In this article, we are going to understand about the Form 15G, the applicability of TDS on EPF withdrawals and how to submit form 15G online by EPFO Portal.

Form 15G

Purpose of Form 15G: The purpose of form 15G is to declare that the interest earned by you on savings schemes is not taxable. Once you file the Form 15G with your bank not to deduct any TDS, there shall not be any deduction of TDS from your income.

Who can submit Form 15G: Form 15G can be filed any individual or HUF within the age of 60 years.

Eligibility for Form 15G:

- Age must be below 60 years

- You must be an Indian Resident

- The total interest income for the financial year is less than the minimum tax exemption limit for the relevant financial year.

- The total tax liability (after considering all the deductions and exemptions) shall be NIL for the financial year.

TDS rate: The rate of TDS shall be 10% in case of submission of PAN

If PAN is not provided, then the highest slab rate that is 30% shall be applicable.

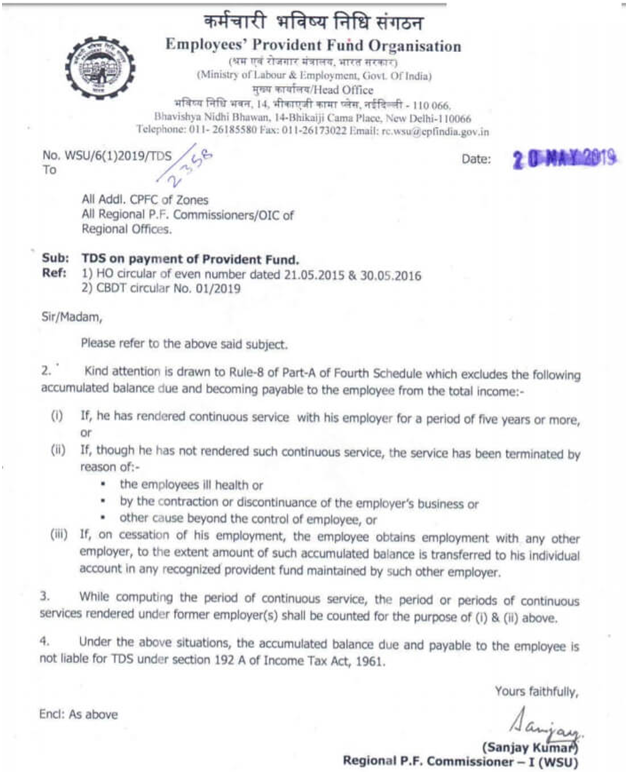

TDS on EPF withdrawals: Considering the requirements of deducting TDS on EPF withdrawals, EPFO has clarified the following:

From FY 2016-17, TDS is not applicable if the PF withdrawal amount is less than Rs. 50,000. So, if you have a withdrawal amount from your PF account exceeding Rs. 50,000, then the EPF portal will deduct TDS.

However, you can submit Form 15G for non-deduction of TDS on your PF withdrawal amount.

Provisions of TDS related to EPF Withdrawal

Here are the following cases in which TDS shall be applicable:

- If the employee withdraws the amount of Rs. 50,000 or more before completing five years of service.

Here are the following cases in which TDS shall be not deducted even if you withdraw the amount from your PF account:

- Transfer of PF from one account to another PF account

- Withdrawal of amount on termination of services due to ill-health

- Any other cause which is beyond the control of the employee.

- PF withdrawal amount is less than Rs. 50,000

- When employees withdraw amount more than Rs. 50,000 with less than serving the five years of service but submits the Form 15G.

