GSTR-9 is the Annual tax return that includes all business transactions i.e., supplies made and received under various tax heads (CGST, SGST, and IGST) during a financial year. It further contains details such as

- Taxes paid or adjusted,

- Input tax credits (ITC) claimed or reversed,

- Refund claimed,

- Previous year transactions etc.

In simple words, it consolidates all the information furnished in the monthly/quarterly returns during the particular financial year.

Eligibility to file GSTR-9

All the taxpayers/taxable persons having GST registration are required to file GSTR-9. However, below-mentioned taxpayers are not eligible to file the return:

- Composition Dealers (GSTR 9A is applicable)

- A person deducting TDS u/s 51

- A person collecting TCS u/s 52 (GSTR-9B is applicable)

- Casual taxable person

- Input Service Distributors

- Non-resident taxable person

Types of GST Annual Return

| Form | Applicability |

| GSTR 9 | It is an Annual return filed by the regular registered persons who file GSTR-1 and GSTR-3B. Note: All the registered taxpayers shall file Annual return, irrespective of their turnover limit. |

| GSTR 9A | GSTR-9A is the annual return applicable composition dealers registered under the Composition Scheme. |

| GSTR 9B | GSTR-9B is the annual Return for the e-commerce operators who collect tax at source and have filed GSTR 8. |

| GSTR 9C | GSTR-9C is the audit form that is filed annually by all the taxpayers having turnover more than Rs. 2 crores. It is basically the reconciliation statement between the annual returns filed in GSTR 9, and the audited annual financial statements of the taxpayer. Note: Reconciliation Statement and Annual return for the financial year 2018-19 due date is till 30th September 2020 (extended by CBIC). Earlier the extended due date was till 30th June 2020. |

Note: Furthermore, in the 39th GST Council Meeting, the government has updated the turnover for filing GST Annual Return

Due date of filing GSTR-9

For all the taxpayers eligible to file, a return has to file GSTR-9 till 31st Dec of the following year once in a year. For example, for the financial year 2019-20, you need to file GSTR-9 till 31st Dec 2020.

Step by step process to fill Form GSTR 9 Annual Return Form

Annual Return is a comprehensive return that is divided into 6 parts as below:

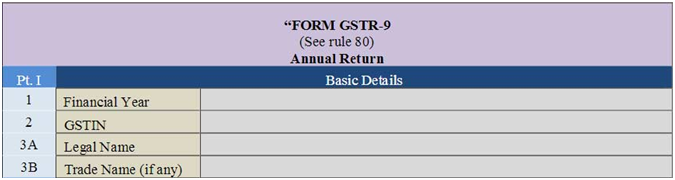

Part I: Basic Details such as

- Financial year,

- GSTN of the taxpayer,

- Legal name of the registered person,

- Trade Name (if any) of the registered business

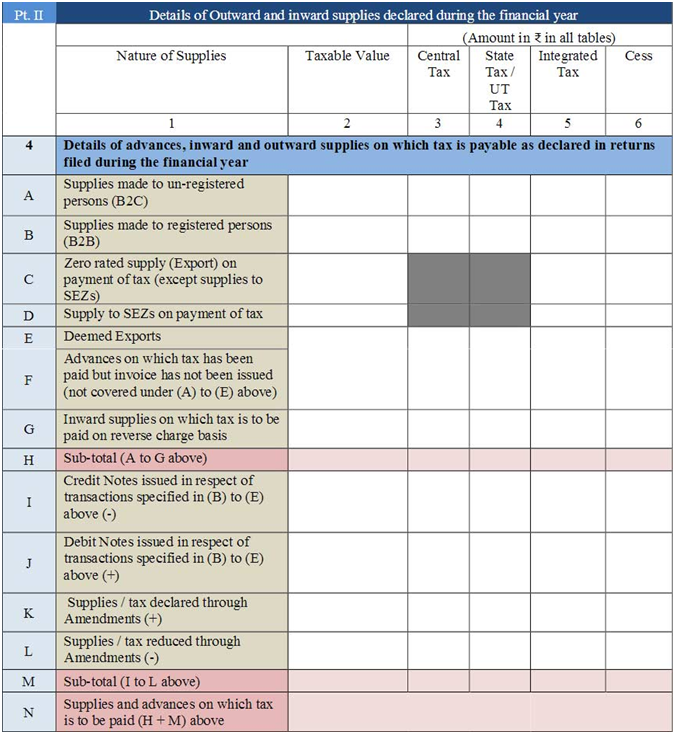

Part II: Consolidated details of advances and outward supplies during the year:

