E-Way bill means Electronic Way Bill. It is a unique Eway Bill Number (EBN)/document that is generated on the movement of the good (either inter-state or intra-state) having value more than Rs. 50,000. Once it is generated, it is made available to the recipient, supplier, and the transporter.

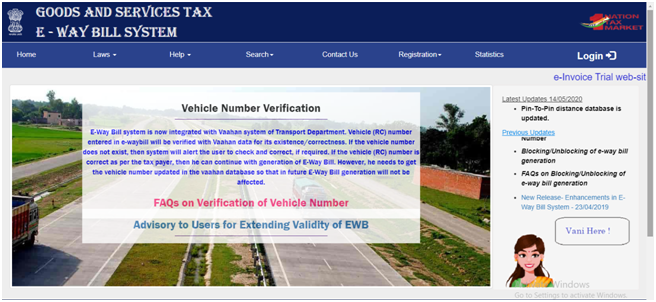

From 1st April 2018, the generation of the E-Way bill is compulsory at the E-way bill portal https://ewaybill.nic.in/.

An e-way bill comprises two parts: Part A (details of the consignment) and Part B (details of the transportation by the transporter).

Also Read: How to generate E-way Bill?

Applicability of E-Way Bill

E-Way bill applies to the movement of the goods from one place to another. The consignment value shall be taken either on an individual invoice basis or the consolidated invoice).

Generation of E-Way Bill

The registered person has to generate an E-way bill before commencing the goods movement in the following cases. However, it should be noted that in case of any error or mistake in the e-way bill, you can’t change or edit it. The only option is to cancel the old e-way bill and create the new one.

1. In relation to “Supply.”

a) For consideration – may or not in the course of business

B) Without consideration – Branch transfer, barter or exchange, etc.

2. Other than supply such as job work, the return of goods

3. Due to inward ‘supply’ from an unregistered person

2. Mandatory generation of E-way Bill

a) Inter-State movement of Goods by the Principal to the Job-worker

b) Inter-State movement of Handicraft goods by a dealer, which are exempted from GST registration.

Documents required to generate E-way bill

There are three main documents for the generation the E-way bill as below:

1. Invoice/ Bill of Supply/ Challan of the goods

2. Transporter ID or Vehicle number (If goods are transported by the road)

3. Transporter ID, Transport document number, and date (if the goods are transported by the other modes such as rail, air, or ship)

Who is responsible for generating an E-way bill?

These parties need to generate an E-way bill:

Registered persons: A Registered person shall be responsible for generating an e-way bill if the value of goods exceeds Rs. 50,000.

Unregistered person: If the unregistered person makes a supply to the registered person, then the unregistered person shall generate the e-way bill, but the receiver will ensure the details filled in an E-way bill

Transporter: in case the supplier has not generated an e-Way Bill, then transporters (either road, air, rail mode of conveyance) will generate it.

Validity of the E-way bill

| Type of conveyance | Transport Distance | Validity of E-way bill |

| Normal Cargo | Up to 100 kms | 1 day |

| For every additional 100 kms or part thereof | 1 additional day | |

| Over Dimensional Cargo | Upto 20 Kms | 1 day |

| For every additional 20 kms or part thereof | 1 additional day |