In this tutorial, you can check the process of downloading or viewing the Form 26AS via the TRACES web portal. The Form 26AS can be downloaded in two ways. You can either download it from the TRACES website through online mode. The other process is to get it from the Net Banking Facility of authorised banks.

How to download & view Form 26AS through the TRACES website?

Here are the simple steps to download and view the Form 26AS through the TRACES web portal:

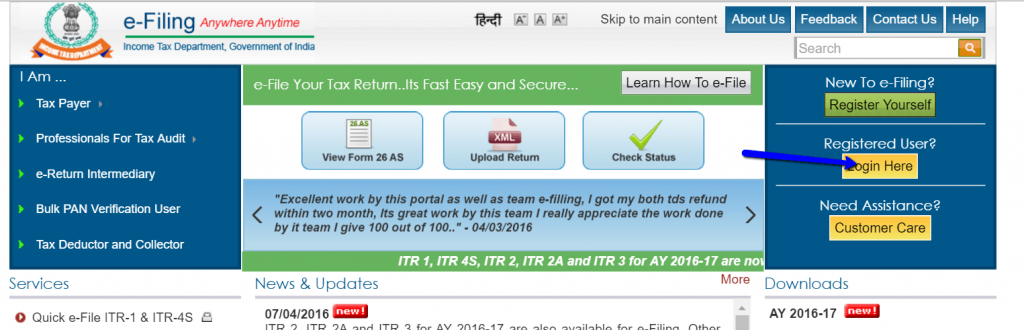

Step 1: First of all, visit the official web portal of Income Tax at https://incometaxindiaefiling.gov.in.

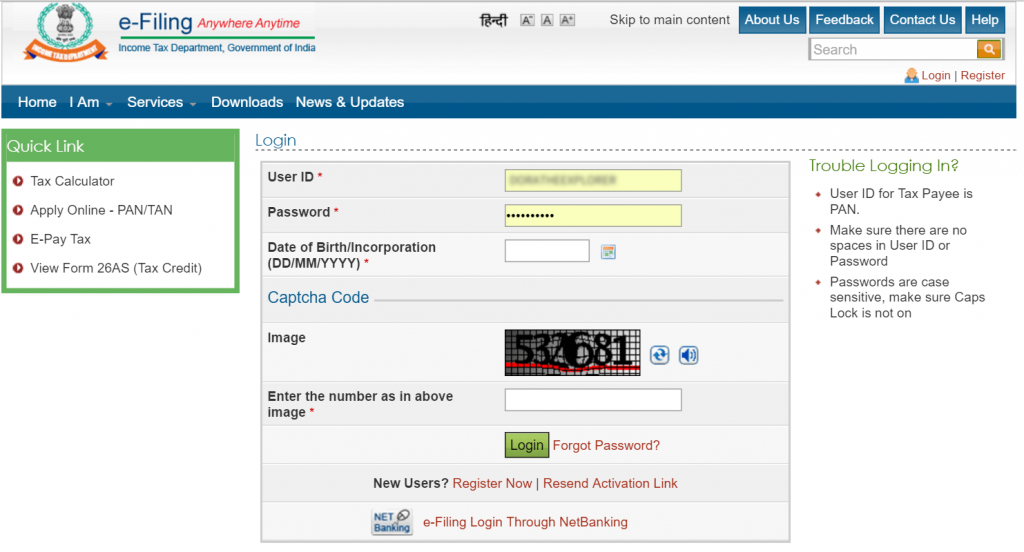

Step 2: You need to make use of your Login id and the password in order to login on to your income tax account.

Step 3: If you do not have an account, you can register a new account.

Step 4: You need to enter your PAN number, password and date of birth or date of incorporation in the DD/MM/YYYY format.

Step 5: Now, you need to enter the Captcha code.

Step 6: Just click on the LOGIN button.

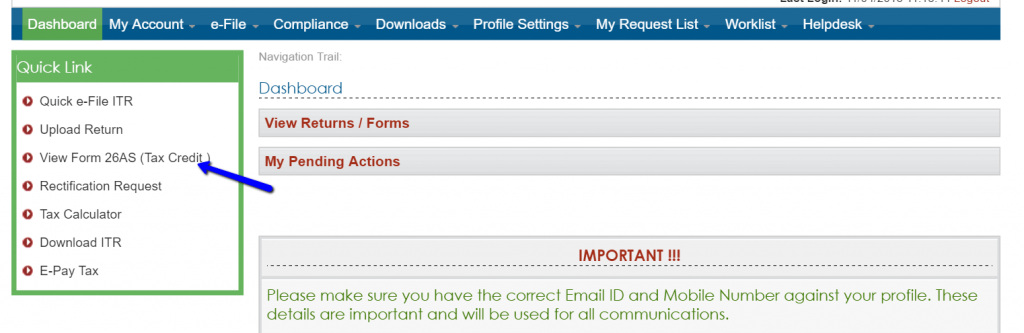

Step 7: Once you click on the login button, a new pop-up window displays on the screen.

