The ongoing coronavirus outbreak has a huge negative impact across many countries of the world. It has been noted that the taxpayers are facing challenges in meeting the compliance requirements under the countrywide lockdown.

Therefore, the Indian government has announced a big relief to the small taxpayers by extending the date for making tax-saving investments for the financial year 2019-20 to June 30, 2020. However, the last date for making tax-saving investments under the various sections of the Income Tax Act is March 31 of a financial year.

However, there was some confusion among the taxpayers that the financial year is also changed. But, the Finance Minister has clarified that there is no change in the financial year. The financial year starts from April 1, 2020.

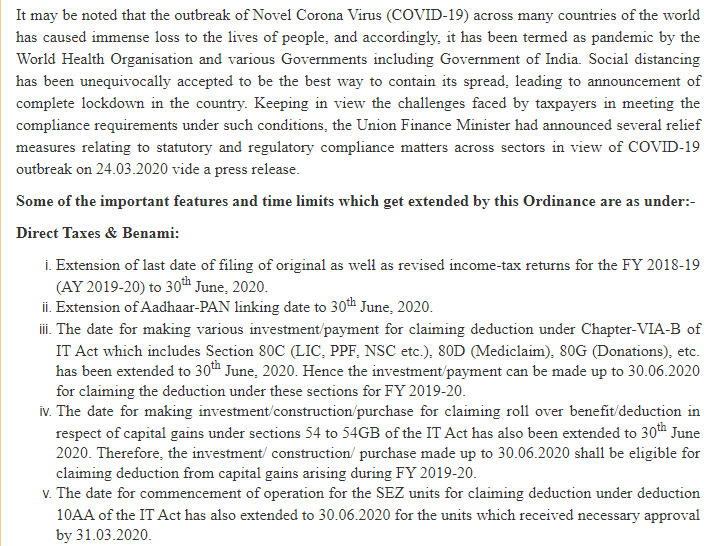

Here is the extract of Press Release

Investment for tax savings

Those who are still waiting to make investments in various instruments, which offer tax deductions, can do their investments till June 30, 2020 and continue to claim a deduction for FY 2019-20.

Here are a few things to be taken care:

- The date for making various investments/payments for claiming deduction under Section 80C (LIC, PPF, NSC, NPS, Tax saving FDs, etc.), 80D (Mediclaim), 80G (Donations), etc. has been extended to June 30, 2020. Hence the investment/payment can be made up to June 30, 2020, for claiming the deduction under these sections for FY 2019-20. Anything that falls within the Section 80C to Section 80GGC of the Income Tax Act is eligible.

- Any contribution to save tax like investing in ELSS, Tax Saving FDs, NSC, NPS or Life Insurance Premium or Health Insurance Premium shall be allowed to make up to June 30, 2020.

- If you have not utilized the full limit of Rs. 1.5 lakh under section 80C in the Financial Year 2019-20. Then, taxpayers can avail the full limit by investing up to June 30, 2020.

- The tax-saving investments done in the first quarter of FY 2020-21 will be eligible for deduction either in FY 2019-20 or FY 2020-21. You have an option in which FY you want to claim the deduction. Hence, taxpayers are can’t claim the same investment in both of the financial years.