| Item No. | Particulars | Explanation | GSTR-1 or 3B column for taking details |

| 4A | Supplies made to un-registered persons (B2C) | Aggregate value of outward supplies made to unregistered persons on which the supplier has paid tax. | Table 5, 7, 9 &10 of GSTR-1. |

| 4B | Supplies made to registered persons (B2B) | The table will contain the aggregate value of supplies made to registered persons on which the supplier paid tax. | Table 4 (4A & 4C) of GSTR-1 |

| 4C | Zero rated supply (Export) on payment of tax (except supplies to SEZs) | This field will contain details of zero-rated supplies such as exports. | Table 6A of GSTR-1 |

| 4D | Supply to SEZs on payment of tax | It includes the supplies of goods & services made to SEZ units or SEZ developers on which tax has been paid | Table 6B of GSTR-1 |

| 4E | Deemed Exports | Fill the aggregate value of supplies of deemed exports on which the supplier has paid the tax | Table 6C of GSTR-1 |

| 4F | Advances on which tax has been paid but invoice has not been issued (not covered under (A) to (E) above) | Details of unadjusted advances on which tax has been paid but no invoices have been raised in this financial year | – |

| 4G | Inward supplies on which tax is to be paid on reverse charge basis | It will contain an aggregate value of all inward supplies (purchases), including supplies made by registered and unregistered persons and import of services, on which GST is paid by the recipient on the reverse charge basis | Table 3.1(d) of GSTR-3B |

| 4H | Sub-total (A to G above) | Auto Populated | – |

| 4I | Credit Notes issued in respect of transactions specified in column (B) to (E) above (-) | The aggregate value of credit notes issued in respect of transactions mentioned in the mentioned fields | Table 9B of GSTR-1 |

| 4J | Debit Notes issued in respect of transactions specified in column (B) to (E) above (+) | The aggregate value of debit notes issued in respect of transactions mentioned in the mentioned fields | Table 9B of GSTR-1 |

| 4K | Supplies/tax declared through Amendments (+) | Details of amendment (if any made) within the same financial year | Table 9A and 9C of GSTR-1 |

| 4L | Supplies/tax reduced through Amendments (-) | Details of the amendment (if any made) that reduces the tax. | – |

| 4M | Sub-total (I to L above) | Auto Populated | – |

| 4N | Supplies and advances on which tax is to be paid 4H + 4M (above) | Auto Populated |

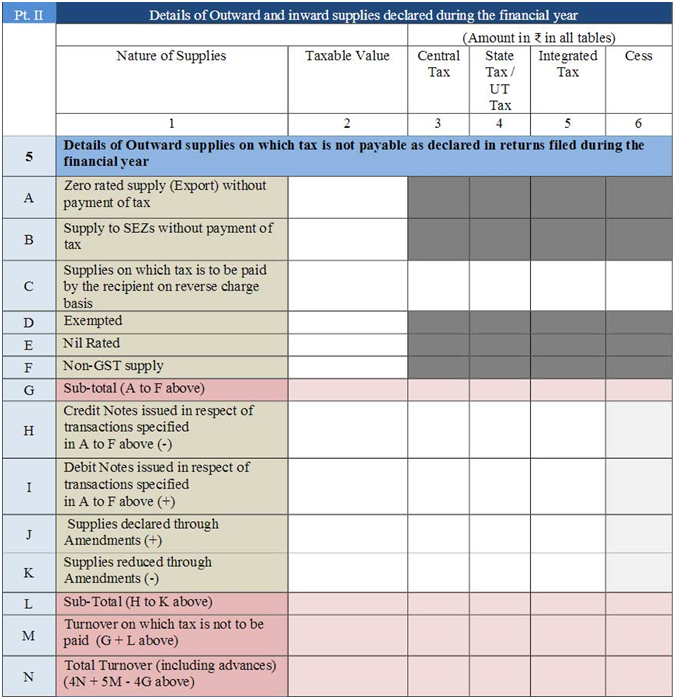

Details of Outward supplies on which tax is not payable as declared in returns filed during the financial year

