From June 2013, it is mandatory to deduct TDS on transfer of immovable property and generating TDS certificate in Form 16B. Here in this article, we will share the complete step by step guide on making TDS payment under section 194-IA, generating Form 26QB and Form 16B and their due dates.

Section 194-IA

Section 194-IA of the Income Tax Act, 1961, specifies the TDS provisions on sale and purchase of the immovable property. The section makes it mandatory to deduct TDS @1% on the total sale consideration if it exceeds Rs. 50 lakhs.

Here, the buyer will deduct the TDS before making payment to the seller and then deposit it to the government. TDS is deducted at the time of making the payment or giving credit to the seller, whichever is earlier.

Note: The TDS provisions under section 194-IA shall not apply to the sale of agricultural land.

Important points regarding section 194-IA

- TDS applies to the entire sales consideration. For example, if you have bought a property at Rs. 60 lakh, the buyer shall deduct TDS on the entire Rs. 60 lakh (TDS 6 Lakh) and not on Rs. 10 lakh (Rs. 60 Lakh – Rs. 50 Lakh).

- No TDS shall be deducted if sale consideration is less than Rs. 50 lakh.

- If the buyer made payment in installments, then TDS shall be deducted on each installment.

- The buyer doesn’t need to obtain TAN (Tax Deduction Account Number)

- The seller must have the PAN; otherwise, the buyer will deduct TDS @ 20% instead of @1%.

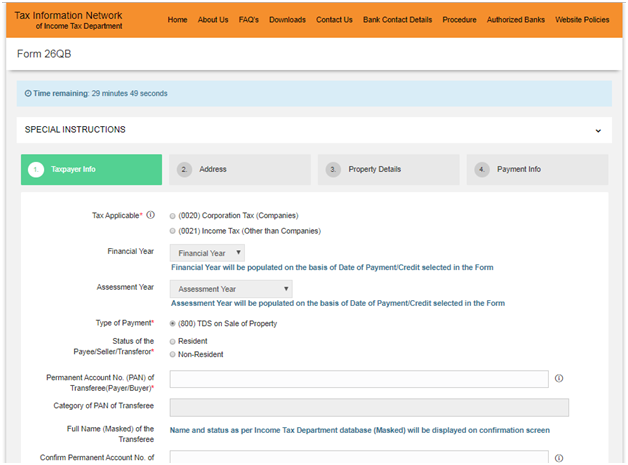

What is Form 26QB?

Form 26QB is a return cum challan for TDS on immovable property payment to the government. The buyer has to obtain Form 26QB. To make an online payment of tax, the buyer is required to fill Form 26QB.

If two or more buyers and sellers make the transaction together, then Form 26QB shall be furnished for each buyer and seller. For example, 1: If there one buyer and 2 sellers, then 2 Form 26QB shall be furnished separately for B1 and S1 combination and B1 and S2 combination.

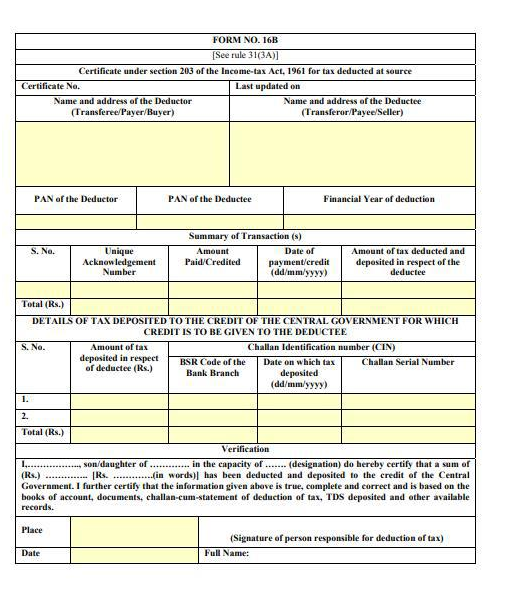

What is Form 16B?

Form 16B is the TDS certificate that buyer issues to the seller, showing the TDS accurate deduction. The buyer needs to furnish this certificate to the seller within 15 days of depositing the TDSA. You can download Form 16B from TRACES website.

How to deposit TDS under section 194-IA?

The buyer will make the payment of TDS online through Form 26QB within 30 days from the end of the month in which TDS was deducted.

Process of making payment through Form 26QB

Step 1: Visit TIN NSDL Website https://www.tin-nsdl.com/index.html and click on “Pay taxes online” or click here https://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jsp

Step 2: Click on TDS on Property (Form 26QB)

Step 3: Form 26QB will be open, select (0020) if you a corporate taxpayer otherwise go for (0021)

Step 4: Fill the further details (Taxpayer info, Address, Property details and Payment info) to proceed further and click on Next.

Step 5: Here, a confirmation message and an acknowledgment number will appear on the screen with two options:

“Print Form 26QB” and

“Submit to the bank”.

Note: It is advisable to save the acknowledgment number for future reference.

Step 6: Click on submit to the bank, and you will be directed to make payment online through internet banking. Proceed to make the payment from the authorized banks.

Step 7: On successful payment, a challan counterfoil will be appeared containing the CIN, bank name, and payment details. It is proof of payment.

Once the payment is made, it shall reflect in the seller’s Form 26AS. After that, the buyer will issue the TDS certificate (Form 16B) to the seller.

How to download Form 16B?

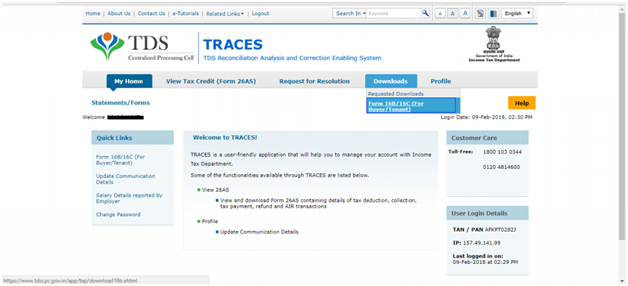

On successful payment of TDS, the buyer has to wait for 5-7 days for the details to be reflected on TRACES and to download the Form 16B.

Step 1: Login as a taxpayer at TRACES Portal

Step 2: Select “Form 16B (for buyer)” under the download tab

Step 3: Enter the property details, Assessment year, Acknowledgement number and PAN of the seller to proceed further

Step 4: Now, you will see a confirmation message and a “Submit request” button.

Step 5: You will get a download request number on the screen. Note down the number and click on “Requested Downloads” to download

Step 6: Now, print or save Form 16B.

Note: It takes a couple of hours to view Form 16B after submitting the request number that you have obtained in Step 5.

Penalties for non-filing of Form 26QB

| Interest Provisions | Non-deduction of TDS: 1% per month or part of the month from the due date of TDS deduction to the date on which TDS is actually deducted. Non- deposition of TDS: 1.5% per month or part of the month from the date on which TDS is deducted to the date TDS is deposited to the government. |

| Late filing Fee of Form 26QB | As per section 234E, a fee of Rs. 200 each day shall be levied on the buyer during such failure continues |

| Penalty | As per section 271H, the penalty of Rs. 10,000 upto Rs. 1 lakh can be imposed by the assessing officer on late submission of Form 26QB. |