Understanding Income Tax Notice under Section 143(1)

Income Tax E-filing is quite important for every business man, a company and an employee who earns specific amount of salary. You need to file your Income Tax Returns every year in the period of April, June and July. The Income Tax Department is responsible to levy specific tax on particular individual based on their annual income. It is mandatory for an individual to file E-filing Income Tax Returns before the due date. For the current financial year 2015-16, the due date for filing income tax returns is 31st July 2016. Here is everything you need to know about the Income Tax notice under the section 143 (1). Have a look!

When is the Income tax notice under Section 143(1) – Letter of Intimation worked?

There are three types of notices that can be sent under the section 143 (1)

- You will receive intimation and at that time, you need to consider the notice as a final assessment of your previously filed Income Tax returns. The Income Tax Processing Centre will send the intimation if they find your income tax return is completely matched with their calculation without any flaws under section 143 (1).

- You will receive a refund notice at times when you have paid an additional amount of Income Tax to the Income Tax department that actual amount. Then, in such a case, you need to wait for the cheque.

- Demand Notice where the officer’s computation shows shortfall in your tax payment. The notice will ask you to pay up the tax due within 30 days.

Is there any time limit for sending the intimation?

Yes, there is specific time limit for sending the intimation. Usually, the intimation is sent before the finishing of 1 year from the end of the assessment year in which the income was computable. In short, before the completion of one year, from the end of the financial year where in the Income Tax returns were filed.

How is the intimation sent to the Tax Payer?

The intimations are sent by the Income Tax Processing Centre to the tax payer via email to the registered Email address that was given at the time of filing income tax returns online. E-filed Income Tax Returns are usually processed by the Central Processing Centre (CPC) in Bengaluru and the sender is [email protected].

You will also receive a hard copy of the intimation which is sent to the tax payer via the post at the address which is associated with PAN number similar to the non-electronic filed ITRs.

The acknowledgement attachment is password protected. You need to enter the password in order to open the acknowledgement file. The Password you need to enter is your PAN number which must be entered in lower case, followed by your date of birth in the format of DDMMYYY.

For instance for Mr. Kumar with PAN number BJKDG8693H and date of birth as 20 September 1992, the password would be bjkdg8693h20091992. The file received by the tax payer via the email is a zip file and you need to extract the pdf and open the pdf file.

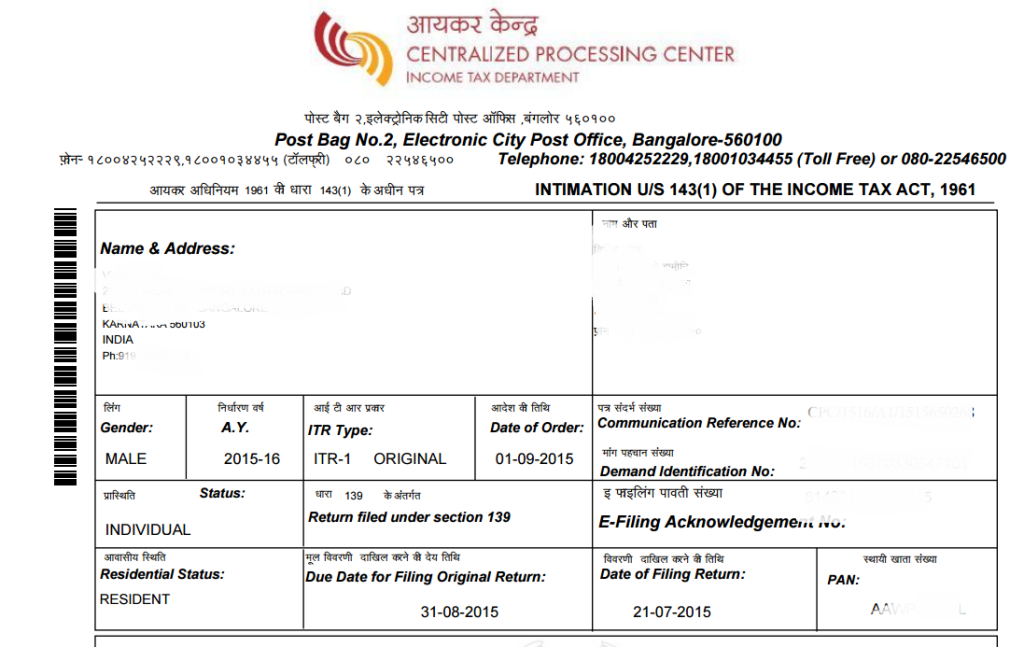

What Includes in the Document?

The first part of the document has specific details such asthe following:

- Name

- Address

- PAN number

- ITR Type

- Assessment Year

- E-Filing Acknowledgement Number

- Communication Reference Number

- Date of Order

Date of order is the Date on which order under section 143(1) was passed by the Central Processing Centre,Bengaluru.

Contact Details

Here is the Income Tax Helpline or Toll Free Number of CPC Bangalore Income Tax Department (Bengaluru) if you have any queries regarding Income Tax:

- 1800 -425 2229

- 080-22546500

You need to have Communication Reference Number before you contact the Income Tax Helpline. Also, you need to have other PAN Card details such as PAN Card number and Date of Birth.

The other part of the document comprises of the following:

- Calculation of income

- Income reported under different categories

- Deductions claimed

- Taxable income

- Tax due

- Tax paid

- Ex advance Tax

- Self-assessment tax

- TDS

These are the essentials details that are present in the Income Tax Acknowledgement or the Intimation.