| Item No. | Particulars | Explanation | GSTR-1 or 3B column for taking details |

| 5A | Zero rated supply (Export) without payment of tax | This field will contain details of zero-rated supplies such as exports on which tax has not been paid. | – |

| 5B | Supply to SEZs without payment of tax | Details of supplies made to SEZ units on which payment of tax is not made | – |

| 5C | Supplies on which tax is to be paid by the recipient on reverse charge basis | Aggregate value of supplies made to registered persons on which GST was paid by the recipient on RCM basis | – |

| 5D/ 5E 5F | (Exempted)/ (Nil Rated)/ (Non-GST supply) | Fill the Aggregate values of exempted, Nil Rated and Non-GST supplies | Table 8 of FORM GSTR-1 |

| 5G | Sub-total (A to F above) | Auto-Populated | – |

| 5H | Credit Notes issued in respect of transactions specified in A to F above (-) | Total value of credit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F | Table 9B of FORM GSTR-1 |

| 5I | Debit Notes issued in respect of transactions specified in A to F above (+) | Similarly, total value of debit notes issued in respect of supplies declared in 5A,5B,5C, 5D, 5E and 5F | Table 9B of FORM GSTR-1 |

| 5J and 5K | Supplies declared through Amendments (+), Supplies reduced through Amendments (-) | Details of amendments made to exports (except supplies to SEZs) and supplies to SEZs on which tax has not been paid shall be declared here | Table 9A and 14 Table 9C of FORM GSTR-1 |

| 5L | Sub-Total (H to K above) | Auto-Populated | – |

| 5M | Turnover on which tax is not to be paid (G + L above) | Auto-Populated | – |

| 5N | Total Turnover (including advances) (4N + 5M – 4G above) | Auto-Populated | – |

