Recently, on March 26, 2020, the Government has announced the new Employees’ Provident Fund (EPF) Rules for all the Employees’ Provident Fund Organisation (EPFO) members. The rules are proposed to enable easier access to the money in such coronavirus pandemic situations.

Here in this article, we are going to discuss the new rules and how to take benefit of New online EPF Advance Rules 2020.

What are the rules for EPF withdrawal 2020?

1. Every EPFO member now allows withdrawing the least of the following i.e.

- 75 percent of the credit standing in the EPF account or

- 3 months of wages (basic and dearness allowance (DA))

2. The withdrawal from the EPF account will be non-refundable. This means you don’t need to refund that withdrawal amount again into your EPF account.

3. Member or his/her employer is not required to submit any certificate or documents for availing the benefit.

4. This advance can be availed irrespective of advances availed earlier.

For example:

Let us say your last drawn wages per month was Rs 30,000, and the EPF balance in your account is Rs 3 lakh. Then the amount of money you are eligible to withdraw will be lower of:

a) 75 percent of the EPF balance, i.e., Rs 2,25,000 (75 percent of Rs 3 lakh)

b) 3 months of wages , i.e., Rs 90,000 (Rs 30,000 X 3); or

Hence, the lower of both i.e., 90,000 can be withdrawn from your EPF Account.

What is the eligibility to withdraw the PF amount as per the new rules?

To apply for claim online, an EPF account holder should have the following details:

a) The Universal Account Number (UAN) must be activated

b) Aadhaar should be verified and linked with UAN

c) The bank account of the EPF member with the IFSC Code should be submitted with UAN.

How to apply for EPF withdrawal by EPFO Portal?

Here are a few steps you need to follow to withdraw the PF Amount:

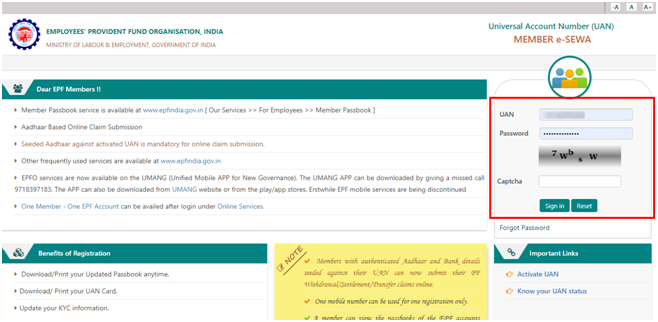

1. Visit the member portal of EPFO by clicking here https://unifiedportal-mem.epfindia.gov.in/memberinterface/

2. Sign in at the portal by entering your UAN, Password, and Captcha code.

3. Go to the “Online Services” Tab and select the option of the claim (Form -31, 19,10C)

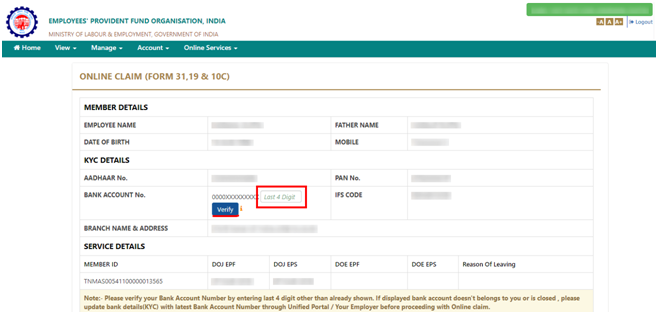

4. A new page will open with all your details such as Employee Name, Father’s Name, Date of Birth, and showing the last four digits of your Aadhaar card number.

5. Here, you will find a column of your bank account details also. Enter the last four digits of your bank account number and click on verify.

6. Once the details are verified, click on ‘Proceed for online claim’.

7. Now, select the option of “PF Advance (Form 31) from the drop-down list of “I want to apply for.”

8. After that, it will ask for the purpose of withdrawal, select the option of “Outbreak of pandemic (COVID-19)’ from the drop-down menu”.

8. Enter the required amount in the column of “Amount of advance required,” upload the scanned copy of cheque or passbook and fill the address details

9. At last, an OPT will be sent to your Aadhaar linked registered mobile number.

10. Enter and submit the OTP. Once the OTP is successfully submitted, the claim for withdrawing the EPF amount will also be submitted.

As soon your details are verified and your claim is accepted by the EPFO, your claim will be transferred to your bank account.

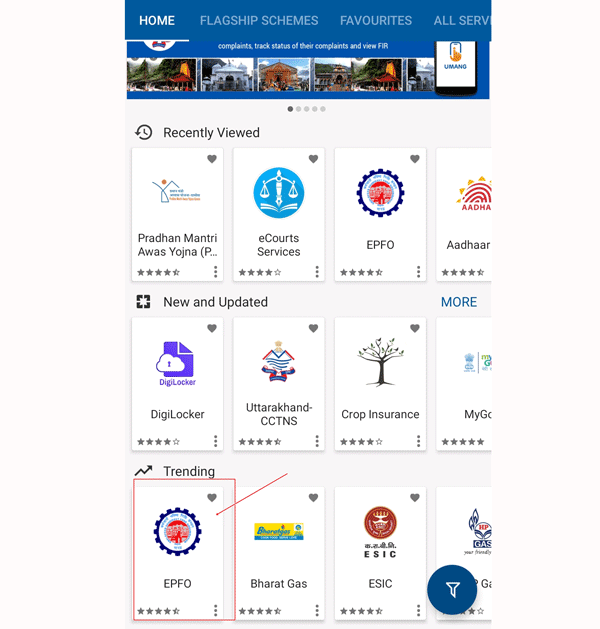

How to apply for EPF withdrawal by EPFO’s Umang App?

1. Login to the UMANG App and select EPFO

2. Now, click on the option ‘Raise Claim’ under the ‘Employee Centric Services’

3. Here, enter your UAN and click on Get OTP to proceed further.

4. Enter and submit the OTP to log in at the EPFO Portal.

5. After login, the age will ask to enter the last four digits of your bank account number and select the member ID.

6. Click on “Proceed for Claim”

7. Now, fill the address details and click on Next to upload the scanned copy of the cheque.

Once all the details are entered and submitted, your request for the claim will be filed.

How to check the status of the claim?

Sign in at the EPFO portal by entering your UAN, Password, and Captcha code. Click on the option “Track Claim Status” under the ‘Online Service’ tab to check the claim status.