Detailed procedure to Handle Notice Received u/s 245 of Income Tax

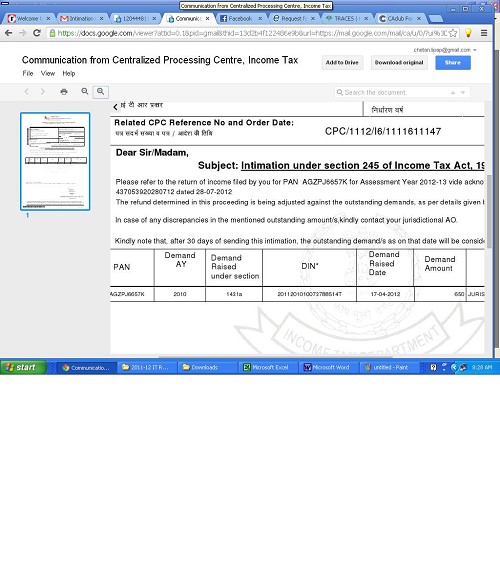

This is the current period of filing Income Tax Returns online. All the tax payers are advised to file their Income Tax Returns prior to the due date fixed by the Income Tax Department. The Income tax department has already commenced sending reminder notice under the section 245 of Income tax Act 1961 to all the tax payers.

In this article, we will be explaining in detailed about the process of handling or managing the Notice received under the section 245 of income tax act 1961. Check out the step-by-step procedure:

- Determine Type of Outstanding Demand

- First of all, you need to know all the details regarding the outstanding demand.

- You can determine all the details of outstanding demand just by logging into the official web portal of Income Tax @ incometaxindiaefiling.gov.in.

- Using your user id and password, you can log into the official website.

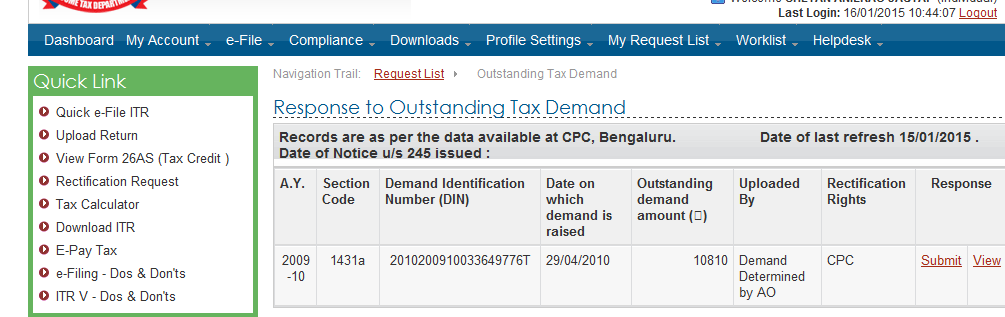

- Then, navigate to the tab ‘e-file’>> Click on the option under the e-file tab ‘Response to outstanding demand.’

- Check who uploaded demand?

- Under the section “Response to outstanding demand”, you will be able to check who uploaded demand.

- You can check it under “uploaded by” option.

- You can also check out the amount of outstanding demand in two ways.

- One is uploaded by Central Processing Centre (CPC) and the other is uploaded by jurisdictional Assessing Officer (AO).

- Firstly, you have to comprehend how the Income Tax department has determined the tax liability of particular tax payer before moving to the further step.