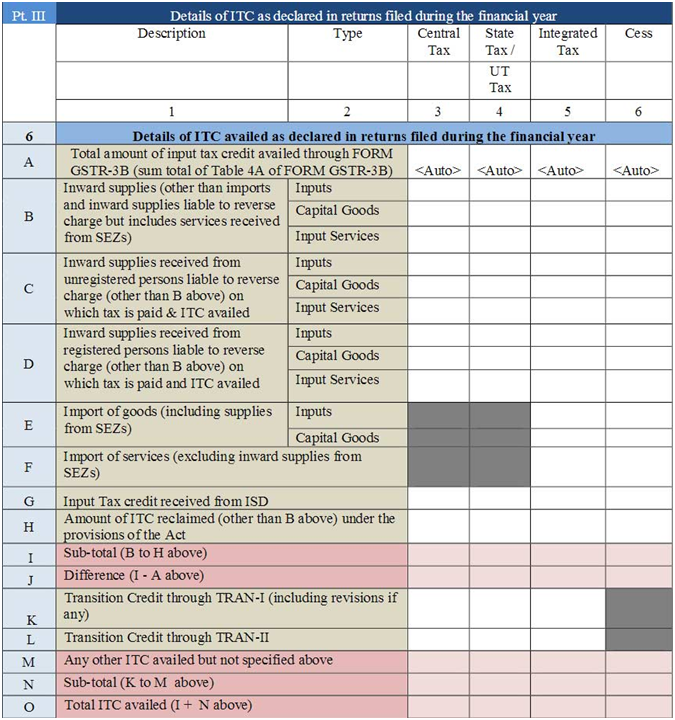

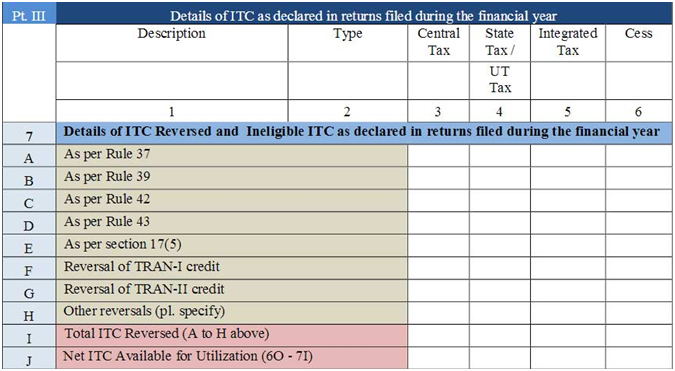

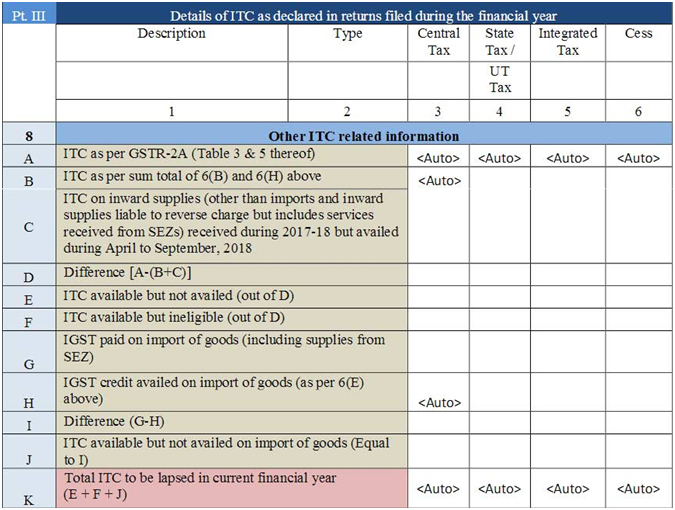

Part III: Details of Input tax credit (ITC) availed and reversed during the Financial Year

| Item No. | Particulars | Explanation | GSTR-1 or 3B column for taking details |

| 6A | Total amount of input tax credit availed through FORM GSTR-3B (the sum total of Table 4A of FORM GSTR-3B) | Auto-Populated | – |

| 6B | Inward supplies (other than imports and inward supplies liable to reverse charge but includes services received from SEZs) | an Aggregate value of input tax credit availed on all inward supplies, including the supply of services received from SEZs. However, it will not include except those on which tax is payable on reverse charge basis. Note: This shall not include ITC which was availed, reversed and then reclaimed in the ITC ledger as such details will be declared separately under 6(H). | Table 4(A)(5) of FORM GSTR-3B |

| 6C | Inward supplies received from unregistered persons liable to reverse charge (other than B above) on which tax is paid & ITC availed | Aggregate value of input tax credit availed on all inward supplies received from unregistered persons (other than import of services) that are liable for tax on reverse charge basis only shall be disclosed. | Table 4(A)(3) of FORM GSTR-3B |

| 6D | Inward supplies received from registered persons liable to reverse charge (other than B above) on which tax is paid and ITC availed | It will include the total input tax credit availed on all inward supplies received from registered persons on which tax is payable on reverse charge basis. | Table 4(A)(3) of FORM GSTR-3B |

| 6E | Import of goods (including supplies from SEZs) | Details of input tax credit availed on the import of goods. It will also include the supply of goods received from SEZs. | Table 4(A)(1) of FORM GSTR-3B |

| 6F | Import of services (excluding inward supplies from SEZs) | Details of input tax credit availed on the import of services. | Table 4(A)(2) of FORM GSTR- 3B |

| 6G | Input Tax credit received from ISD | An Aggregate value of input tax credit received from input service distributor. | Table 4(A)(4) of FORM GSTR-3B |

