How to Reset Password at Income Tax India e-Filing Website (6 Simple Methods)

Filing Income Tax Returns to the Income Tax Department is quite important for all the people whose income is above the limitation. It is quite important to file Income Tax returns within the due date. Starting this year, the Income Tax Department has facilitated all its users to file IT returns through the online mode of filing so that the tax payers could easily login to the official portal using the id and password provided by the concerned department. But, some of the people encounter glitches at the time of filing Income Tax returns due to fail to recall their password for signing into the Income Tax E filing official portal.

Also, some of the people face issues as the tax advisers suggest the users not to reveal or disclose their password to any of their friends or family members. You don’t have to worry about your password. The Income Tax Department has come up with not just a single solution but, it has provided 6 different methods to reset your Password at the official Income Tax E-Filing portal. We are here to assist you in the best way to explain all the 6 methods to the users or tax payers in order to reset the password at the Income Tax return e-Filing website.

How to Reset Password at Income Tax India e-Filing Portal?

The user id that you must enter at the Income Tax India official portal is your PAN (Permanent Account Number) number. The due date to file the Income Tax Returns for business people, salaried persons and others for the Financial Year 2015-16 as per the Income Tax Department is 31st July, 2016. In order to reset your Password at the Income Tax India E-filing official portal, you need to follow the below steps:

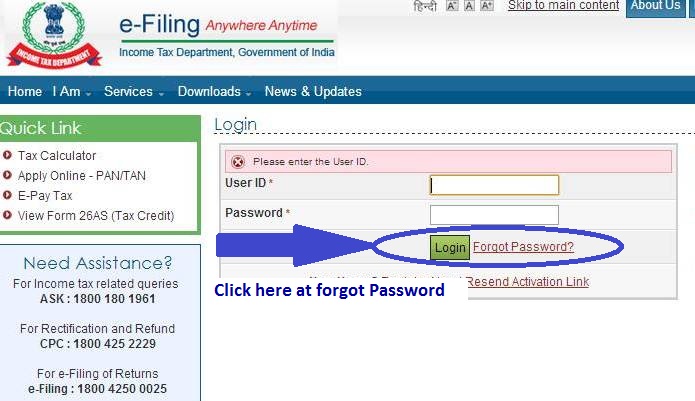

- Initially, navigate to the official website of the Income Tax Department.

- Simply hit the link to Login into your account.

- Enter your PAN card number and just leave the field of password empty.

- Now, you need to simply click on the link that says ‘Forgot Password.’

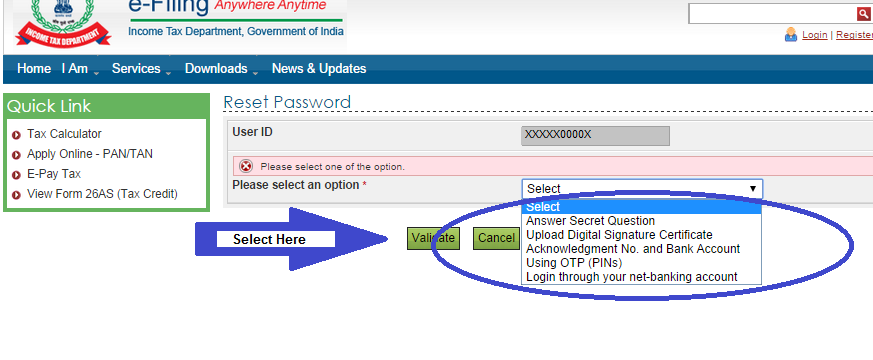

- Check out the below-given six different methods to reset your password.

6 Simple Methods to Reset Password at Income Tax India e-filing Portal

Check out the details description of each method in order to reset your password at the Income Tax e-filing official portal:

Method 1: Reset Password via Answer Secret Question

- This is quite simple method if you remember the answer to some secret question so that you could easily reset your password.

- At the time of registration of PAN at the e-filing portal, you will be asked one secret question.

- If you enter that secret question and few other details like Date of Birth, you will be able to reset your password.

Method 2: Upload Digital Signature

- In this method,you need to ‘upload your registered digital signature’ or a New Digital signature.

- Also, you need to upload PFX file or through USB token.

Method 3: Acknowledgement Number & Bank Account Number

- In this method, you need to enter your acknowledgement number which you’ve received at the time of filing your Income Tax Returns.

- Along with the Acknowledgement number, you need to enter your and Bank account number in the provided fields.

- Using these two numbers, you will be able to reset the password immediately.

Method 4: Password Reset via OTP on Email & Mobile Number

In this method, you will receive an OTP (one time password) to your registered Email id and your mobile number. Using these OTPs, you will be able to reset your password.

Step 1: OTP to Old Email Address &Mobile number

- In this method, you will be shown the first and last letters or digits of your registered email id and Mobile number.

- Just open your old registered email id and mobile number and simply hit on the option‘validate’.

- You need to enter the OTP which you’ve received on your email and mobile number in respective fields.

- That’s it! You can now validate and reset your password of the e-filing site.

Step 2: OTP to New Email Address & New Mobile number

If you don’t have access to your old email id or Mobile Number, you need to enter new email id and mobile number in order to get OTP at your new email id and mobile number.

For doing this, you need to verify few parameters.

- You need to provide your TAN number of your Bank or employer if tax has been deducted by your employer/Bank or other person. If no tax has been deducted, head over the other method provided below.

- You need to provide details of Tax which was directly deposited by you such as challan details, BSR code,Date and amount of Tax deposited.

- You can use the option of using bank account if you have filed income tax returnonline previously.You need to confirm your bank account number which was earlier usedat the time of filing your Income Tax returns.

Method 5: Send PANDetails to IT department

If none of the above methods are working for you, here is another method. You need to send your PAN card details to the Income Tax department so that you will be able to reset your password. The details include:

- Name of the PAN Holder

- Date of Birth

- Father’s Name

- Registered PAN address

Method 6: e-Filing Login via NetBanking

If you’re a registered taxpayer, you can login via the NetBanking and reset your password. Just follow the below steps to reset your password via net banking:

- Go to the home page of Income Tax portal and hit on the option “Login Here”.

- Hit the link that says “Forgot Password”.

- Enter your User ID (PAN), Captcha and hit on ‘Continue’ button.

- Now, hit the link that says”e-Filing Login through NetBanking”.

- Choose the Bank from the list of different Banks provided.

- Login to your bank account via the Net Banking account and hit the link “Login to the IT e-Filing account” which is displayed on the screen.

- You can then reset the password from the tab‘Profile settings.’

These are the 6 different methods that help you reset or change your Password at E-filing Income Tax portal.