Meaning of Income Tax Refund

When the taxpayer pays the taxes more than they are liable to, they are eligible to claim the Income Tax Refund. Taxes can be paid more in the form of TDS, TCS, Advance tax, or Self-assessment tax. So, you can calculate your income tax refund as follows:

Refund: Amount of tax paid during the year (-) Amount of tax payable during the year

Now, the question arises, how shall a taxpayer claim the Income-tax refund?

The income tax department sent the refund either by the RTGS/NECS or account payee cheque. Therefore, it is necessary to mention the correct bank details in the ITR.

Time limit to receive a refund: For crediting a refund from the department, you must have verified your ITR online. Once it is verified, it takes around 30-45 days from the e-verification of your Income-tax return.

How can I claim the refund of previous years?

For claiming the refunds, it is necessary to file the Income-tax returns. However, the CBDT had issued a circular 9/2015 stating that the taxpayers can claim the refund for the previous six assessment years. Therefore, if your refund is due to the excessive deduction/collection of tax and excess deposit of advance /self-assessment tax, then you can demand the refund for the AY 2013-14; AY 2014-15; AY 2015-16; AY 2016-17; AY 2017-18 and AY 2018-19.

However, for taking the benefit of the circular No. 9/2015, the taxpayers need to make an application to the appropriate authority depending upon the Amount of refund:

| Amount of refund | Application authority |

| Rs. 10 Lakhs or less | Principal Commissioner of Income-tax (PCIT)/ Commissioner of Income-Tax (CIT) |

| More than Rs.10 Lakhs but less than Rs. 50 Lakhs | Principal Chief Commissioners of Income-tax (PCCIT)/Chief Commissioners of Income-tax (CCIT) |

| More than Rs. 50 Lakhs | Central Board of Direct Taxes (CBDT) |

Meaning of different types of Income tax refund status

After few days of verifying your return, if you proceed to check the income tax refund status, you will see some status as explained below:

Refund Not Determined:

It means there is no refund after processing your ITR.

Return submitted but not verified:

It means that your Income Tax Refund has not been processed. You need to ensure if your return is filed and duly verified and check after a few days. Make sure to verify the return within 120 days of the date of return filing.

Refund Paid:

It means that the department has paid your income tax refund by cheque or has been directly credited to your bank account. In case it is still not received, either track out the speed post status or ask your bank if there is an issue.

Refund Failed:

This status appears when the refund amount could not be credited to your bank account because of incorrect bank details, etc.

Assessment Year not displayed in Refund / Demand Status:

It implies that you haven’t filed the ITR. Immediately file and submit your ITR.

Refund Expired:

The refund cheque issued by the Income-tax department is valid for 90 days. If it expires, then you will have to get a refund cheque re-issued in your name.

The Cheque has been Encashed:

This message reflects when you have received the cheque sent by the IT department and also encashed.

Refund Returned/Unpaid:

In case the cheque is returned to the Income-tax department, either due to the wrong address or bank details. You will see this status. In such cases, you need to update the correct information at your E-filing portal and send a request to refund re-issue request.

Defective return 139(1):

This implies that your return is in the category of the defective return. For further action, please check the income tax site.

Return processed & refund adjusted against demand:

In such case, you must have some previous outstanding pending as a demand to the department, then the department will adjust the amount against your current year’s Refund. However, before adjusting, they will send you a notice u/s 245.

How to request/apply for a refund re-issue?

Once the income tax department processed your return, they will proceed and credit the Refund in your bank account. However, sometimes, your Refund gets rejected or delayed due to the invalid bank or address details. In such a case, you can request the department for the refund re-issue by following the simple steps:

Step 1: Log in at the Income-tax E-filing site by using a User ID and password.

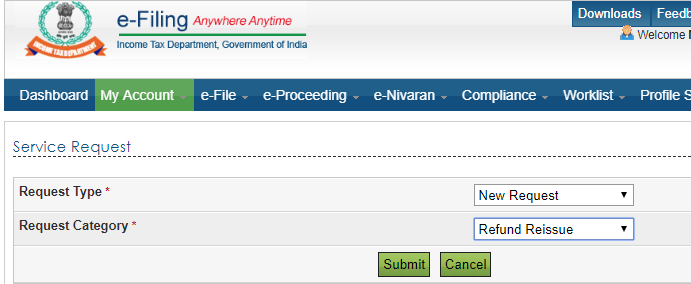

Step 2: Click on the option “Service Request” under the drop-down list of “My Account.”

Step 3: Now, select the “New Request” option as request type and “Refund Re-issue” as request category.

Step 4: You will see the screen, as shown below and click on the “Submit.”

Step 5: Enter the required bank details such as Bank Account Number’, ‘Account Type.’, ‘IFSC Code,’ and ‘Bank Name’ and click on ‘Submit.’

Your refund re-issue request is submitted, and the government will credit your Refund after a few days.

How to check Income-tax refund status online?

You can check the refund status in two ways:

1. By login at Income tax E-filing portal

2. By using the NSDL website

USING E-FILING PORTAL

Step 1: Visit at the E-filing portal and log in by using User ID (PAN) and Password.

Step 2: Click on the “View Returns/Forms”

Step 3: Choose the option “Income tax Returns” under the “Select an option” category and the relevant Assessment Year.

Step 4: Click on the “Submit” button and then “Acknowledgement number.” You can see the Income-tax refund status on your screen.

USING NSDL WEBSITE

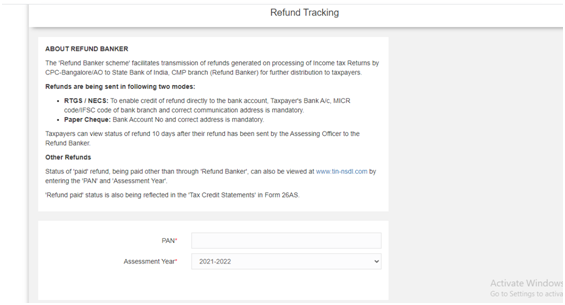

Step 1: Visit the NSDL site https://tin.tin.nsdl.com/oltas/refundstatuslogin.html

Step 2: Enter your PAN number and select the “Assessment year” to proceed further. You can see the status on your screen.

What are the reasons of the delay in the issue of Refund?

There could be multiple reasons for delay in Income tax refund:

- Income Tax Return (ITR) submitted but not verified by you

- Delay in filing of ITR

- Incorrect bank account details

- Incorrect communication/address details

- Defective or revised return

- Wrong submission of details