| 6H | Amount of ITC reclaimed (other than B above) under the provisions of the Act | an Aggregate value of input tax credit availed, reversed and reclaimed as per the ITC provisions. | – |

| 6I | Sub-total (B to H above) | Auto-populated | – |

| 6J | Difference (I – A above) | Auto-Populated | – |

| 6K | Transition Credit through TRAN-I (including revisions if any) | Details of transition credit received in the electronic credit ledger on the filing of FORM GST TRAN-I including revision of TRAN-I. | |

| 6L | Transition Credit through TRAN-II | It will include the details of transition credit received in the electronic credit ledger through FORM GST TRAN-II | |

| 6M | Any other ITC availed but not specified above | Details of ITC availed but not covered in any of heads specified under 6B to 6L above shall be declared here. Further, the details of ITC availed through FORM ITC01 and FORM ITC-02 in the financial year will also be entered here. | |

| 6N | Sub-total (K to M above) | Auto-Populated | |

| 6O | Total ITC availed (I + N above) | Auto-Populated |

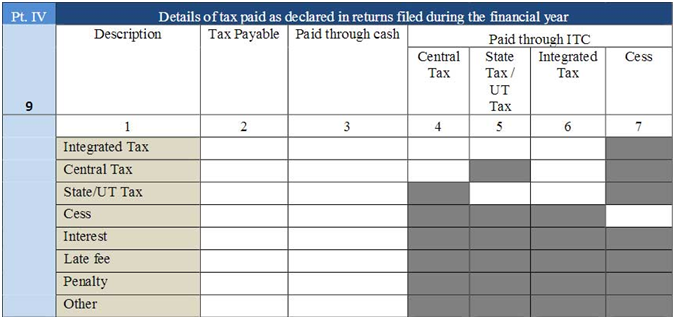

Part IV: Details of actual taxes paid during the financial year

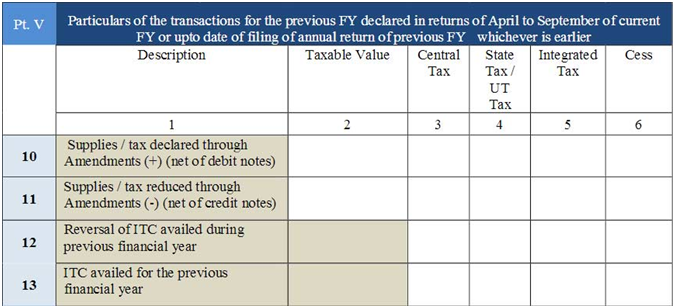

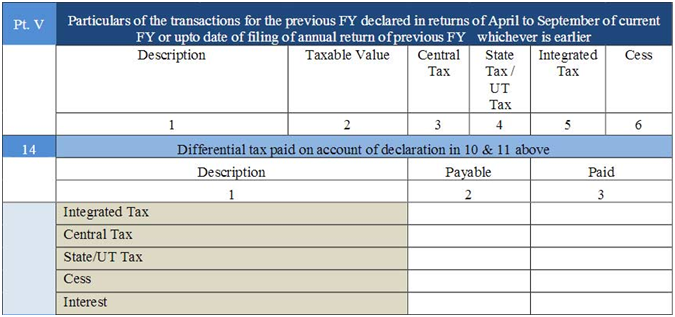

Part V: Details of amendments (if any made) for the previous FY declared in returns of April to September of current financial year or upto date of filing of annual return of previous FY whichever is earlier.

| Item No. | Particulars | Explanation | GSTR-1 or 3B column for taking details |

| 10 | Supplies / tax declared through Amendments (+) (net of debit notes) and 11 Supplies / tax reduced through Amendments (-) (net of credit notes): | Here, enter the details of the additions (debit notes) or amendment or reductions (credit notes) made during the period April 2018 to September 2018 (against invoices reported in previous financial year) in GSTR-1, which created the additional liability. | |

| 12 | Reversal of ITC availed during the previous financial year | ITC availed in during the period July 2017 to March 2018, which has been reversed (Ineligible credit availed) during the current financial year. | |

| 13 | ITC availed for the previous financial year: | Details of ITC for goods or services received in the previous financial year but ITC for the same was availed in the current financial year or date of filing of Annual Return for the previous financial year whichever is earlier shall be declared here. | Table 4(A) of FORM GSTR-3B |