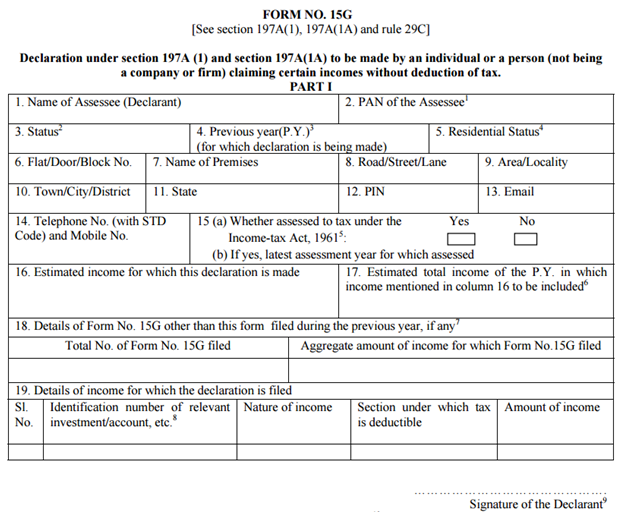

Contents of Form 15G:

Part 1: The first part is to be filled by the person who wants to claim income without deducting TDS.

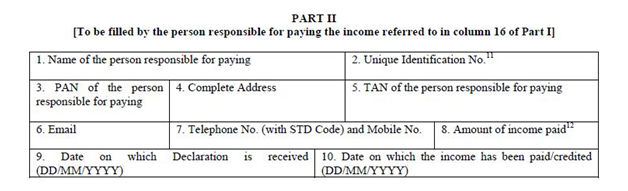

Part 2: The person/institution ( who is eligible for paying the income) is responsible to fill the Part – II:

How to Submit Form 15G for EPF Withdrawal online?

Form 15G can be filed online as well as in physical form. Let’s understand the process of How to Submit Form 15G for EPF Withdrawal online?

Earlier there was no provision to submit Form 15G online. However to provide convenience, now, this online facility is available at EPFO’s Unified Member Portal.

Step 1: Visit EPFO Member portal and log in by submitting UAN and Password or click here to visit directly at login page https://unifiedportal-mem.epfindia.gov.in/memberinterface/

Step 2: Once you log in, click on the online services drop-down list and find “Online Claim (Form 31, 19, 10C).”

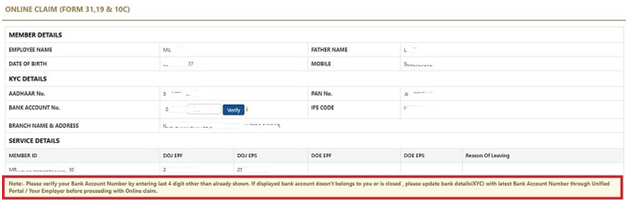

Step 3: Now, enter the last 4 digit bank account number, as shown below:

Step 4: Once you verify your bank details, an EPF Withdrawal form will be displayed.

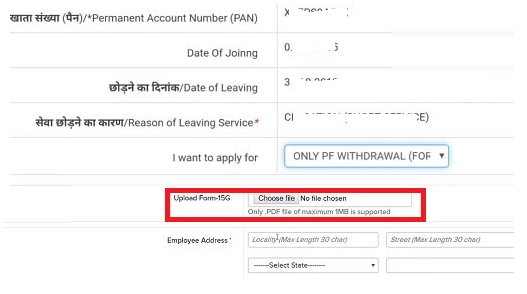

Step 5: Here, you will see the option of uploading FORM -15G, Upload the same and submit for withdrawing the PF amount.

Note: For uploading the Form 15G, you are required to download the Form 15G, take print and fill (part 1).

Once it is filled, scan it and convert it into a PDF file of a maximum 1MB to upload it on the portal.

Note: If you are not able to upload Form 15G online from the EPFO portal, then you can submit Form 15G physically i.e. hard copy at the EPF regional office. Make sure to mention your UAN and PF number on Form 15G.

How to Submit Form 15G for EPF Withdrawal offline?

Step 1: Visit https://www.incometaxindiaefiling.gov.in/home

Step 2: Download Form 15G under the ‘Frequently Used Forms’ tab. Here, the PDF file shall be downloaded

Step 3: Print and fill the required details of the form 15G

Step 4: After filling the form, you can submit at the bank or financial institution

Step 5: The form submitted shall be duly verified by the bank or financial institution.