E-Way bill is a document with a unique number required to be generated at the time of the transportation of goods. Every registered person, transporting the goods, having Value more than Rs. 50,000 shall generate the E-way bill. It contains the details of the goods, supplier, recipient, and transporter.

In this article, we will share “How to generate E-way Bill?”

Modes of generating E-way bill

The taxpayer can create the E-way bill by following any of the methods as prescribed, which includes

- Using portal (web-based system) https://ewaybill.nic.in/

- SMS facility

- Bulk generation

- Android app from smartphone

- Using GSP (GST Suvidha Provider) services

Let’s know the step by step procedure of different modes of generating E-way bill:

1. How to generate an E-way bill by using the E-way bill portal?

The E-way bill portal (EWB) is the platform to generate single or consolidated E-way bills. Therefore, it is mandatory to register at the EWB portal before generating the E-way bills.

Process to register at EWB portal

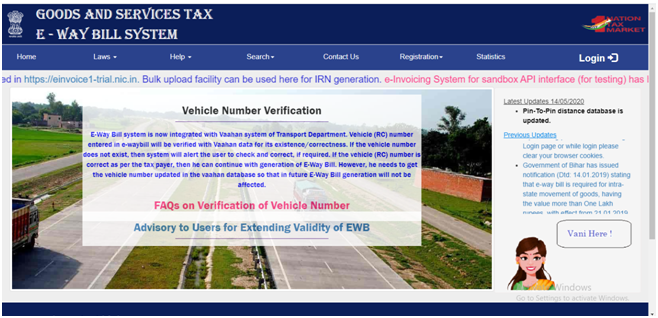

Step 1. Visit at https://ewaybillgst.gov.in/

Step 2. At the home page, click on E-way bill registration under the drop-down list of “Registration.”

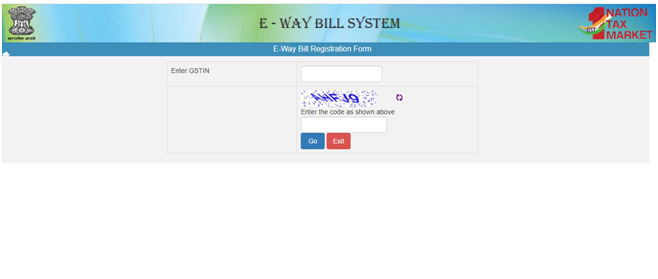

Step 3. Now, enter the GSTIN and the captcha code and click on “Go.”

Step 4. A new screen will open with pre-filled details as below:

Step 5. Click on “Send OTP” and verify the same.

Note: You will receive the OTP on your registered mobile number (As on the GST portal).

Step 6. Create a new ID and password of your choice.

Once you are successfully registered at the portal, follow these steps to generate the e-way bill on the e-way bill portal:

Step 1: Log in at the portal https://ewaybill.nic.in/ by using the User ID and password.

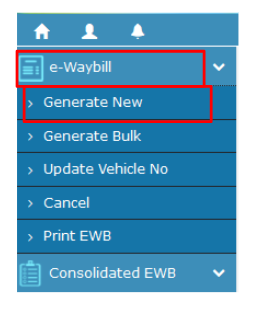

Step 2: At the dashboard, click on the ‘Generate new’ option under the ‘E-waybill.’

Step 3: Enter the required details such as

- Transaction type

- Subtype

- Document type

- Document no.

- Document date

- From/ To (depending on whether you are a supplier or a recipient)

- Item details (details of the consignment)

- Transporter details

Step 4: Click on “Submit” and let the system validate the data. If okay, the E-way bill will be generated in Form EWB – 01 form, or case of any error, the portal will highlight the same.

Step 5: Print the E-way bill and carry it with yourself while transporting the goods.