Step 8: You can now click on ‘View Form 26AS (Tax Credit)’ which is present on the left side of Quick Links.

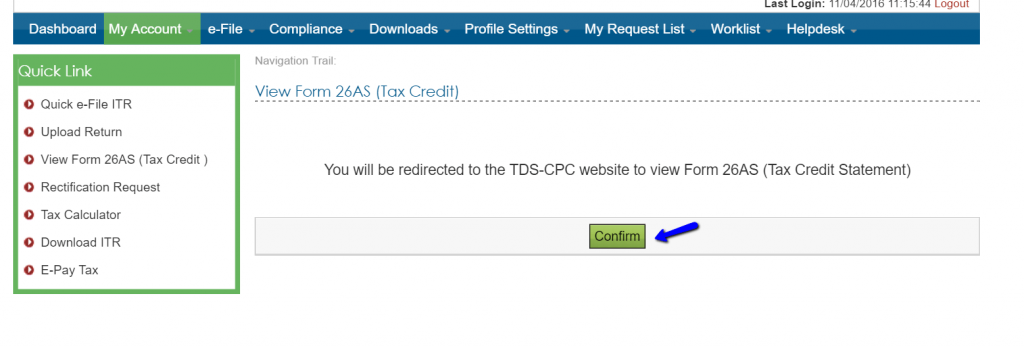

Step 9: Just hit the ‘Confirm’ button.

Step 10: Later, you redirects to the TRACES website. This is an essential step in order to complete the process in a secure way.

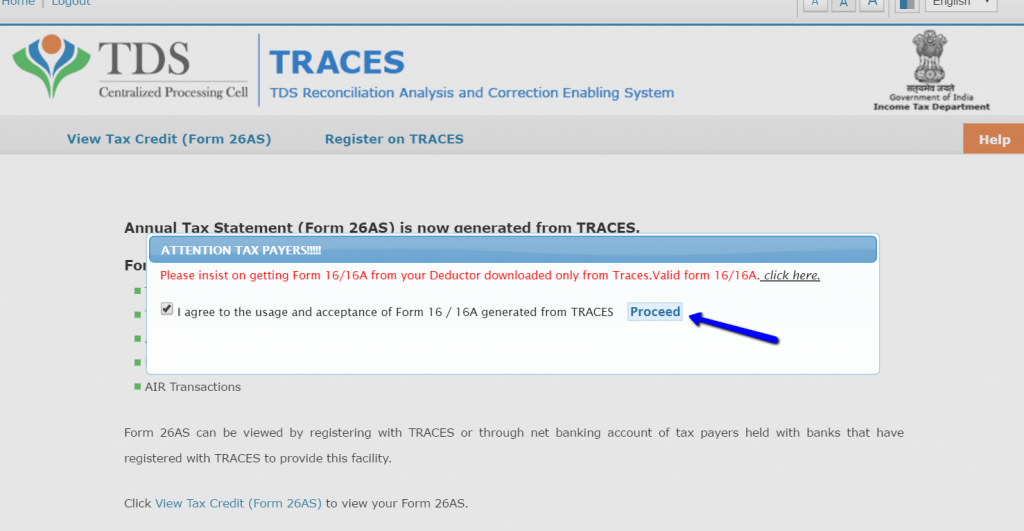

Step 11: On the TRACES (TDS-CPC) web portal, you need to choose the box on the screen and just hit the ‘Proceed’ button.