3.File Application for Rectification

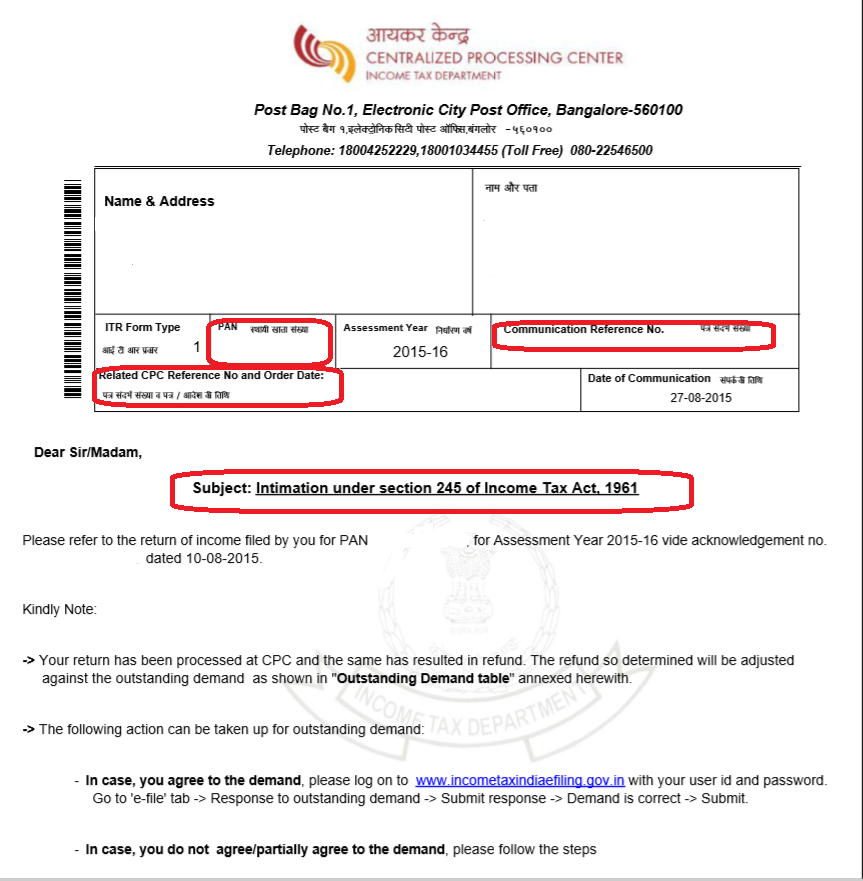

If in case, the outstanding demand is uploaded by the Central Processing Centre, Bengaluru, you can check out the steps provided below in order to file an application for rectification:

- First of all, open your Email Inbox and check whether you have received an intimation u/s 143(1) from CPC, Bengaluru. You can see the subject line as follows:

- “Income Tax Return Status for PAN PHRxxxxx1F A.Y.:20015-16”

- If you don’t receive any of such intimation, you will have a possibility to send a request for intimation for the current assessment year for which the outstanding demand exists.

- You can make a request online by logging into the official portal of income tax.Navigate to the section My Account >> Request for intimation u/s 143(1)/154.

- The intimation under the section 143(1) will have two columns:

(a) Tax determined as per the IT return filed by the tax payer.

(b) Tax determined by the department.

You need to compare these two columns to find out the purpose for outstanding demand.

- If you are not ready to accept the tax calculation made by CPC, Bengaluru, you have a chance of filing an online application for rectification.

If the outstanding demand is uploaded by jurisdictional Assessing Officer (AO), you need to check out the below given steps. The Assessing Officer is the one who have the right to

- In order to assess the details of your Jurisdictional AO, you need to log on to https://incometaxindiaefiling.gov.in and just hit the option that says “Know Your Jurisdictional AO” under “Services” tab.

- If the location of your Assessing officer is altered from the place where you are currently living, you need to request for PAN transfer.

- You need to contact relevant officer and check out the reason for the outstanding demand.

- If you do not accept with the outstanding demand, you can file application for rectification u/s 154 of income tax Act alongside the documentary proof in support of your statement.

- Senda Response Online

Once you have successfully submitted the application for rectification to CPC, Bengaluru or to the Assessing Officer, you have to submit an online response. If you do not respond to the outstanding demand within sent by CPC or AO within a stipulated time of 30 days or 1 month from the date of receipt of notice u/s 245, the Income Tax department will regulate the outstanding demand with the refund due to the tax payer.

You need to submit your response online for the outstanding demand by logging into the official Income Tax portal using your user id and password.

- Go to ‘e-file’ tab >> Response to outstanding demand >> Submit response >>Choose relevant category for disagreement.

- Fill all the essential details and hit the submit button. The Income Tax department will review your online response.

That’s it! This is the process of handling or managing the Notice received under the section 245 of income tax act 1961. Hope this tutorial guides you in the best way to handle the Notice received under the section 245 of income tax act 1961 and submit an online response in regard to the outstanding demand.