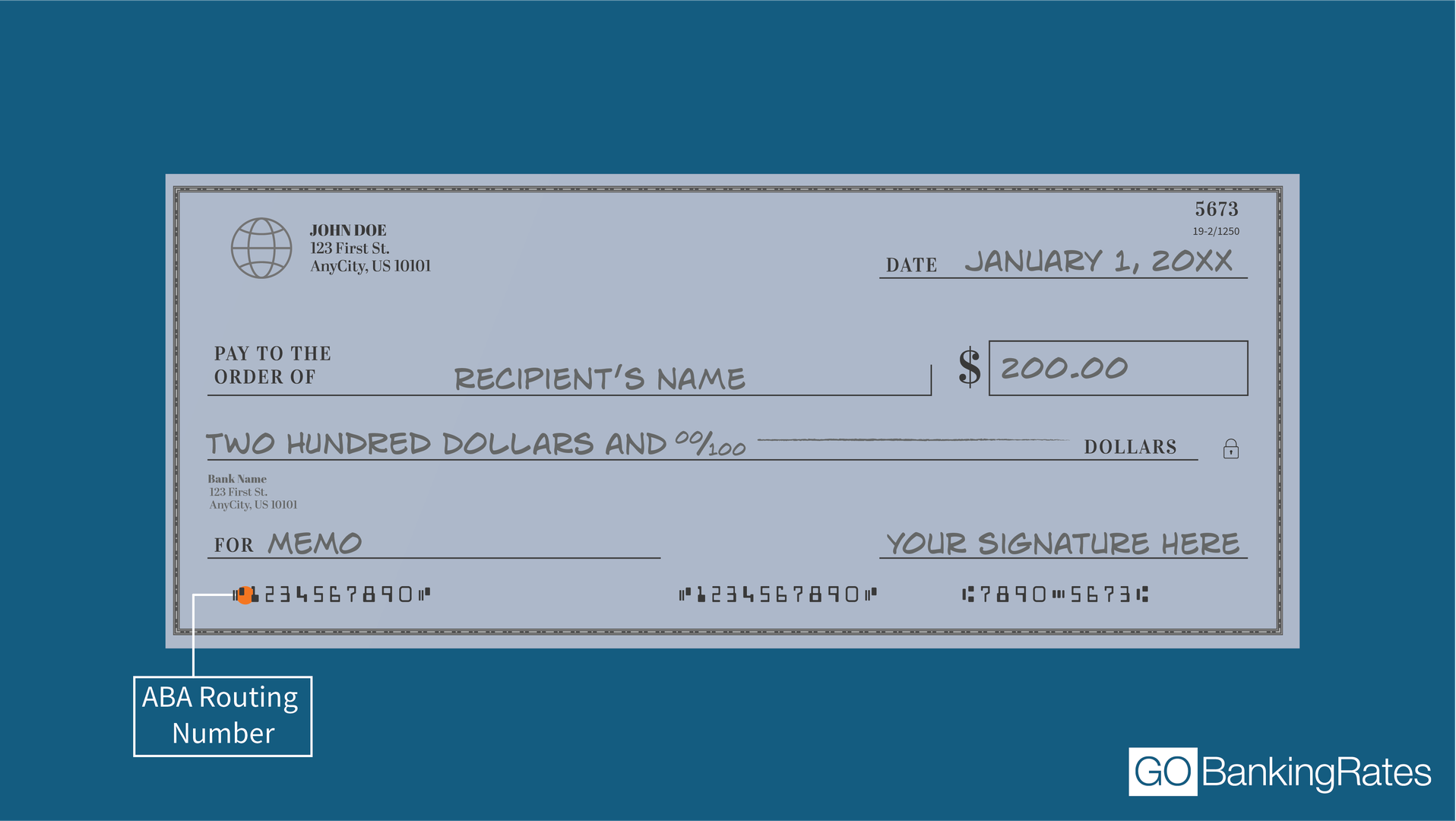

Buy financing as you would other big purchase. You won’t know the way a good financing you can aquire up to you have got numerous rates. Contact three or maybe more lenders and you will contrast the interest rate, items, and costs. You need to discover a good faith Guess, which obviously teaches you this new loan’s facts, off a loan provider within 3 days from trying to get that loan.

Examine the new estimates you’ve got out-of more lenders. Look at the mortgage words and you will charge. It needs to be very easy to tell those is predatory. Select the right financing to the reduced interest rate and fees.

Subprime money

Without having good credit, lenders think you a top-chance debtor. The greater the risk you are, the higher the rate you might be expected to expend. They are not planning to offer you a knowledgeable money having a reduced prices. not, you could qualify for a subprime mortgage. A good subprime mortgage features a high rate of interest and you can charge than just perfect financing that are available so you’re able to homeowners with a good borrowing rating. You should think about highest-notice subprime loans as being quick-title. In case the credit history advances, you might and should apply for a much better financing.

Taking subprime loans

- High-rates of interest and you will fees.

- Monthly premiums that just defense the attention and do not reduce the dominant balance.

- Balloon payments with an enormous percentage due in one lump sum after the loan.

- Changeable interest levels that will increase the amount of your monthly percentage.

- Prepayment penalties if you pay back the borrowed funds very early, in the event it’s so you can re-finance the mortgage having ideal terminology.

Negotiate financing costs and costs

Really banking institutions, credit unions, and you will financing brokers costs factors and you can fees to give you a good loan. There are not any put costs and you will costs. Mortgage costs is actually flexible and certainly will are priced between financial in order to lender. You really need to negotiate the amount of these types of charge as you create various other significant buy.

Before signing

Everything you had been promised shall be on paper into mortgage data files. If you do not see some thing, dont sign. Request an explanation. Review the loan data files carefully.