Leave Encashment & Tax Implications

Most of the employees working as salaried individuals well-known about various types of leaves that people take in a company or office. There are different types of leaves that include casual leave, sick leave, personal leave, earned leave and much more. In some situations, it is not possible for a single individual to take all kinds of leaves at a time in one single month. In some cases, most of the leaves might remain unused by the individuals.

Some of the companies let the employees make use of their unused leaves into cash during their service period or at the time of resignation to their job. Some employees allowed to encash their remaining leaves upon their retirement. The process of converting the balance unused leaves called as ‘Leave Encashment.’ One of the beneficial schemes for all the employees during their service is leave encashment.

Most of the employees might have some doubts and queries regarding the Leave Encashment like when you can take it, whether the leave encashment is taxable or not, various tax implications of Leave Encashment and many more. In order to learn and understand much more about the Leave Encashment, here is detailed information on this topic provided below. Check it out!

When Employees can use Leave Encashment?

Most of the companies allow the employees or the workers make use of the benefit of encashment of leave during various situations that include the following:

- At the period of employment

- Retirement period

- Termination period of the employee.

Tax Treatment of Leave Encashment

The employees are categorised into two different types based on the tax behaviour of leave encashment under the section 10 (10AA) as per the Income Tax Act 1961.

- Government Employees

- Non-Government employees (Private employees)

1) Government Employee & Tax treatment of LC

- During the time of service of particular employee, they can encash their leaves and the total amount for all the Leave Encashment is completely taxable.

- In case of retirement or resignation, the Leave Encashment completely excluded from the main Income Tax.

- In case of termination of the employee, Leave Encashment is completely taxable.

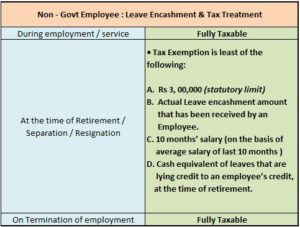

2) Non-Government Employee & Tax treatment of LC

- If an employee encash their leave at the time of service or employment, they are completely taxable.

- At the time of resignation or retirement, the Leave Encashment completely or partially excluded.

- Rs 3,00,000

- Actual amount of LC acquired by the employee.

- Salary for a period of 10 months.

- During the period of retirement, the salary equivalent of total number of leaves. The calculation of the leaves calculated based on the maximum of 30 leaves per finished year of service.

- During the period of termination, LC is completely taxable.

Salary for Leave Encashment Means

- Salary = Basic salary + Dearness Allowance + Commission

The tax treatment and implications of LC are pretty clear regarding a Govt employee.

Key Points about Leave Encashment & Taxation

Here are some important points noted by every salaried individual. Have a look!

- The Leave credit provided for the employee after the completing the total years of service.

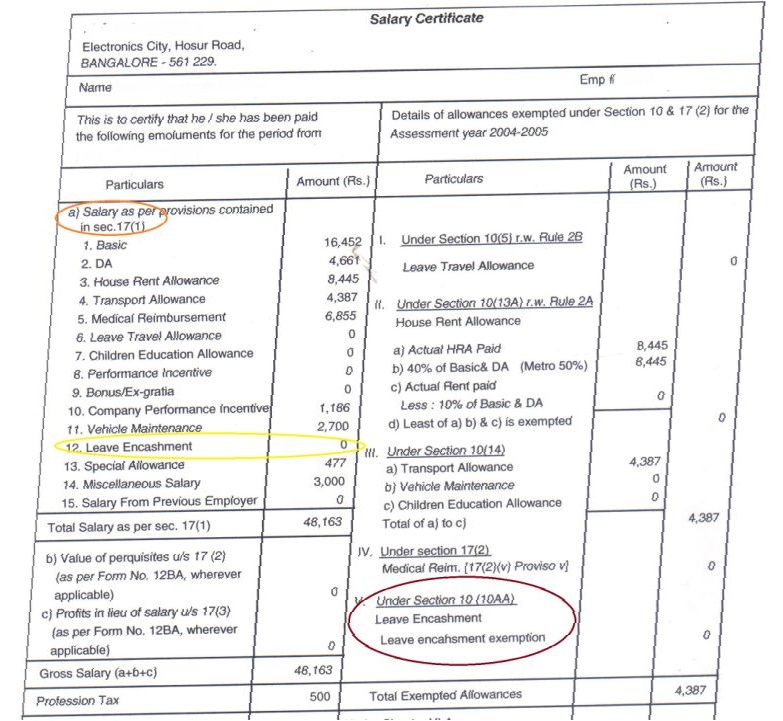

- Under the Section 17 (1), you can check out the complete information about the Leave Encashment in Salary Certificate or Form 16.

- If the employees are non-Government individuals, the Leave Encashment received at the period of resignation or the retirement of the employee.

- The Leave encashment given to the nominee of the employee are not taxable.

This is all you need to know about Leave Encashment and other Tax Implications.