Living in a rented property and not bothering to take the rent receipts from your landlord? You are paying more tax than expected. Yes, payment of rent can help you to save your tax.

If you are living in rented accommodation, nearly 30 percent of your salary is diverted towards the payment of rent. However, you can reduce your rent burden by availing the House Rent Allowance (HRA) exemption after fulfilling certain conditions.

What is rent receipt and its benefits?

A rent receipt is simply a record or proof of paying rent by the tenant to his/her landlord. When the landlord receives the payment of rent, he issues a document containing the details of rent. But every tenant is not aware of the benefit of having the rent receipts.

The primary benefit of the rent receipt is to claim the tax benefits. The employer can provide the deductions and allowances after verifying the same.

It can be used for some legal matters

Establish evidence of making payment for rent.

You must have the experience that your HR or employer asks to submit the rent agreement, rent receipts, etc. before the end of the financial year. However, it is not mandatory to provide the rent receipts every month but after a specific frequency like quarterly or yearly.

It should be noted that if you are making payment of rent in cash more than Rs. 5,000, then revenue stamp is required to be affixed on rent receipts. But if rent is paid through cheque, then revenue stamp is not needed.

What are the contents a rent receipt includes?

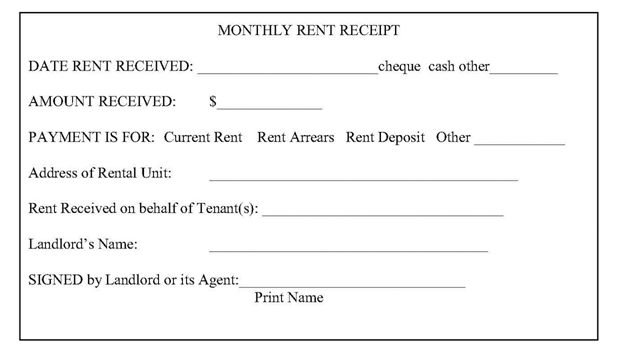

- The specimen of rent receipt can be different, but few important elements remain the same and are compulsory to fill, such as:

- Tenant Name

- Landlord Name

- Address of rented property

- Rental period

- Amount of rent paid (can mention advance rent paid or payable)

- Date of payment

- Signature of tenant and landlord

- Revenue stamp (If making payment in cash exceeds Rs. 5,000)

- PAN number (If rent exceeds yearly Rs. 1,00,000)

Sample of rent receipt:

From where shall I download the rent receipts?

As there is no specific format of rent receipts, you can simply download the rent receipts from the web search or even buy it from a stationery shop. Make sure to have the contents as mentioned above in the receipt.

Now, let’s continue to understand how rent receipts can be used to avail of the income tax benefits.

The rent receipts are required to claim the House Rent Allowance (HRA).

What is HRA?

House Rent Allowance (HRA) is a part of the salary given by an employer to his employee for his rented accommodation. The employee is eligible to claim the HRA exemption only if he/she is living in a rented property.

Who is eligible to claim HRA?

To claim the HRA:

- You should be a salaried person; a self-employed person can’t claim HRA benefits

- You must live in a rented property

- You must have accepted your salary package including HRA as a part of the salary. Hence, not all the employees can avail of the HRA, if it is not a part of your salary.

What are the documents required to claim HRA?

The HR or employer of your company will ask you to submit the following documents to claim HRA:

1. Rent Agreement

2. Rent receipts

3. PAN Number of the landlord (As per circular No. 8/2013 dated 10 October 2013, in case of rent amount exceeds Rs. 1 lakh per annum)

Why is there a need to submit the rent receipts to the HR or employer?

The Income-tax Law, 1961, states the provisions of deducting Tax at Source (TDS). As per the TDS provisions, every person, who is paying a salary is required to deduct TDS from the salary and deposits the same to the government. After deducting TDS, the remaining amount is paid to the salaried person.

Now, if a salaried person made any tax saving expenditure, he/she is eligible to get the benefit of that expenditure, which generally reduces their tax liability.

Here, the HR department is responsible for collecting proof of such expenditure. For example, in the case of HRA exemption, rent receipts, and rental agreements are required.

What is the importance of Rent Agreements?

Well, it has been seen that to take the income tax benefit, people submit fake receipts. Therefore, the HR must confirm that the rent agreement is original to avoid the counterfeit receipts.

When is the rent receipt mandatory for claiming HRA?

If an employee is receiving HRA more than Rs. 3,000 per month, then it is mandatory to submit the rent receipt as proof. However, even if you are getting HRA less than Rs. 3,000 per month, it is advisable to keep the rent receipts with yourself. There may be a need in case the officer asks.

How is tax exemption from the HRA calculated?

HRA is one of the biggest tax saving options because it is not wholly taxable. A part of HRA gets exempted under Section 10 (13A) of the Income-tax Act, subjected to certain conditions. As it becomes part of the salary, the least of the three amounts is tax-exempt –

· Actual HRA provided by the employer

· Actual rent paid less 10% of your basic salary

· 50% of basic salary in metro cities that are Mumbai, Delhi, Chennai, and Kolkata or 40% of basic salary in case of non-metro city

For example, Mr. Sourav is employed in Mumbai is living in a rented property. He pays rent of Rs. 10,000 per month during the financial year 2019-20. He receives a monthly salary of Rs. 30,000 and HRA of Rs. 80,000 from his employer during the year.

| S.No. | Particulars | Amount in Rs. |

| 1. | Actual HRA provided by the employer | 80,000 |

| 2. | Actual rent paid less 10% of your basic salary Rent paid (10,000*12 = 1,20,000) 10% of basic salary (10%*3,60,000=36,000) Difference of above (1,20,000 – 36,000) | 84,000 |

| 3. | 50% of basic salary (50%*3,60,000) | 1,80,000 |

| 4. | Exempt HRA (Least of 1,2 and 3) | 80,000 |

Therefore, the whole of the HRA received from the employer is exempt from tax.

What is the last date of submitting rent receipts to the employer?

The deadline for submitting the documents depends upon the employer to employer. Usually, delay in submitting may cause you the extra deduction of TDS. However, TDS can be claimed later on, but it is suggested to ask from the employer about the last date of submitting documents.

What to do if I forget to submit the documents on time to your employer?

If you have missed the deadline to submit your rent receipts to your employer, you can claim HRA directly when you are filing your income tax returns.