Tax Filing Can't Get Easier

Get Your Income Tax Prepared And Filed On Your Behalf In Minutes Without Any Hassle.

Stressed About Income Tax Filing?

Our Team Of Experts Can Make You Enjoy Your Work By Taking Away All Your Stress

All Our Tax Experts Are CAs

Lean Back And Sip!

Tracking

We keep track of your ITR V and Refund and keep you informed.

Reviewing By Experts

Our experts review your form 16 and 26AS and then it is finalized for filing.

Hassle Free

No more lengthy and boring tax forms to fill. We do it for you.

Email Support

Round the clock support from our expert CAs to all your tax related queries.

Analysis And Suggestion

We analyse your CTC and suggest best possibilities to save on taxes.

Tax Advisory Services

Notice / Demand Resolution

First of all relax if you have got any notice from Income Tax Department. We will take care of it in the best possible way.

ITR Rectification / Demand Resolution

Our experts take care of your outstanding amount if any being shown by doing rectification in ITR and following up with the concerned department. You don’t have to panic when you see outstanding in your name. Just Relax and leave that to us.

Tax Queries

We have got the core expertise in managing personal taxation assisting over thousands of individuals in India and abroad. The services offered by us are diligently personalized by experts keeping our clients in mind. Our objective is to make sure you save on taxes and take away the maximum paycheck.

Refund Reissue

Our expert panel of CA keeps track of each of our client’s refund status and keep following up with our sources until its credited. We help in getting the refund reissued if it has not been credited for any reason.

Tax Planning

We offer comprehensive guidance to individuals for efficient tax planning to get optimum exemptions, deductions besides other tax concessions provided under different laws which most people do not know.

What our clients say

I have never come across such an easy platform to file Income Tax Returns. I am a businessman and I get very less time to look into my income tax stuffs. Thankfully, I have EtaxAdvisor to my rescue who are always ready to go the extra mile to get work done.

I had never imagined that income tax e filing could be so easy and hassle-free. EtaxAdvisor has simplified the online tax filing process substantially. I advocate for EtaxAdvisor services to all my friends.

EtaxAdvisor.com is one of the best website I have come across for filing tax and getting your queries answered. The support staffs and CAs are well spoken and well behaved. I strongly recommend EtaxAdvisor to my friends.

One of the best website I have used recently for filing my tax. Extremely professional Tax experts who are always ready to go the extra mile to help resolve any query. I Strongly recommend EtaxAdvisor.com.

About us

No Documents Required

You do not need to submit any tax document while filing with us.

Inexpensive

We provide you the best service at prices no one can beat.

Precise Calculation

Our tax experts ensure accurate calculation keeping compliance in mind.

24×7 Available

You can file your tax now from anywhere and anytime.

Maximum Refund

E-filing your tax with us comes with maximum and quick refund guarantee.

Intuitive, Fast and Secure

Fast and secure way with intuitive design to file your tax with super ease.

Latest From Our Blog

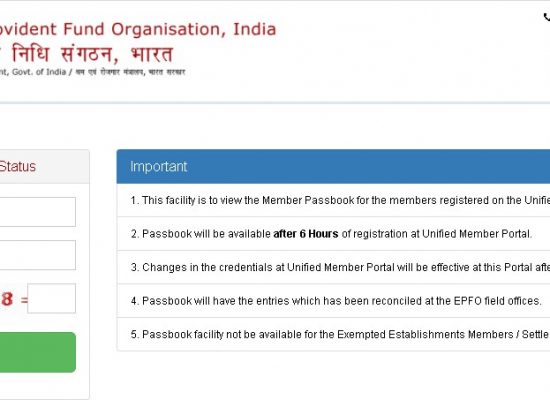

How to check EPF Balance without UAN Number?

Universal Account Number (UAN) is a unique number provided to the employees […]

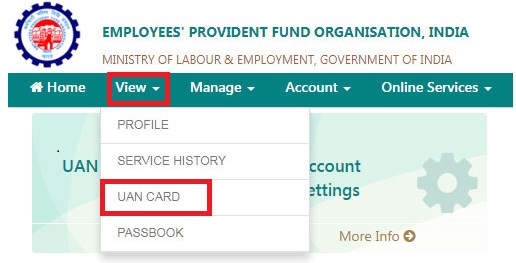

How to Download and Print UAN Card?

The Employee Provident Fund Organization (EPFO) has made the EPF services easy […]

Atal Pension Yojana (APY) – Benefits, Eligibility & Monthly Contribution

About Atal Pension Yojana (APY): Working sectors are divided broadly into two […]