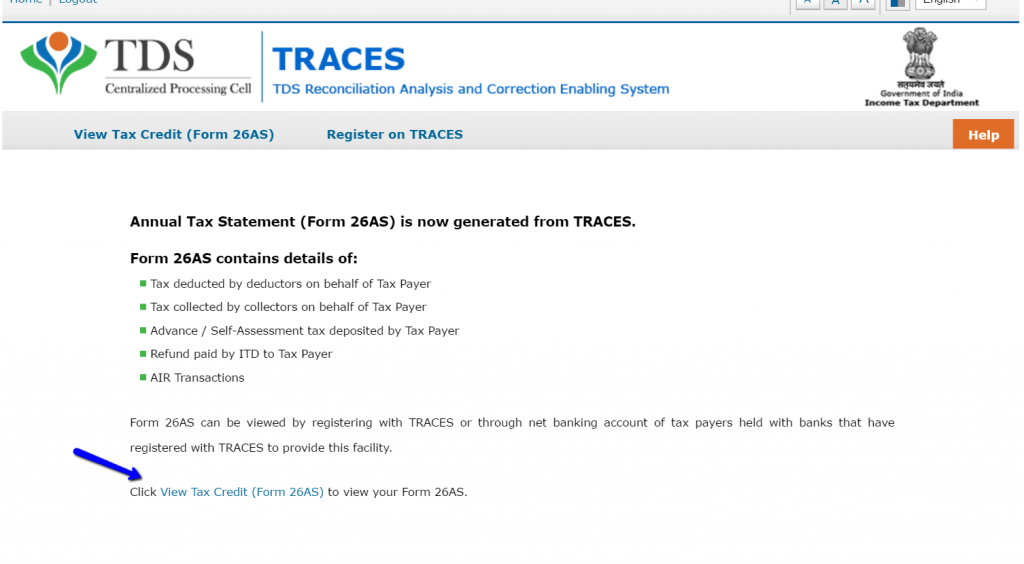

Step 12: Just hit the link provided at the bottom of the page that says ‘Click View Tax Credit (Form 26AS) to view your Form 26AS’.

Step 13: You need to select the Assessment Year and the format wherein you wish to see the Form 26-AS.

Step 14: You can choose the format either HTML or PDF. You can then hit the option of ‘View/Download’.

Step 15: In order to open the document, you need to enter the required password. The format of Form 26AS password is the Date of Birth in DDMMYYY format.

That’s it! The Income Tax Form 26AS will be displayed on the screen.

View Form 26AS through Net Banking of your Bank Account

The facility of viewing the Form 26AS is available for the PAN card holders. The users having an account of net banking with any of the valid bank can view the tax credit card statement. If you have a PAN number, only then you can view the Tax Credit Statement of Form 26AS. This service is available to the users absolutely for free of cost.

List of Banks

Here is the list of various authorised banks registered with NSDL for offering the view of Tax Credit Statement (Form 26AS) shown below:

- Axis Bank Limited

- Bank of India

- Bank of Maharashtra

- Bank of Baroda

- Citibank N.A.

- Corporation Bank

- City Union Bank Limited

- ICICI Bank Limited

- IDBI Bank Limited

- Indian Overseas Bank

- Indian Bank

- Kotak Mahindra Bank Limited

- Karnataka Bank

- Oriental Bank of Commerce

- State Bank of India

- State Bank of Mysore

- State Bank of Travancore

- State Bank of Patiala

- The Federal Bank Limited

- The Saraswat Co-operative Bank Limited

- UCO Bank

- Union Bank of India

How to use the Income Tax Department’s e-Filing website?

Here are the simple steps that help the income tax payers to make use of the official web portal of Income Tax department:

- The first and foremost step is to login or register on the official web portal of the Income tax department at incometaxindiaefiling.gov.in.

- If you enter your PAN number, the portal says that you are an existing user of the account.

- If you file your income tax returns before the due date, there are several chances to get benefits.

- If you know the password and the User ID, just log on to the web portal using the credentials.

- If you do not remember the password, you have a possibility of resetting your password.

- In order to reset the password, the website provides various options.

- The reset password sent to the registered mail of the user with the following details:

- PAN

- PAN holder’s Name

- Date of Birth

- Father’s Name

- Registered PAN address

Parts of Form 26AS

The tax payers who are seeking to file their Income Tax returns online, they need to fill in the Form 26AS. This form consists of various sub divisions that include the following:

Part A: In this part, you can need to enter all the details regarding the Tax Deducted at Source (TDS).

Part A1: In the part A1, the users need to fill in the information related to the Tax Deducted at Source for Form 15G/Form 15H.

Part A2: In Part A2, you need to enter the information of Tax Deducted at Source on sale of Immovable Property as per the Income Tax act.

Part B: The tax payer needs to provide the details regarding the Tax Collected at Source in the Part B.

Part C: In the part C, you need to enter the details of Tax Paid (Other than TDS or TCS).

Part D: Just enter the details regarding the Paid Refund.

Part E: In this part E, you need to provide the information of AIR Transaction.

Part F: This is the last but one section wherein you need to provide the information of Tax Deducted on sale of immovable property under the section of 194IA.

Part G: The Part G is the final part wherein you can find the processing of TDS Defaults.

This is all you need to know about the tax credit statement. Hope this tutorial helps you in the best way to view the tax credit statement from the official web portal of the Income Tax department.