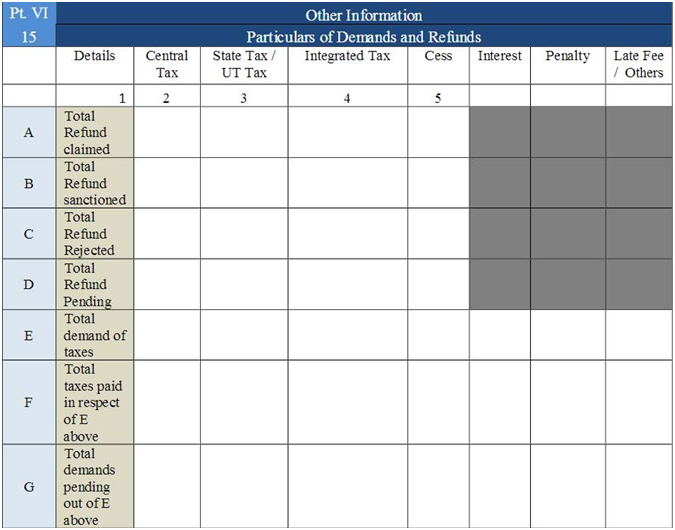

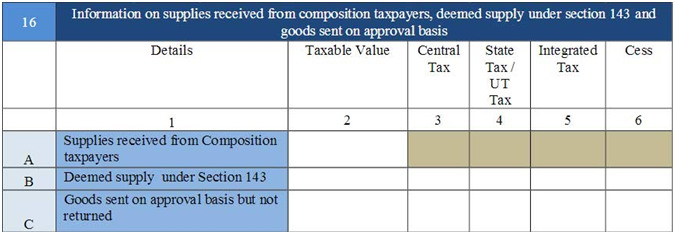

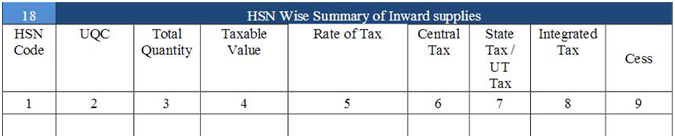

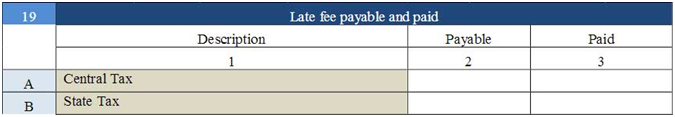

Part VI: Other details such as any refund, demand, deemed supply, HSN wise summary and if any late fee payable or paid.

| Item No. | Particulars | Explanation | GSTR-1 or 3B column for taking details |

| 16A | Supplies received from Composition taxpayers | Sum total of inward supplies received from composition taxpayers need to be disclosed. | GSTR-3B Table 5 |

| 16B | Deemed supply under Section 143 | It includes the inputs/capital goods sent for job work has not been received back with the specified time limit under section 143 and these are considered as deemed supply. | – |

| 16C | Goods sent on approval basis but not returned | Goods sent on approval but not has been approved within the period of six months are required to be disclosed here. | – |

Fee and Penalty for non-filing of GSTR-9

Non-filing of GSTR-9 on time attracts late fees and penalty:

Fee:

The late fee for not filing the GSTR 9 within the due date is Rs 200 per day (i.e., Rs 100 under CGST and Rs 100 under SGST). However, the total penalty can’t be exceeded by 0.25% of the taxpayer’s turnover in the relevant state or union territory.

Note: For the financial year 2017-18 and 2018-19, the late filing penalty has been waived off for the Annual return and the Reconciliation Statement for the taxpayers having turnover lower than Rs. 2 crores.

Penalty:

As per section 125 of the CGST Act, 2017, the general penalty can also be levied up to Rs 25,000.