Now Use ATM to e-Verify your Income Tax Return

In a bid to support its tax payers, the Income Tax department has introduced the online system for e-filing Income Tax Returns from this financial year 2016-17. This has eventually helped all the tax payers and employees to make use of their precious time in the best way without the need of spending a lot of time for sending E-filing and other documents to the CPC Bengaluru in a manual way. As the last date for filing Income Tax Return has been approaching, all the tax payers have to accumulate all the essential documents and file their IT Returns soon prior to the due date.

Apart from introducing the online process of E-Filing Income Tax Returns, the Income Tax department has expanded the ATM-based authentication system for filing their e-ITRs Income Tax Returns in order to aid the tax payers. In an attempt to improve the paperless management of filing the annual Income Tax Returns, the Income Tax Department has rolled out this new system of using ATM to e-verify the IT Returns.

ATM-Based Authentication for e-filing IT Returns

IT Department has launched ATM or bank account based validation facility on its official e-filing website. This new system was rolled out for the taxpayers who don’t have the proper facility of internet banking. Directing presumptuous in the similar way, the department has now launched ATM based verification facility for e-filing ITRs.

By including the Axis Bank after SBI, the Income Tax Department has expanded its ATM service in order to validate the filing of e-IT Returns.This mission was initiated by the Income Tax Department in order to save paper and get rid of paperwork.

Earlier, SBI was the first and foremost bank to offer this ATM based validation via ATM. Following the footsteps of SBI, other banks are likely to launch this ATM-based authentication for e-filing IT Returns. This new system of e-verifying ITR has made available to all the tax payers at its website which will operate making use of OTP (One Time Password) verification system as started by the department previous year using the Aadhaar unique identification number.

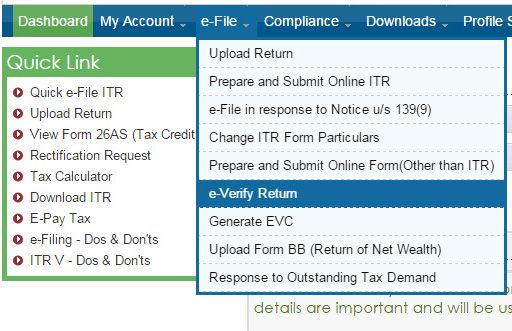

Electronic Verification Code (EVC) for e-verification or authentication will be generated by pre-authenticating your ATM offered by the authorised bank wherein the taxpayer has a valid bank account.

This new move taken by the IT department will guarantee that all the services related to Income tax that are offered by the IT department will be more accessible to the tax payers in a digital way without negotiating on excellence, security and privacy of e-filing.