What is TDS and its applicability?

Tax Deducted at Source (TDS) is the tax deducted at the time of making specified payments such as rent, commission, interest, etc. All the provisions related to TDS are specified under the Income Tax Act, 1961.

In the TDS mechanism, a person (known as deductor) is liable to make a specific type of payment to another person (known as deductee) shall deduct TDS and make the remaining payment. The amount deducted as TDS is transferred to the government on the due dates i.e., every 7th of the following month in which the TDS is deducted. However, for the month of March, it is allowed to pay the deducted TDS on or before 30th April of that year.

Once the payment 7 is made to the government, the deducator issues the TDS certificate to the deductee and the deductee is eligible to claim the credit of TDS in Form 26AS.

There are various income on which the TDS is deducted, such as:

Importance of TAN in TDS

TAN means Tax Deduction and Collection Account Number (TCS) having 10 digits alphanumeric number. The TAN is required to be mentioned in the TDS returns.

Also, section 203A of the income tax act, 1961 mandates for all the assesses to mention the TAN in all TDS documents, who are liable to deduct TDS. Non-compliance with TAN in TDS attracts the penalty of Rs. 10,000. Further, without a valid TAN, banks do not accept TDS returns and payments.

Therefore, it is necessary to have TAN for the TDS related work. In case you don’t have the TAN, you can apply for the TAN by filing up the online form 49B.

Procedure to pay TDS online

The assesses are required to make the payment of TDS online. So, here is the step by step process to pay TDS online by using TIN NSDL Portal.

Before moving for the procedure to pay the TDS, make sure that you have the net-banking of the bank authorized by the Income-tax for the payment of TDS. You can check the list on the NSDL- TIN website.

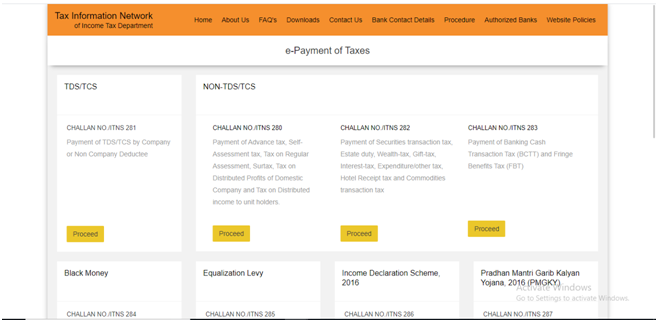

Step 1: Visit at TIN NSDL Portal https://www.tin-nsdl.com/services/oltas/e-pay.html (Income tax department website) for the e-payment of TDS and click on “Click to pay tax online”.

Step 2: Select Challan ITNS 281. ITNS 281 is used for depositing TDS/TCS by company or non-company deductee.

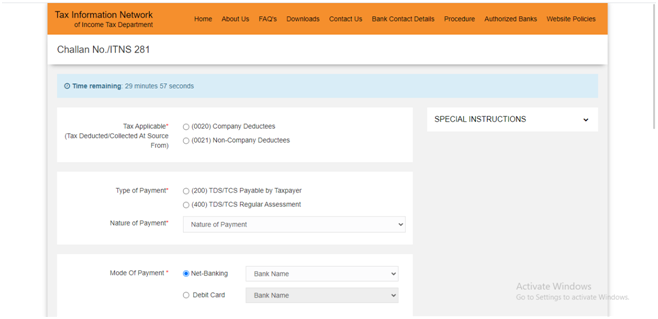

Step 3: A challan will open, asking the required details. Fill the details accurately, as explained below:

- Select ‘(0020) Company Deductee’ – if you are a company

- Select ‘(0021) Non-Company Deductees’ – If you are other than the company

- Select (200) TDS/TCS Payable by Taxpayer- If it is a regular payment

- Select (400) TDS/TCS Regular Assessment – if the payment is against any demand raised by the IT department.

- Select the nature of payment from the drop-down list

- Next, you need to choose the mode of payment among the “Net banking” or the “Debit Card” along with the Bank Name from where you want to make payment of TDS.

- Now, mention the Tax Deduction Account No, select the Assessment Year and fill the other necessary details.

Step 4: After filling all the details, click on the “Proceed” and you will get a confirmation screen

Step 5: You will see the challan details, here you need to confirm that all the data entered in the challan has been entered correctly and true to the best of your knowledge.

Step 6: Now, you will be redirected to the net-banking page of your selected bank, login at the net banking page, and make payment of TDS.

Step 7: On successful payment of TDS, the system displays a challan counterfoil. The generated challan contains the following details for your future reference:

- CIN – Challan Identification Number

- Bank name through which payment is made

- BSR Code (7 digit code)

- Date of challan

At last, the bank will transmit the details to the Tax Information Network (TIN) through the Online Tax Accounting System (OLTAS).

Once the process of making TDS payment online is completed, you can check the status of the challan deposited in the bank at the NSDL – TIN website under the option of ‘Challan Status Inquiry.”

Benefits of Online Payment of TDS

- 24x7x365 payment facility is available. So, even on the last date, you can pay anytime.

- Deductor can make the payment from anywhere.

- Get the instant acknowledgment of the TDS payment

- Deductor can download the challan acknowledgment copies from the NSDL website anytime and save for future reference

- No paperwork is required.

Interest and penalty provisions in case of delay in TDS deduction and deposition

Delay in TDS deduction

If the TDS is not deducted (either whole or in part) on the due date, then the deductor shall be liable to pay interest at a rate of 1% per month or part thereof, from the due date of TDS deduction up to the date on which TDS is actually deducted.

Delay in TDS Payment

If the TDS is deducted by the deductor but has not deposited (either whole or in part) to the government up to 7th of the next month,

As per Section 201(1A), the deductor is liable to pay interest, applicable at a rate of 1.5% for every month or part thereof, from the date on which TDS was collected up to the date to which the tax is actually deposited to the government.

In addition to the above, the deductor (assessee) shall also be liable for the penalty. However, the amount of the penalty shall not exceed the amount of TDS.