2. How to generate an E-way bill by using the SMS facility?

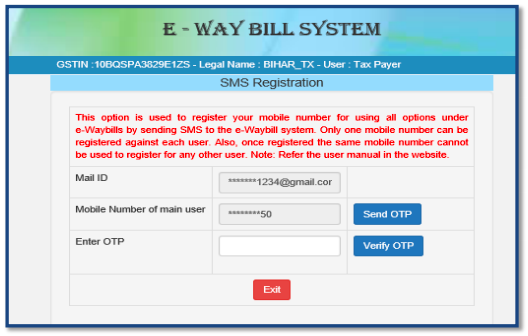

Step1: Login to the E-way portal https://ewaybill.nic.in/ and select the option “For SMS” under the drop-down list of the “Registration.”

Step 2: On clicking, you will see the registered mobile number (as registered at the time of E-way bill registration), here click on the “Send OTP.” You will receive OTP on the same number, Enter it, and “Verify OTP.”

Step 3: On successful validation, the user will be directed to a new page to select the user ID from the drop-down menu. The mobile number will be auto-filled by the system.

Step 4: Now, you are ready to generate the E-way bill by SMS. You need to send SMS to e-way bill generation at 7738299899. The format to send SMS is

EWBG TranType RecGSTIN DelPinCode InvNo InvDate TotalValue HSNCode ApprDist Vehicle

| EWBG | Fixed Value for E-way bill generation |

| TranType | Transaction Type (Referred to the Code list). |

| RecGSTIN | Recipient’s GSTIN or URP. |

| DelPinCode | PIN Code of Place of Delivery as per the invoice. |

| InvNo | GST invoice or bill number |

| InvDate | GST invoice or bill date |

| TotalValue | Total Value of goods as per Invoice or Bill |

| HSNCode | HSN Code of the goods |

| ApprDist | Distance in kms from the consignor to the consignee |

| Vehicle | Vehicle Number of the transport |

3. How to generate E-way bill by using bulk generation?

Bulk, e-way generation facility, helps to generate the multiple or consolidated e-way bills in one-time to save a lot of time.

In the simple process, the taxpayer requires to upload a file in the JSON format, which shall contain the multiple requests for the e-way bill. Once the system generates the e-way bills, you can extract the details and use the same.

Now, you can create the JSON Format files in 2 ways:

Using E-way Bill JSON Format File

JSON Format file is a predefined template to prepare the consolidated E-way bills. Fill the details in the downloaded template and upload the same to the portal.

Using the E-way Bill JSON Preparation Tool

Step 1. Visit the official portal, and in the Bulk Generation Tools page, click “E-waybill JSON Format.”

Step 2. Once done, a webpage will open up, right-click on the page and save the file on the system. The file will get downloaded on the system as a JSON file.

Step 3. You will get a downloaded excel sheet, which will include the e-way bill JSON format, parameters, master codes, and error codes.

Step 4. Fill in the details of transactions in the downloaded Excel file and validate all the parameters of the request before preparing the final JSON file.

Once the process is over, update the vehicle information by downloading “Vehicle No Updation JSON Preparation” under the drop-down list of “Tools.” Now, you are ready to generate the bulk or consolidated E-way bills by visiting the EWB Portal – www.ewaybill.nic.in

4. How to generate E-way bill by using the Android app from the smartphone?

To generate the E-way bill using the Android App, you need to download the app on your smartphone.

Step 1: Go to ewaybill.nic.in and login to the portal.

Step 2: Select the option “Android Registration” under the drop-down list of registration.

Step 3: Now, select the user ID from the drop-down list. Once selected, the name and place will be auto-filled by the system. After that, the user needs to select the “Yes” option under “Do you want to enable the android app” option.

Step 4: Once done, enter the IMEI number, who is authorized to generate e-way will on your behalf. Then click on the Save button.

Step 5: You will receive a link to download the app on your registered mobile number through SMS.

Step 6: Install the app and log in by using the user ID and password. The authorized user will be able to generate, save, or print the E-way bill through the android app.

5. How to generate E-way bill by using GSP (GST Suvidha Provider) services?

Another option to generate the E-way bill is to approach the GST Suvidha Provider with the relevant documents. Users are advised to check the list of GST Suvidha Providers at the GST portal.