Should you invest in ELSS or PPF for Tax-Saving?

If you are a tax payer, you must be quite familiar with the terms ELSS and PPF. You come across these terms at the time of E-filing Income Tax season. Actually, these are used at the time of the tax-saving season. Conventional depositors assume that PPF is pretty much better compared to ELSS. On the other hand,the supporters of equity investments often support ELSS. However, first of all, you need to know about the benefits offered by both these equity and debt products ELSS and PPF and then, it is good to come to a final conclusion to choose either ELSS or PPF.

Generally, most of the people are confused between ELSS and PPF. Both ELSS and PPF are the equity and debt products respectively that offer amazing tax benefits to all its tax payers under the Section 80C of the Income Tax Act. Here is everything you need to know about the ELSS, the equity product and PPF, the debt product. Have a look!

What is ELSS?

ELSS is abbreviated as Equity Linked Savings Schemeswhich is an equity product. With the ELSS, there is no guarantee of getting back the returns. The investments of Equity Linked Savings Schemes have lock-in of 3 years. ELSS offer incredible tax benefits to all its users similarly to the PPF.

What is PPF?

PPF is abbreviated as Public Provident Fund which is a debt product. With the PPF, returns are guaranteed. The investments of Public Provident Fundmature in 15 years. PPFdeliverunbelievable tax benefits to all its users in the same way to the ELSS.

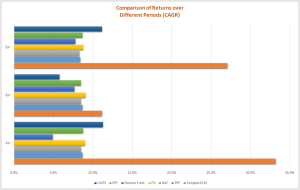

Preferably, you need to have fiscal goals and you have tochoose investments that are well-matched to run into those goals. For long term goals, you need to have an equity substantial portfolio. For short term goals, you need to have a debt substantial portfolio.

When you are comparing ELSS and PPF, you need to take some factors into consideration. The tax considerations are making your investment decisions. None of them concerns for financial goals. In this article, I have come up with a detailed description about the comparison between ELSS and PPF. Take a look!

Equity Linked Savings Scheme (ELSS)

Equity Linked Savings Schemes, in short, it is called as ELSS. ELSS is usuallyreferred to as tax saving equity mutual funds.

- In ELSS, you will havea lock-in of three years. Each and every investment in ELSS will lock-in of three years which means that you will not be able to take your money out before three years.

- If you are investing in ELSS through SIP, every installment of Systematic Investment Plan (SIP)is locked in for every three years. If you have purchased the units via installment on January 15, 2016, it can be redeemed on January 16, 2019.

- Investment in ELSS is appropriate for a tax deduction of up to Rs 1.5 lakhs under the Section 80C of the Income Tax Act.

- You don’ have any kind of limit on the amount of investment in ELSS per every FY.

- The returns are actually associated with the market and are not definite.

- The long term investment gains on transaction of equity mutual funds are exempted from the Income tax.

- Bonus from equity mutual funds is exempted from the Income tax.

- Even if you pick the option of dividend, it will be considered as tax-free in your point.

- Non-residents are eligible to invest in ELSS equity product.

Public Provident Fund (PPF)

On the other hand, Public Provident Fund is usually referred to as PPF. Public Provident Fund is a debt product. When you make use of the PPF, returns are definite. The investments of Public Provident Fundcomplete in 15 years and then, you will be able to collect your investment. PPF deliver unbelievable tax benefits to all its users correspondingly to the ELSS. Here are some of the essential points and features you need to know about the Public Provident Fund debt product. Check it out!

- Usually, Public Provident Fund(PPF) account matures after 15 years. Hence, the lock-in period for PPF investment lessensyearly. On the other hand, with Equity Linked Savings Schemes(ELSS), every investment is depending on a new lock-in of 3 years.

- After thepreliminary maturity of 15 years, you will have a possibility of extending thePPF account in block of five years.

- With this PPF, you will have a facility of loans alongside your PPF balance from the 3rd From the 7th year of investment, partial withdrawals are allowable.

- In your PPF account, you will be able to invest a maximum of Rs 1.5 lakhsfor which you act as guardian to that particular account in the current financial year. Additional amount will not make interest.

- You can acquire some of the tax benefits under Section 80C up to Rs 1.5 lakhs.

- PPF comesunder the category of Exempt-Exempt-Exempt (EEE). The interest which you’ve gained and the maturity amount is also exempted from income tax.

- The Non-residents are not allowed to invest in PPF.

This is all about the ELSS and PPF equity and debt products. The choice of your investment product for a financial goal will be based on several factors such as

- Time to goal

- Risk appetite

- Fiscal position

You can go for ELSS if you are 30 years old and are planning to save for the education purpose of your children after 15 years. You can consider PPF, if you are 55 years old and the emphasis is saving for retirement.